DE 40 forecast: the index trend has turned upwards

The DE 40 stock index has approached its all-time high within an uptrend. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

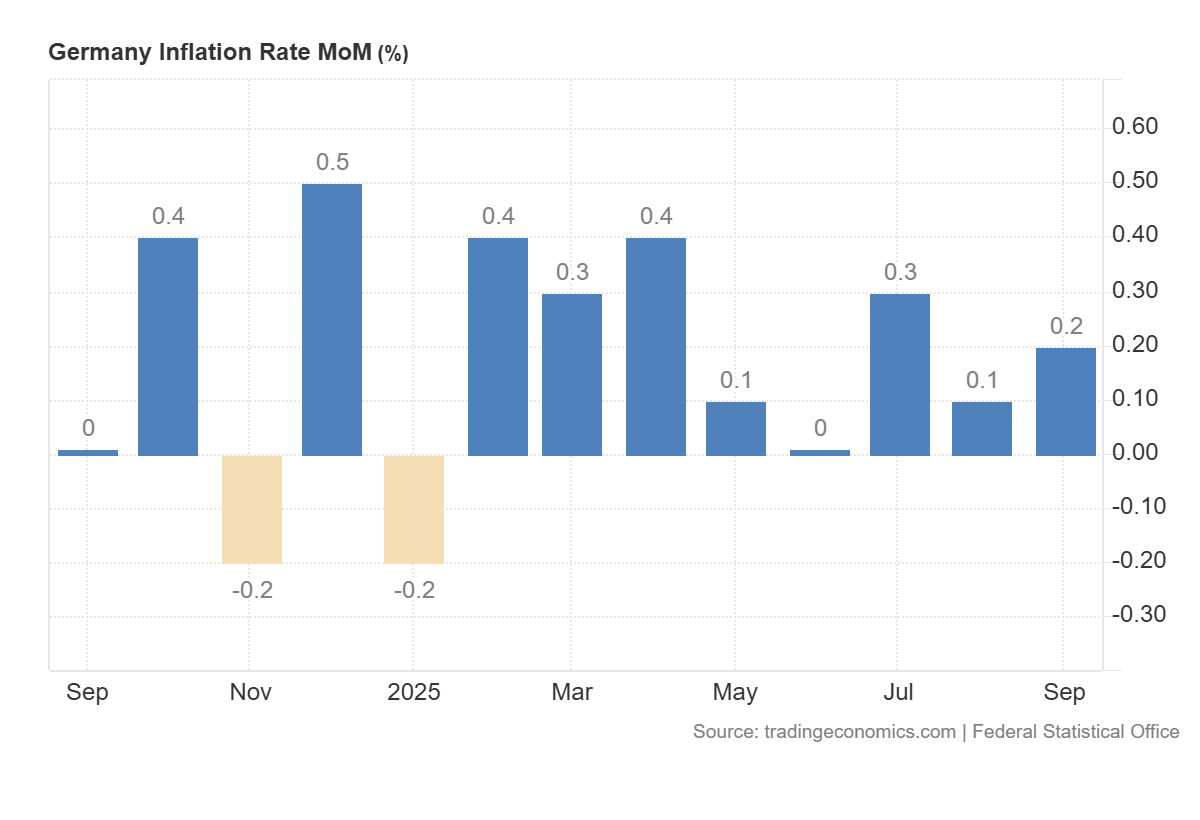

- Recent data: Germany’s CPI for September 2025 rose by 0.2% compared to August

- Market impact: the data creates a moderately positive background for the German stock market

DE 40 fundamental analysis

Germany’s Consumer Price Index (CPI) increased by 0.2% month-on-month in September 2025, matching the forecast of 0.2% and slightly above the previous reading of 0.1%. The reading in line with expectations indicates stable inflationary pressure. For investors, this means no new signals to change expectations regarding the European Central Bank’s monetary policy. Since price growth remains moderate, the likelihood of a sharp policy tightening remains low, which is perceived as a moderately positive factor for the stock market. However, a slight acceleration compared to the previous month could prompt caution among market participants, especially if signs of broader price increases emerge.

For the DE 40 index, which reflects the performance of Germany’s largest companies, the current data appears neutral with a slight positive bias. Investors are likely to interpret stable inflation figures as confirmation that price dynamics remain under control, supporting expectations of gradual rate cuts in the future. This may help sustain investor confidence in industrial and export-oriented stocks, particularly amid moderate domestic demand and inflation stabilisation.

