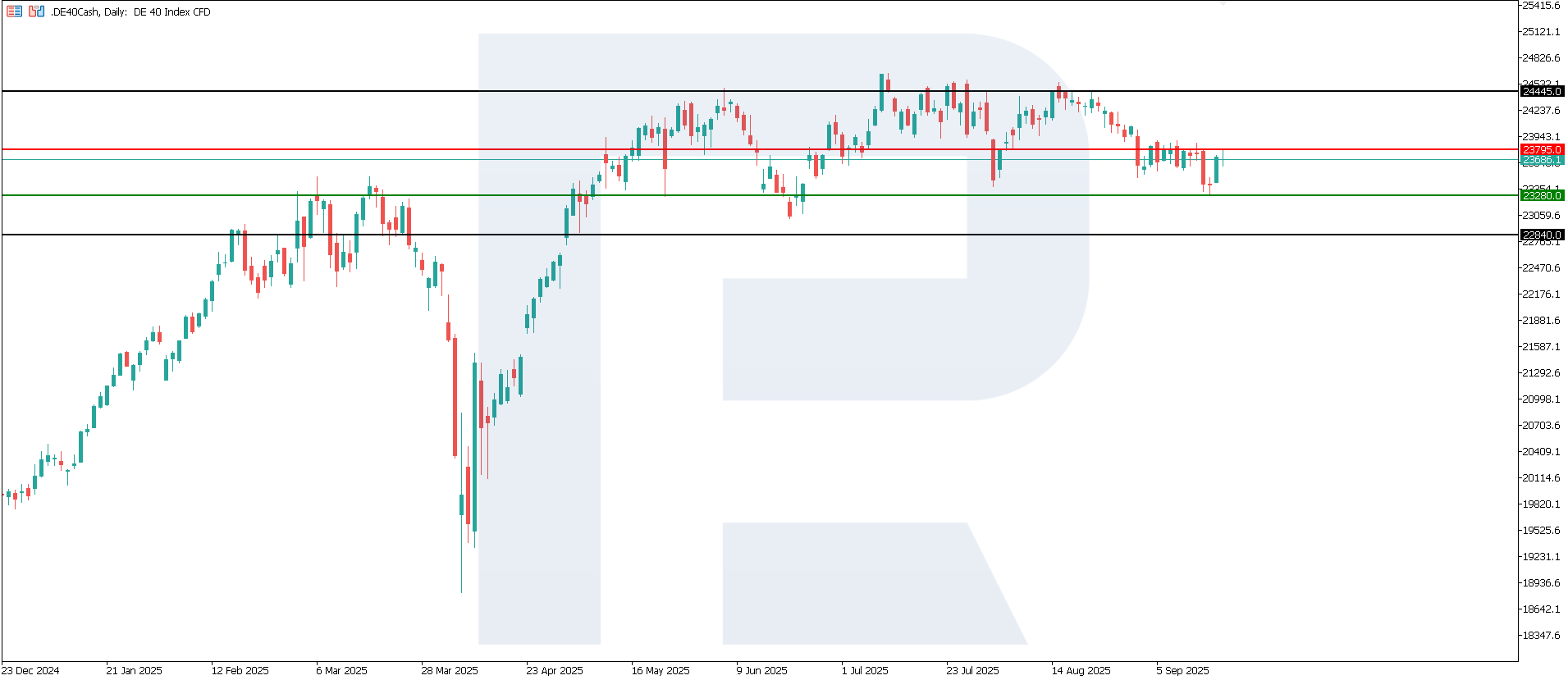

DE 40 forecast: the index breaks out of sideways channel and continues to decline

The DE 40 stock index continued to fall within the downtrend. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

