DE 40 forecast: the index declines, the likelihood of a reversal to a downtrend increases

The DE 40 stock index has entered a sharp downward correction following the signing of a new trade agreement between the EU and the US. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

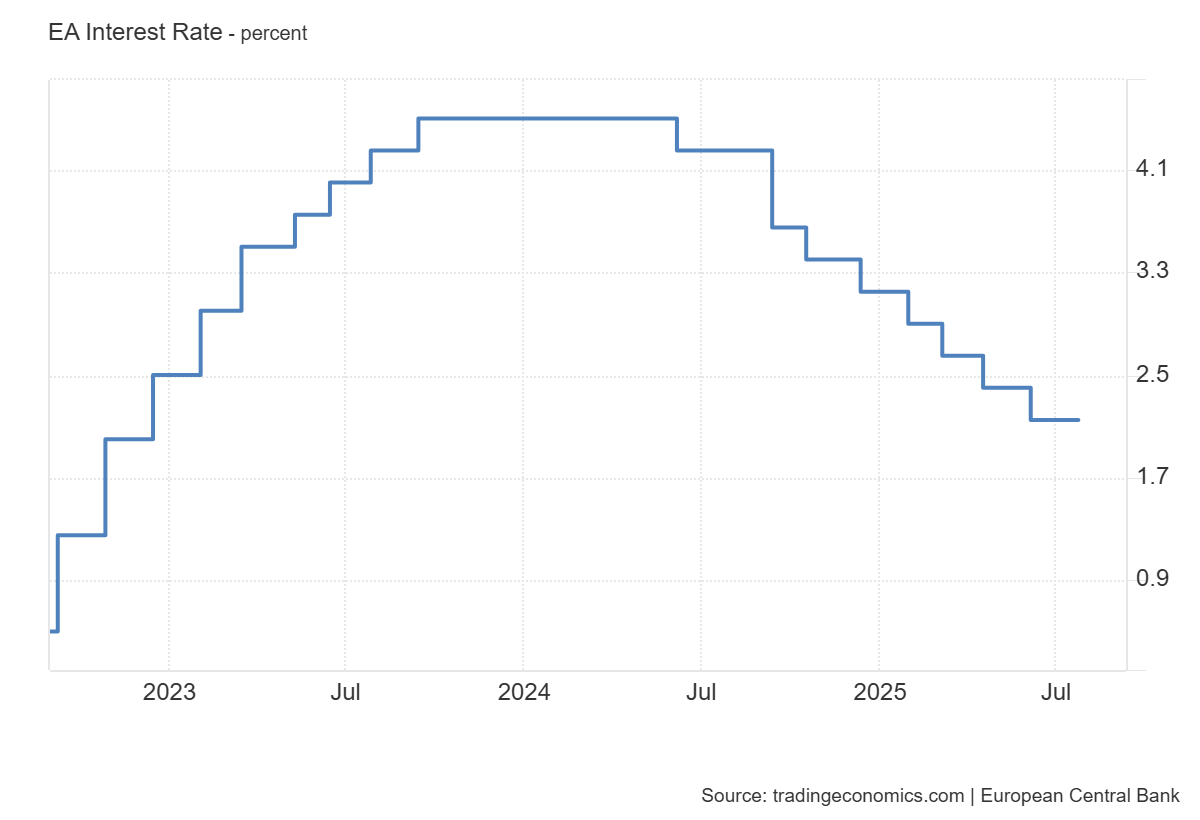

- Recent data: the ECB key interest rate remained unchanged at 2.15%

- Market impact: investors are more concerned about the new EU-US trade deal, which is pushing the index down

DE 40 fundamental analysis

The European Central Bank kept its key interest rate at 2.15%, in line with both forecasts and the previous figure. This suggests the regulator views current monetary policy as sufficient to contain inflation and support the economy. On 27 July 2025, the US and the European Union announced a framework trade agreement aimed at avoiding a full-scale tariff war between the world’s largest economies.

Instead of the previously discussed 30% tariffs, a softer duty was introduced. The tariff covers almost all product categories from automobiles and pharmaceuticals to semiconductors. For comparison, before the agreement, tariffs on some goods were even higher, while the average tariff rate in 2024 stood at just about 2.5%. Steel and aluminium remain an exception, still facing a 50% duty, although a future reduction to quotas is possible. Europe effectively opens financial flows towards the US through reduced tariff tensions, investments, and binding purchase agreements. The total value of the deal is estimated at around 1.7 trillion USD.