Germany Consumer Price Index (CPI): https://tradingeconomics.com/germany/consumer-price-index-cpiDE 40 technical analysis

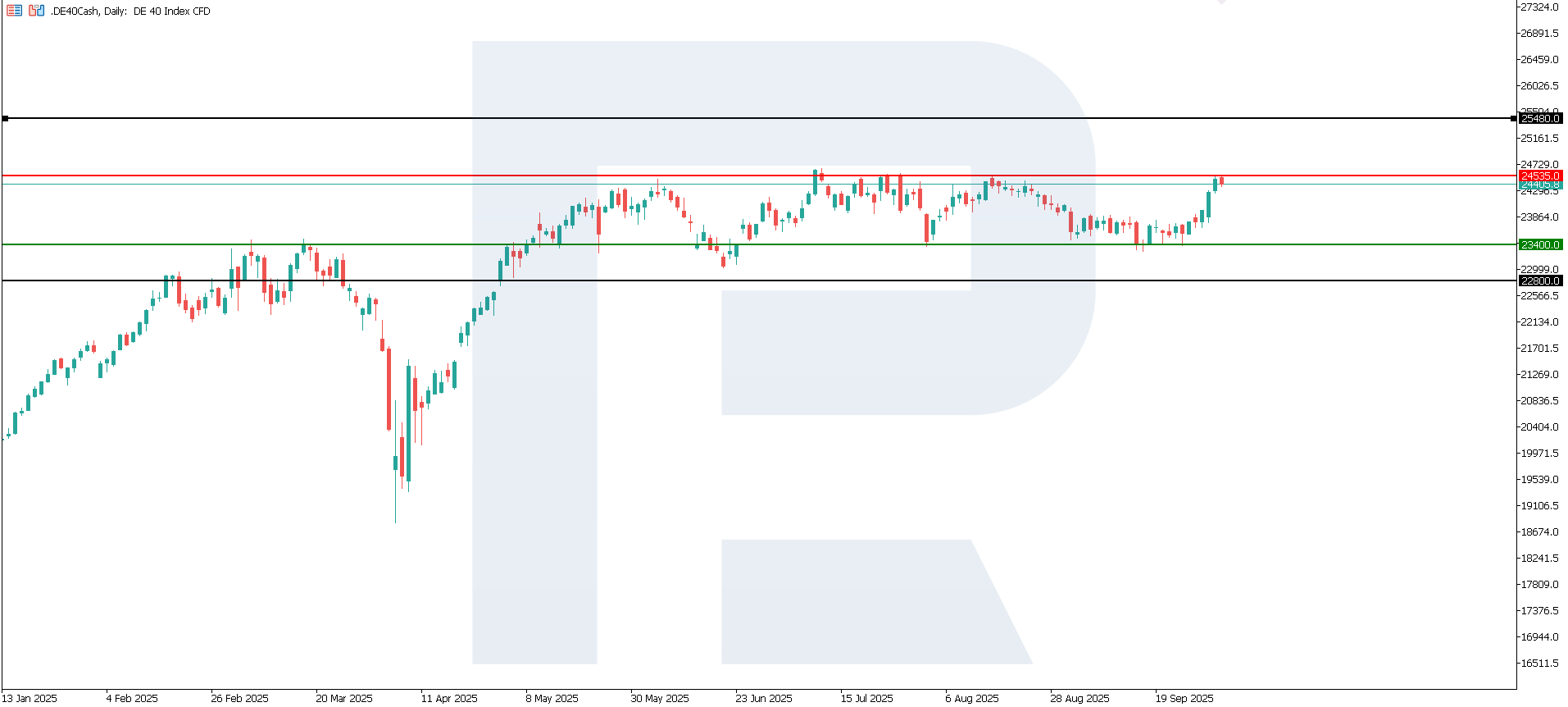

The DE 40 index has resistance established at 24,535.0 and support around 23,400.0. Prices have managed to reverse the trend to an upward direction. A breakout above the current resistance level would automatically lead to a new all-time high. The uptrend may have a medium-term character.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 23,400.0 support level could push the index down to 22,800.0

- Optimistic DE 40 scenario: a breakout above the 24,535.0 resistance level could propel the index to 25,480.0

Summary

CPI data in line with expectations does not create significant market pressure, supporting a positive sentiment in the German stock market. The DE 40 index may show moderate growth or consolidation as long as current macroeconomic trends remain stable. The nearest downside target for the index may be at 22,800.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.