DE 40 forecast: the downtrend has ended, but growth momentum is slowing

The growth pace of the DE 40 stock index has slowed. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

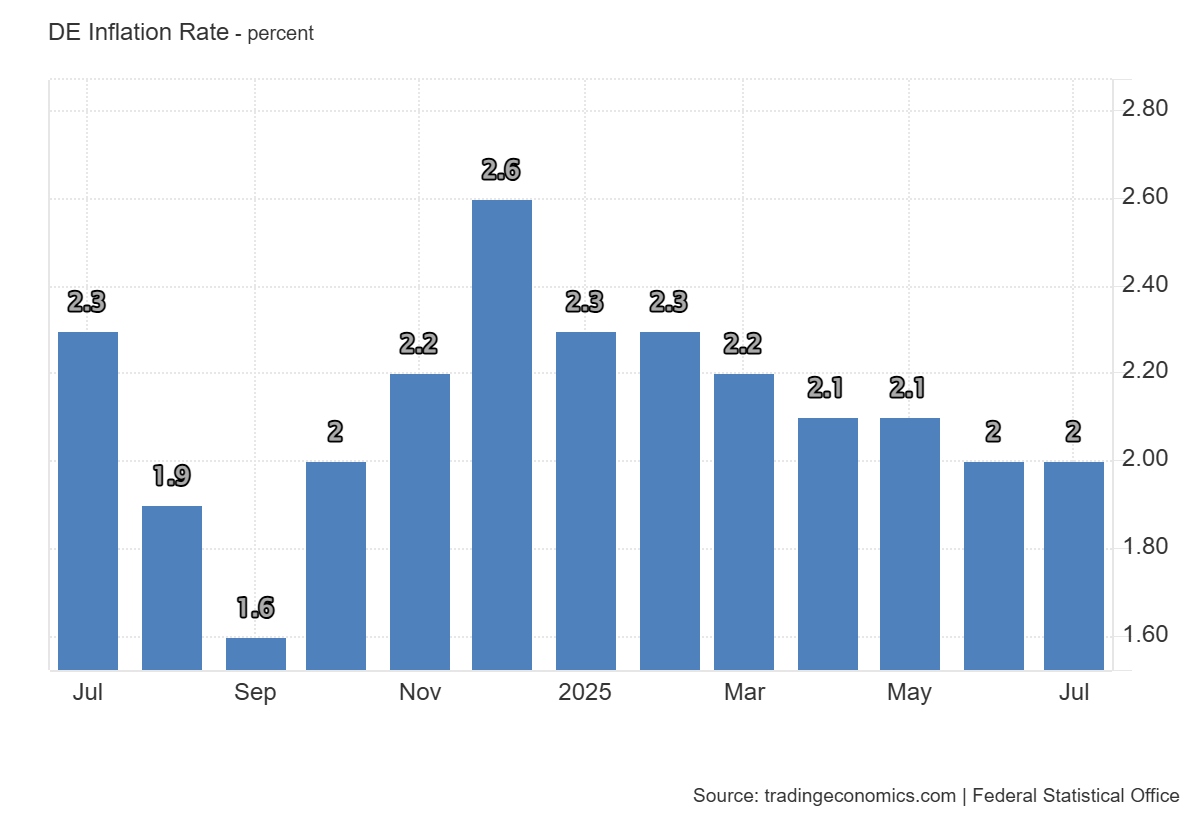

- Recent data: Germany’s CPI for July 2025 came in at 2.0%

- Market impact: this news is moderately positive for the broader equity market

DE 40 fundamental analysis

Annual inflation in Germany stood at 2.0% year-on-year in July, in line with forecasts and unchanged from the previous month. This result highlights price stability at a level close to the ECB’s target. The absence of surprises reduces uncertainty over monetary policy: the baseline scenario suggests current settings will remain, with a cautious readiness for easing later if the economic slowdown deepens and eurozone-wide data allows.

The current inflation data has a moderately positive impact on the DE 40 index. A short-term upward impulse is possible, while market participants will await further comments from the ECB. The lack of additional price pressure improves cost predictability. The effect on exporters will depend primarily on external demand and the EUR exchange rate.

