DE 40 forecast: the index enters a downtrend within the correction phase

The growth momentum of the DE 40 index has slowed. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

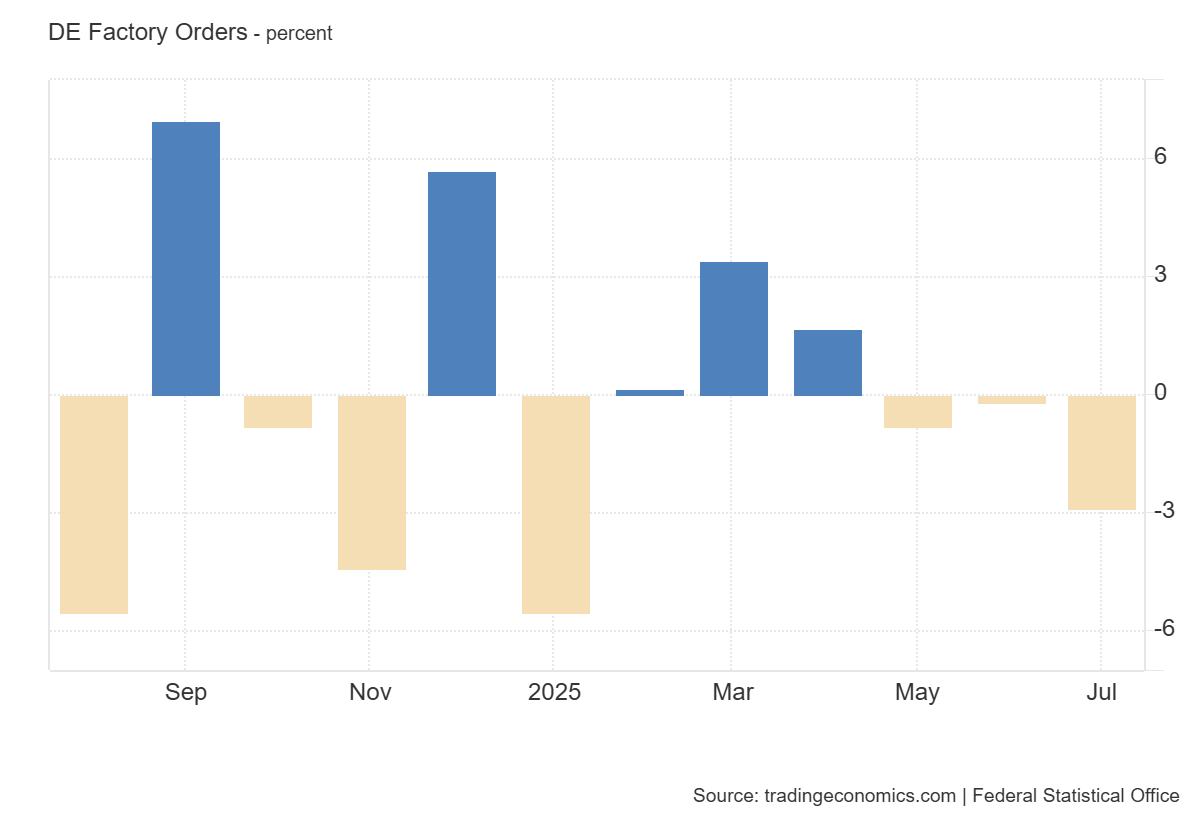

- Recent data: Germany’s factory orders for July 2025 fell by 2.9%

- Market impact: this signals potential difficulties in industry and mechanical engineering for the German equity market

DE 40 fundamental analysis

Germany’s factory orders for August 2025 showed a sharp decline, with the actual reading at -2.9% versus the forecast of +0.5% and the previous level of -0.2%. This result indicates a significant drop in industrial demand, reflecting weaker domestic and external activity in the country’s key economic sector. For the German equity market, this signals potential challenges for industry and mechanical engineering, which traditionally form the backbone of the economy.

Negative orders dynamics lower expectations for future output and exports, reducing the investment appeal of companies linked to heavy industry, machinery, and component supply. For the DE 40 index, the overall impact is assessed as negative. The decline in orders undermines expectations for steady corporate earnings growth and may reinforce investor caution.

