DE 40 forecast: the index moves into a sideways channel

The DE 40 stock index has entered a sideways channel. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

- Recent data: the ECB key interest rate remains at 2.15% per annum

- Market impact: for the German equity market, this signals no additional borrowing cost pressure, which is seen as a stabilising factor

DE 40 fundamental analysis

The ECB decision to keep rates unchanged at 2.15% signals status quo in monetary policy. For the DE 40 index, this reduces short-term uncertainty and helps form a neutral sentiment among investors.

The financial sector, including banks and insurance companies, faces limited margin growth potential as lending yields remain stable. Industrial companies and exporters benefit from favourable financing conditions, which support investment in production and external trade. The consumer sector also gains indirect support: unchanged rates keep credit conditions affordable, sustaining household demand.

Eurozone Interest Rate: https://tradingeconomics.com/euro-area/interest-rateDE 40 technical analysis

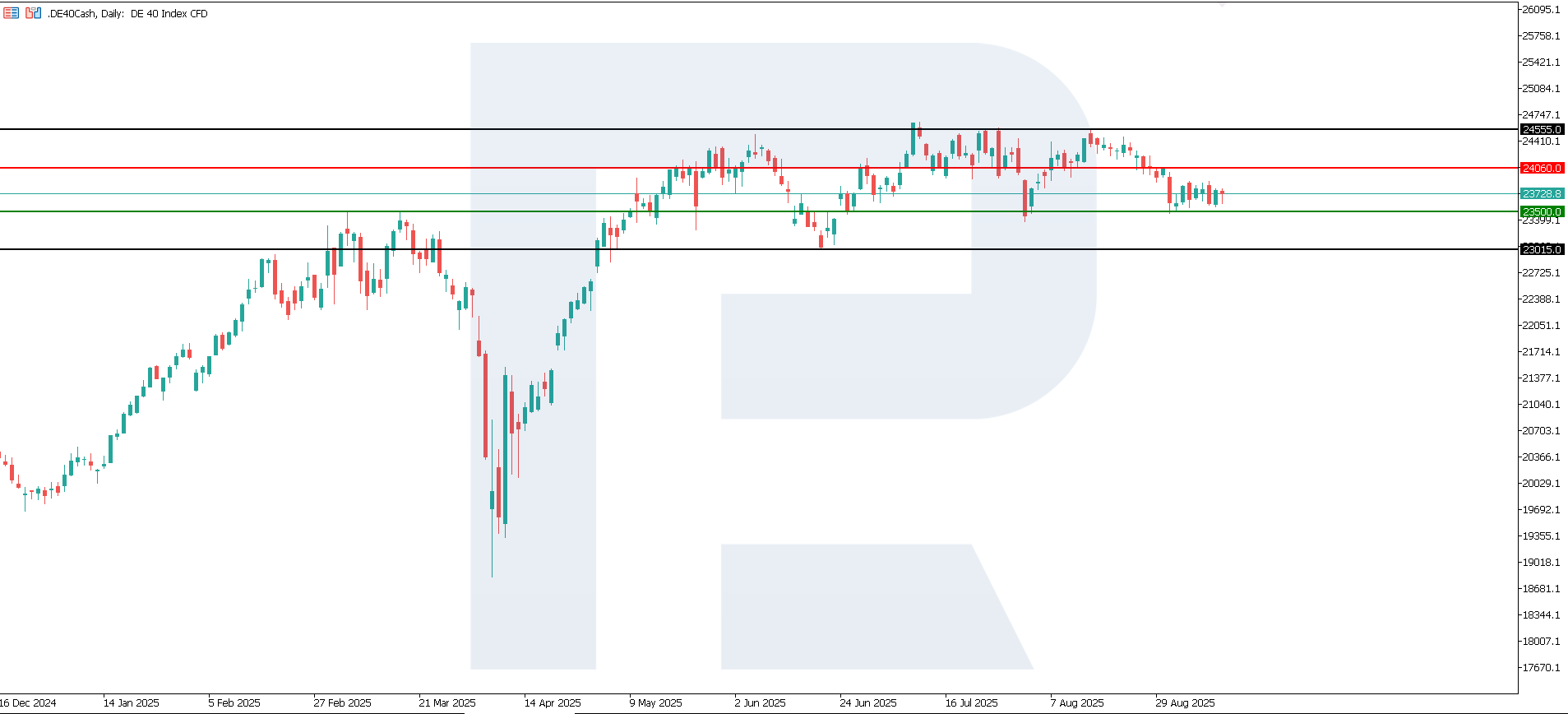

The DE 40 index has formed a resistance level at 24,060.0, with support at 23,500.0. The asset remains highly volatile, with frequent changes in its broader trend. Currently, a fragile sideways channel has formed. However, in the near term, the prevailing direction is still downward.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 23,50 support level could push the index down to 23,015.0

- Optimistic DE 40 scenario: a breakout above the 24,060 resistance level could drive the index to 24,555.0

Summary

Overall, the impact on the DE 40 can be described as moderately positive: investors see monetary policy as predictable, which contributes to stability and lower market volatility. For technology stocks, the decision also acts as a supportive factor, since predictable monetary conditions ease pressure on high-growth businesses and sustain their investment appeal. The nearest downside target for the index may be 23,360.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.