DE 40 forecast: the index continues to decline

The DE 40 stock index remains under pressure, although the pace of decline slowed significantly at the end of last week. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

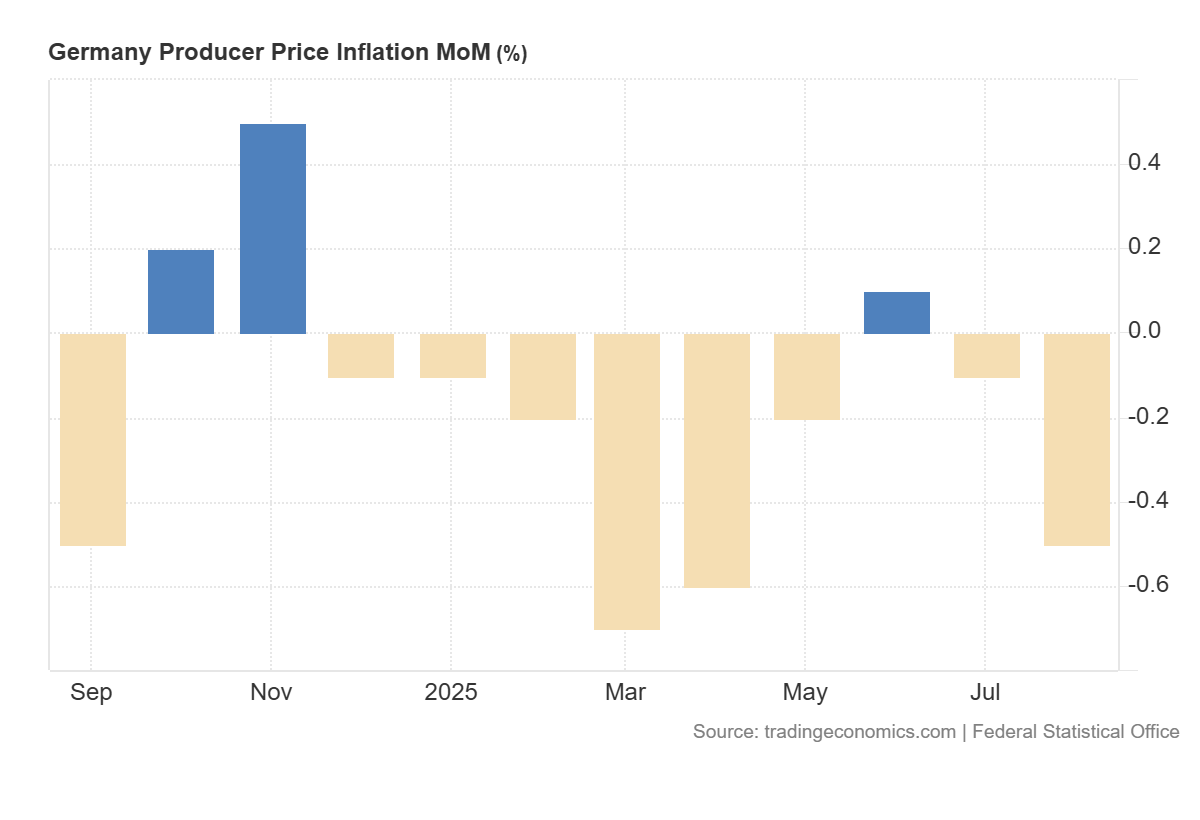

- Recent data: Germany’s PPI decreased by 0.5% in September 2025

- Market impact: the data creates a mixed backdrop for the German stock market

DE 40 fundamental analysis

Germany’s latest Producer Price Index (PPI) for September showed a 0.5% month-on-month decline, compared to an expected fall of just 0.1%. This indicates that price pressure at the producer level is easing faster than anticipated. For the stock market, this is a crucial signal on two fronts – capital cost (interest rate expectations) and corporate earnings (balance between demand and costs). If the decline in PPI persists alongside a deterioration in leading indicators such as PMI and industrial orders, the market may need to revise its revenue forecasts – a clear risk for cyclical stocks.

For the DE 40 index, the short-term baseline scenario points to a moderately positive reaction. However, the medium-term trajectory will depend on whether leading indicators such as PMI, industrial orders, and exports confirm a sustained weakness in demand. Conversely, if data shows that the PPI drop is temporary and not systemic, while orders remain stable, there will be more room for growth.

