DE 40 forecast: the correction has ended, further growth is expected

The DE 40 stock index is poised to resume upward movement. Today’s DE 40 forecast is positive.

DE 40 forecast: key trading points

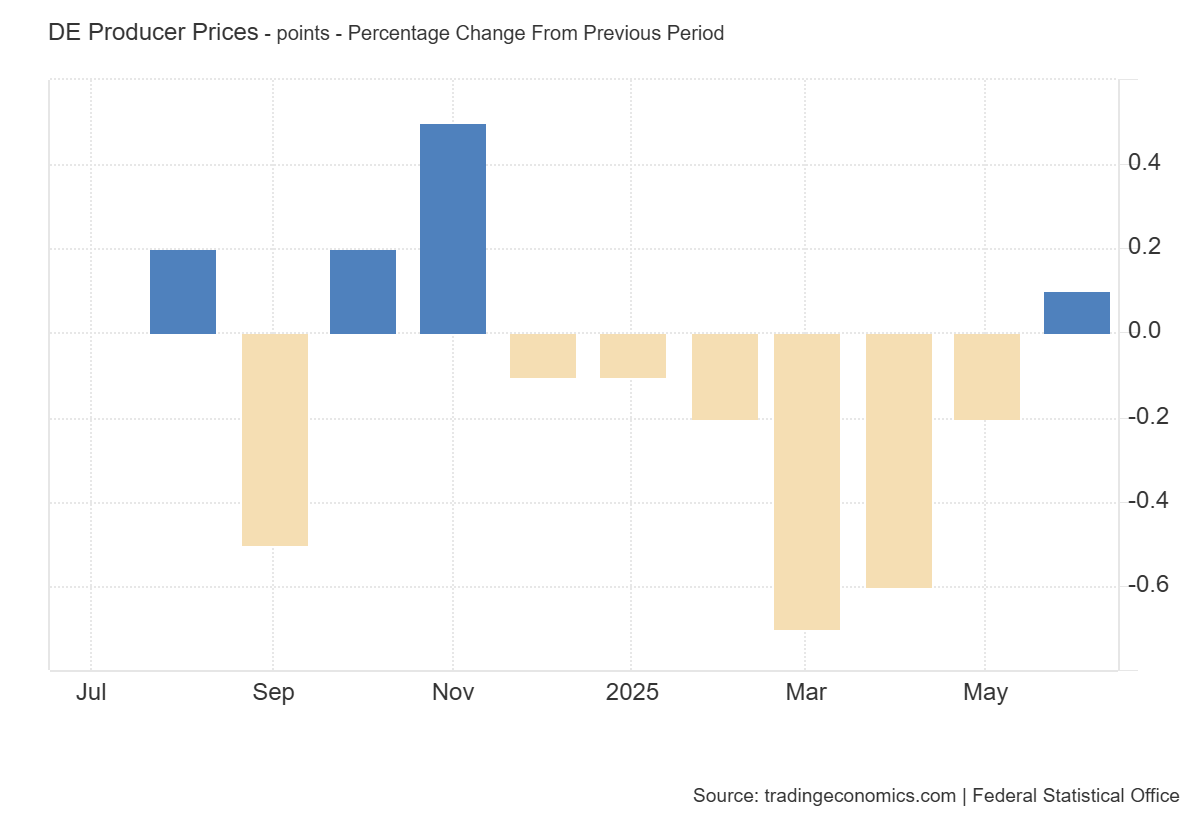

- Recent data: Germany’s Producer Price Index (PPI) for June came in at 0.1%

- Market impact: the value is neutral for the German stock market and the DE 40 index

DE 40 fundamental analysis

Germany’s PPI for June 2025 showed a 0.1% increase, matching forecasts and improving from the previous month’s -0.2%. A moderate rise in producer prices indicates stability in the manufacturing sector and the absence of sharp price surges, which reduces risks for corporate profitability within the index. This supports investor confidence in sectors such as industrials, engineering, and chemicals, as their cost base is not significantly affected by inflationary shocks.

Overall, the PPI data confirms expectations of a stable economic backdrop without abrupt inflationary spikes, which supports a positive outlook for the German stock market in both the short and medium term. Investors may expect a continued moderate rise in shares of leading DE 40 companies, while maintaining a balance between risks and opportunities.