Germany Factory Orders: https://tradingeconomics.com/germany/factory-ordersDE 40 technical analysis

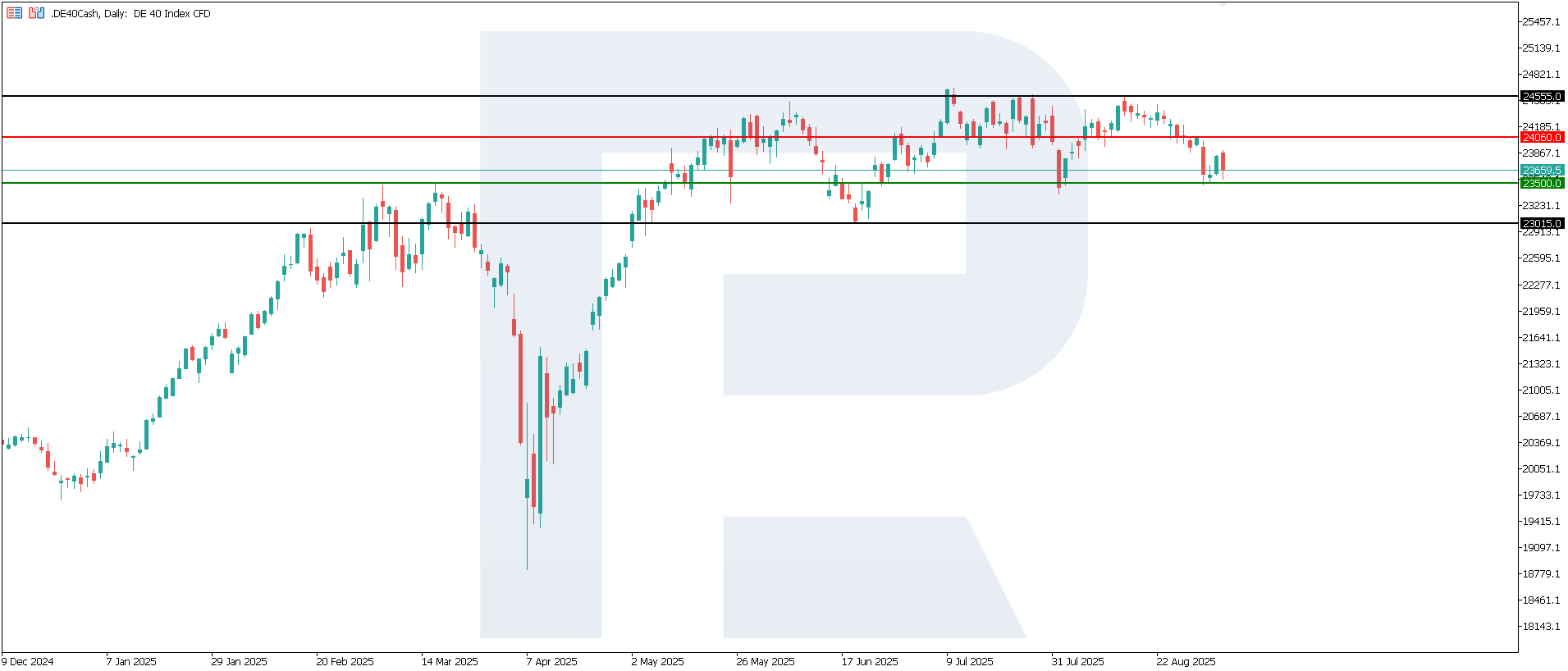

The DE 40 index has formed a resistance level at 24,460.0, with support at 23,500.0. The asset sees heightened volatility, with frequent shifts in the broader trend. The downtrend will prevail in the short term.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 23,500.0 support level could send the index down to 23,015.0

- Optimistic DE 40 scenario: a breakout above the 24,060.0 resistance level could propel the index to 24,555.0

Summary

The most vulnerable sectors after the release of factory orders data are machinery, automotive, and industrial equipment. Meanwhile, companies focused on the domestic consumer market and services may be less affected, as weak industrial orders do not always directly impact consumption levels. The next downside target for the index could be 23,360.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.