Germany producer price inflation m/m: http://tradingeconomics.com/germany/producer-price-inflation-momDE 40 technical analysis

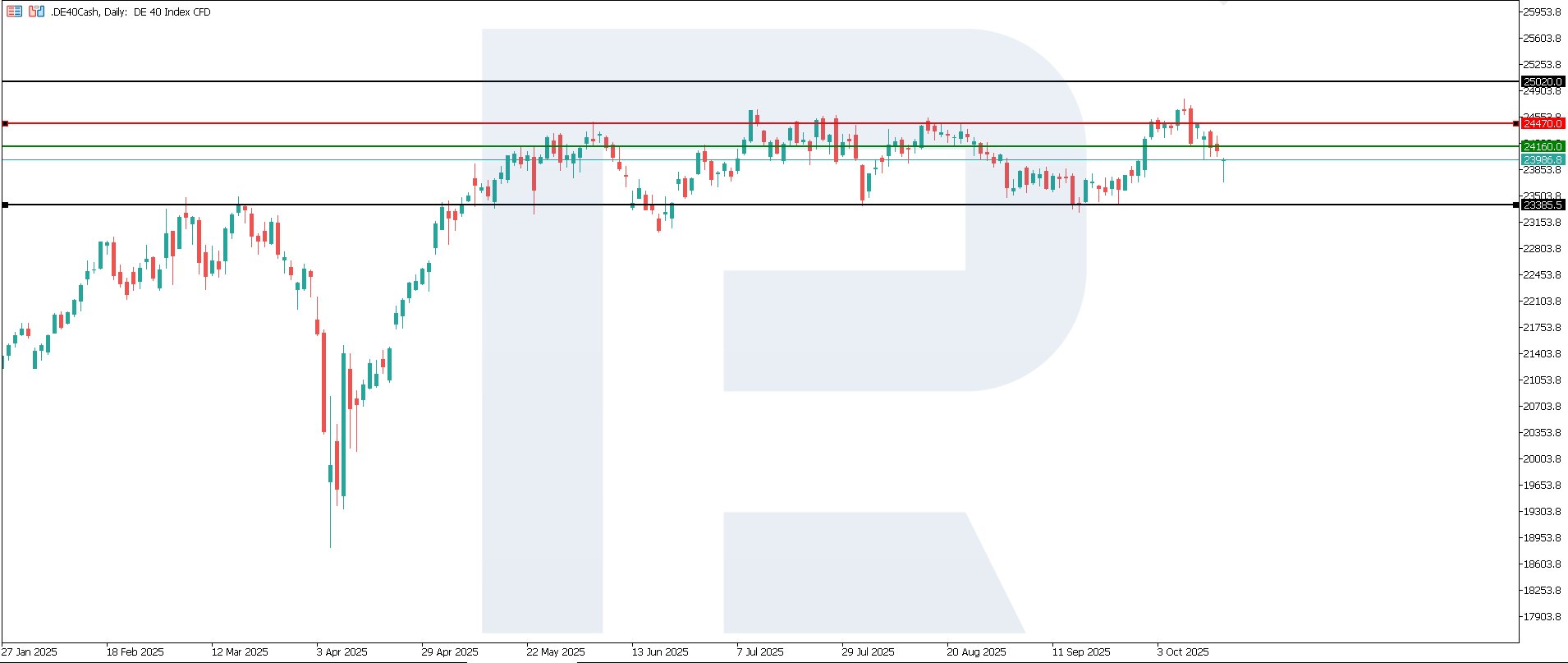

The DE 40 index has established resistance at 24,470.0 and broken below the 24,160.0 support level. Prices remain in a downtrend, although its duration remains uncertain. The next downside target could be at 23,385.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: if the price consolidates below the previously breached support level at 24,160.0, the index could dip to 23,385.0

- Optimistic DE 40 scenario: a breakout above the 24,470.0 resistance level could push the index to 25,020.0

Summary

The unexpectedly weak PPI reading signals disinflation at the producer level. For the DE 40, this is likely a mildly positive factor amid expectations of softer monetary policy and a weaker euro. However, the sustainability of this effect depends on whether falling prices reflect weakening final demand, which would pose a risk to corporate revenues and sales volumes. The next downside target for the index could be at 23,385.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.