Germany Inflation Rate: https://tradingeconomics.com/germany/inflation-cpiDE 40 technical analysis

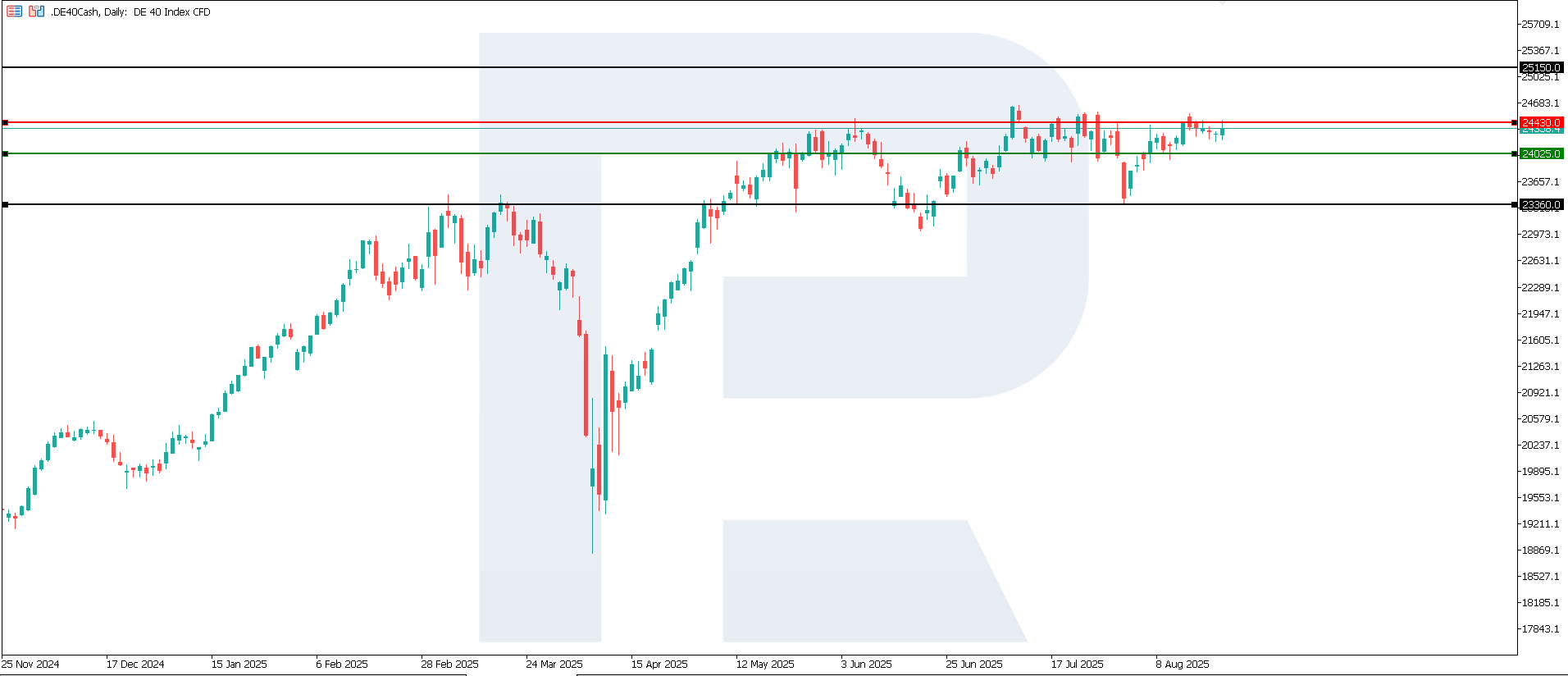

The DE 40 index has formed a resistance level at 24,430.0 and a support level at 24,025.0. Volatility has increased, evident in frequent shifts in the overall trend. However, in the medium term, the main direction is highly likely to remain upwards.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 24,025.0 support level could push the index down to 23,360.0

- Optimistic DE 40 scenario: a breakout above the 24,430.0 resistance level could drive the index to 25,150.0

Summary

The CPI data confirms that Germany’s price dynamics have stabilised near the ECB’s target. For the DE 40, this means the baseline scenario remains intact, regulatory uncertainty is reduced, and the overall outlook is neutral-to-positive. Rate-sensitive segments receive the greatest relative support. The next upside target for the index may be 25,150.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.