Germany producer prices: https://tradingeconomics.com/germany/producer-pricesDE 40 technical analysis

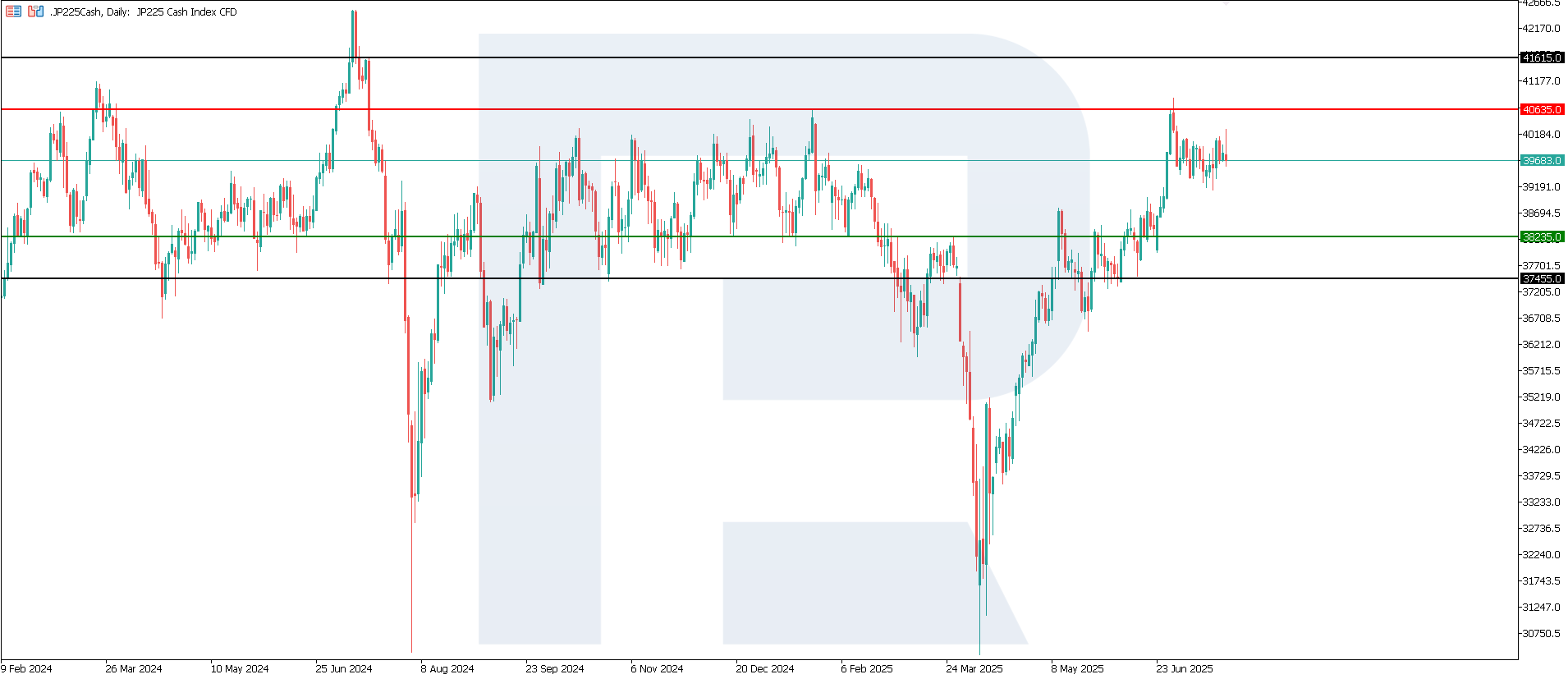

The DE 40 index broke above the previous resistance level with a strong upward impulse, confirming the strength of the medium-term uptrend. A new resistance level formed at 24,660.0, while support shifted to 23,695.0. This price action indicates a high likelihood of continued growth and a possible new all-time high.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 scenario: a breakout below the 23,695.0 support level could send the index down to 23,010.0

- Optimistic DE 40 scenario: a breakout above the 24,660.0 resistance level could drive the index up to 25,150.0

Summary

The slight increase in Germany’s PPI creates favourable conditions for medium-term growth in the DE 40 index. For the consumer and retail sectors, a moderate rise in PPI signals subdued producer-level inflation, which may help preserve household purchasing power and stable demand for goods. The DE 40 index continues its upward momentum, aiming for a new all-time high. The next upside target is 25,150.0, which would mark a new record.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.