DE 40 technical analysis

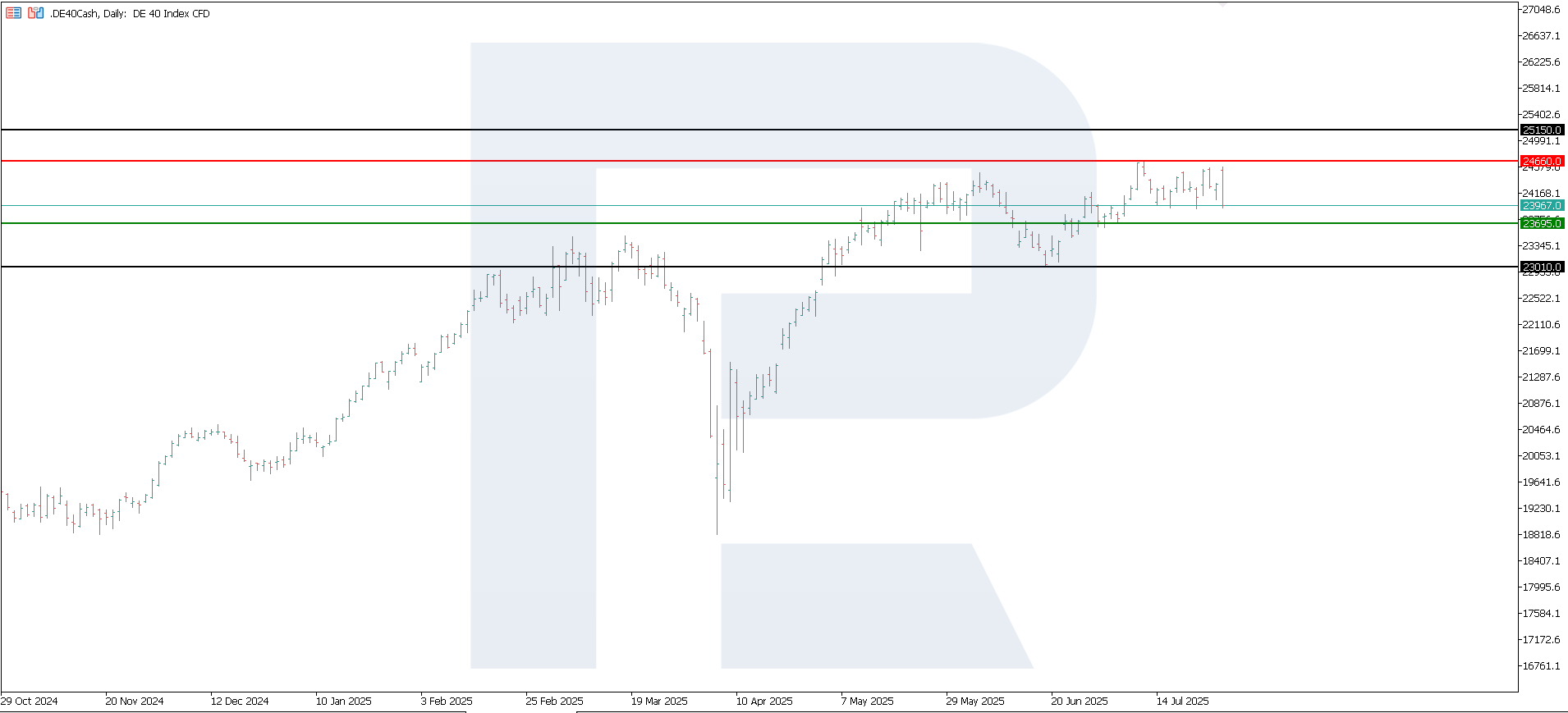

The DE 40 index rushed towards the support level, confirming concerns about a potential trend reversal. The resistance level has formed at 24,660.0, with support at 23,695.0. This performance casts doubt on the likelihood of continued growth and potential new all-time highs.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 scenario: a breakout below the 23,695.0 support level could send the index down to 23,010.0

- Optimistic DE 40 scenario: a breakout above the 24,660.0 resistance level could boost the index up to 25,150.0

Summary

The newly signed trade agreement between the EU and the US clearly favours the latter. German exporters are among the most affected, as they face higher tariff-related costs. Manufacturers will need to choose between raising consumer prices or reducing net profits – both outcomes will likely weaken financial performance. This could pressure the DE 40 index and weigh on Germany’s economy, which is only just recovering from the energy crisis.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.