DE 40 forecast: decline continues, trend shifts to downward

The DE 40 stock index entered a sharp downward correction following the introduction of new US tariffs. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

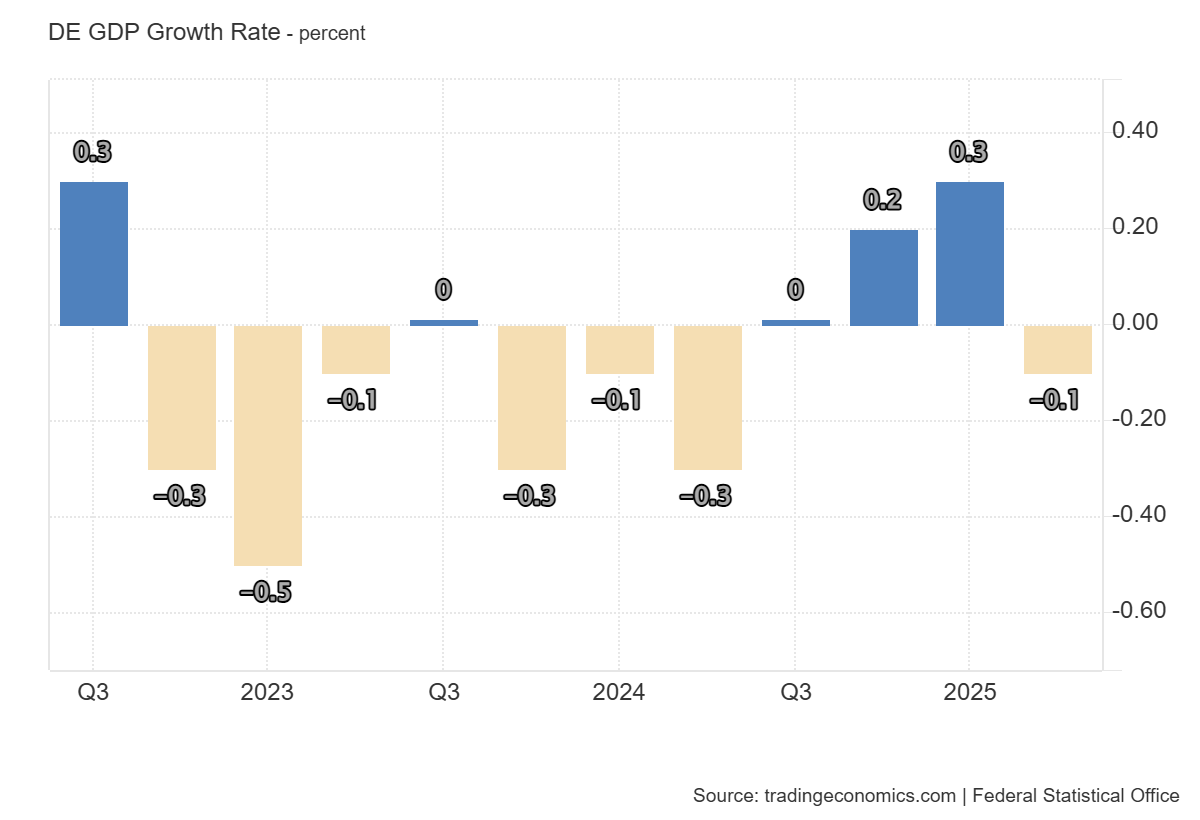

- Recent data: Germany’s GDP fell by 0.1% in Q2 2025

- Market impact: this is a worrying signal for the stock market, as weak GDP typically indicates a decline in business activity and weaker corporate earnings

DE 40 fundamental analysis

Weak German GDP data (-0.1% quarter-on-quarter) indicates an economic slowdown after a 0.4% rise in the previous quarter. The GDP decline may pressure the entire market, as investors could fear further economic slowdown and potential deterioration in corporate outlooks. As a result, they may turn more cautious, reducing exposure to risk assets, including equities, thereby putting additional pressure on the DE 40 index.

Additionally, the market also faces headwinds from new US tariff measures. Germany is likely to bear the brunt within the EU under the new trade agreement. A drop in GDP often points to weakening consumer demand, particularly for high-value durable goods such as cars.