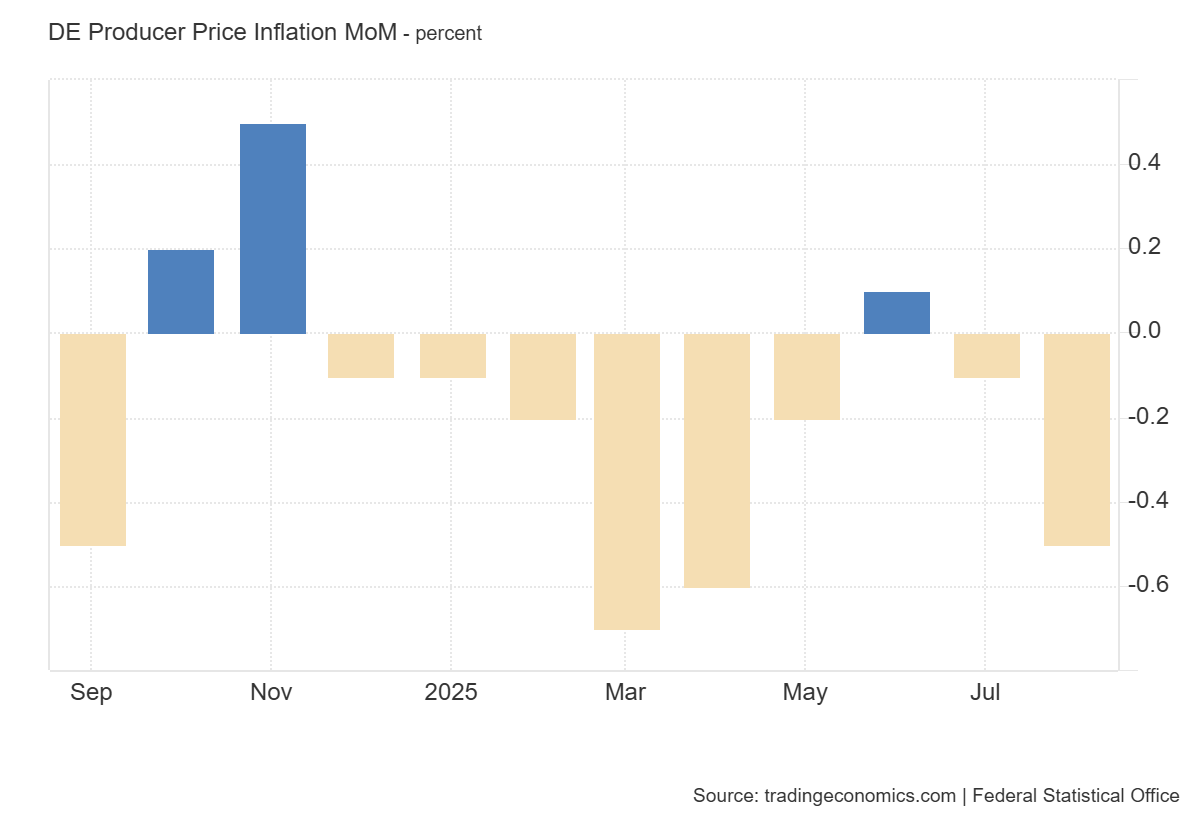

- Recent data: Germany’s PPI fell by 5% in August compared to July 2025

- Market impact: the data is mixed for the German equity market

DE 40 fundamental analysis

Germany’s Producer Price Index (PPI) for August 2025 showed a drop of 0.5% month-on-month, far weaker than the forecast of -0.1% and also below the previous reading of -0.1%. The fall in producer prices indicates reduced cost-side pressures in industry. This reflects an easing of inflationary factors at the producer level and could signal stabilisation of consumer prices further down the line. However, such a sharp decline may also point to weakening demand, raising doubts about the sustainability of economic recovery.

Lower production costs can support margins for companies, especially in energy-intensive and industrial sectors. This is seen as a factor that reduces inflationary pressure and may weaken the case for further monetary tightening by the European Central Bank. At the same time, a sharper-than-expected fall in PPI may indicate soft demand both domestically and abroad.

Germany Producer Price Inflation MoM: https://tradingeconomics.com/germany/producer-price-inflation-momDE 40 technical analysis

The DE 40 index has formed a resistance level at 23,795.0, with support at 23,280.0. The price broke out of the previously formed sideways channel, maintaining its downward momentum. However, the quotes have recently tested the resistance level, indicating stronger bullish activity. While buyers have not yet managed to break above this level, the downtrend may end soon.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 23,280 support level could send the index down to 22,840

- Optimistic DE 40 scenario: a breakout above the 23,795.0 resistance level could drive the index to 24,445.0

Summary

For the DE 40 index, the impact of the data looks mixed. In the short term, the price may find support from easing inflation risks and expectations of a dovish ECB stance. However, in the medium term, pressure from weakening economic activity could cap the index’s growth potential. The next downside target for the DE 40 could be 22,840.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.