Germany GDP growth rate: https://tradingeconomics.com/germany/gdp-growthDE 40 technical analysis

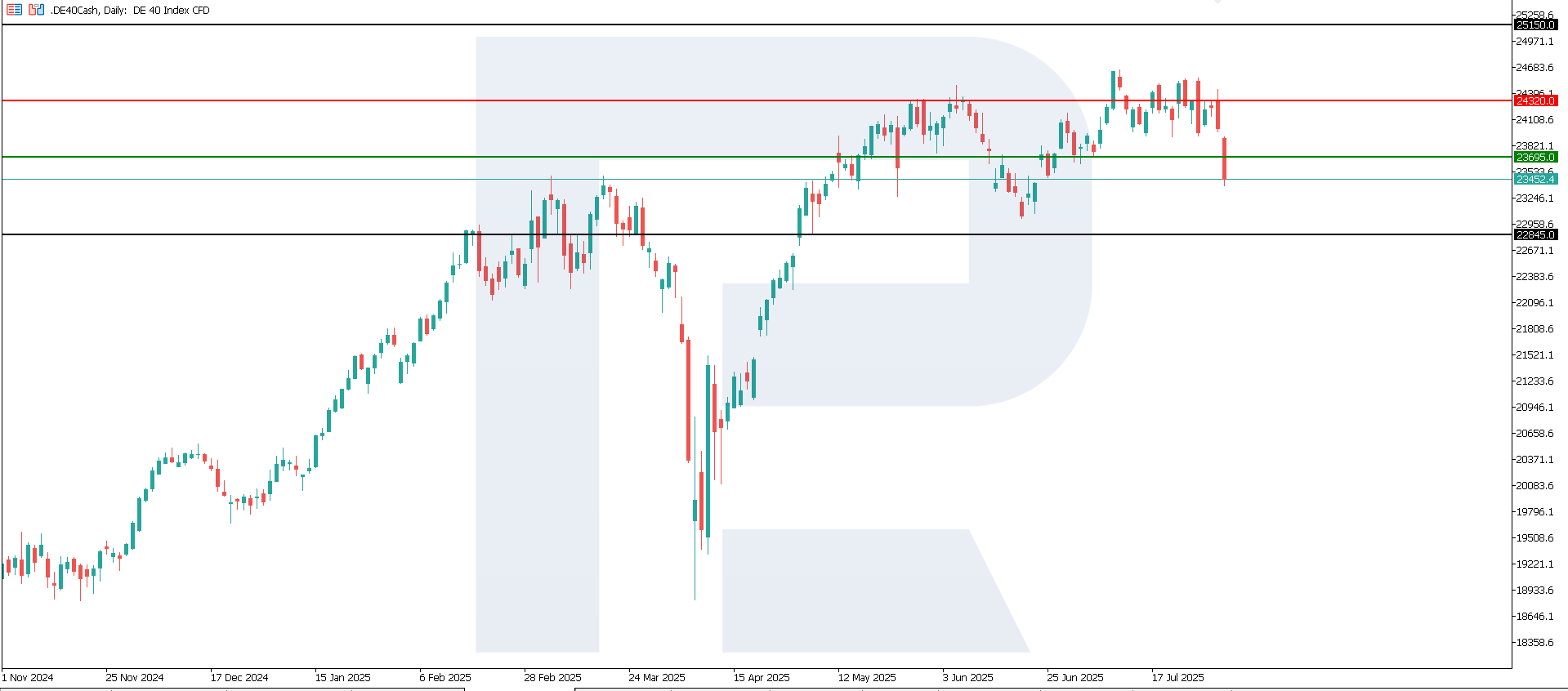

The DE 40 index broke below the support level with strong momentum. The resistance level has formed at 24,320.0, while no clear support zone has yet emerged. Given the current downtrend, the likelihood of a short-term rally or new all-time highs appears very low.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 forecast: if the price consolidates below the 23,695.0 support level, the index may drop further to 22,845.0

- Optimistic DE 40 forecast: a breakout above the 24,320.0 resistance level could boost the index to 25,150.0

Summary

The current GDP figure (-0.1%) delivers a generally negative signal for the DE 40. However, the extent of the correction will depend on upcoming economic indicators and central bank responses. In the short term, the market may react moderately negatively, correcting downwards as corporate earnings forecasts and Germany’s economic outlook are reassessed. The next potential downside target is the 22,845.0 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.