DE 40 forecast: the index faces a correction, but growth potential remains

The DE 40 stock index has approached a resistance level and aims to resume its upward movement. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

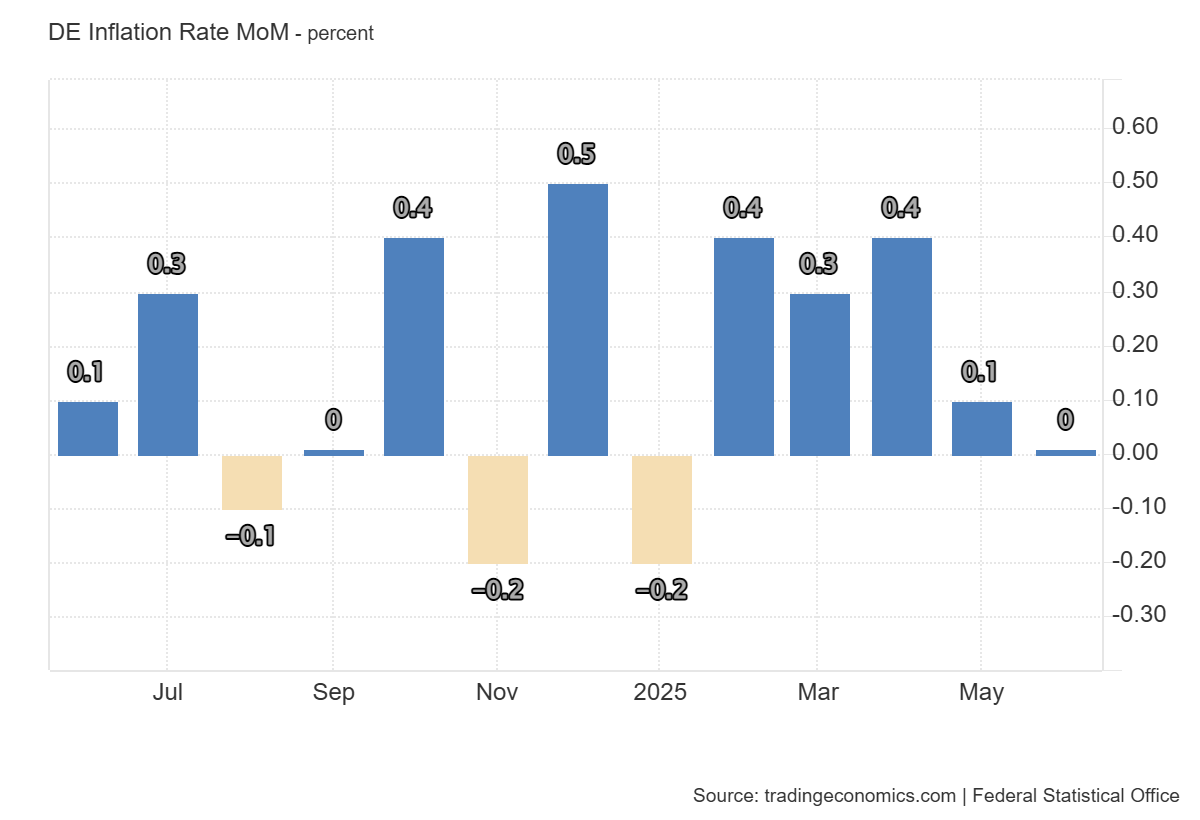

- Recent data: Germany's CPI for June came in at 0.0%

- Market impact: for the German equity market, especially the DE 40 index, such data may be perceived positively

DE 40 fundamental analysis

Germany's Consumer Price Index (CPI) came in at 0.0% for June, in line with forecasts and slightly below the previous reading of 0.1%. This indicates stabilisation in inflationary pressures on consumer prices. A flat CPI figure reduces the risk of aggressive monetary tightening by the European Central Bank, thereby supporting corporate stability, especially in sectors heavily reliant on consumer demand such as retail, automotive, and durable goods manufacturing.

At the same time, a stable CPI could apply moderate pressure on the banking sector, since low inflation reduces the potential for interest rate hikes, which impacts lending margins. For industrial and technology firms, the environment is neutral to positive, as stable prices enhance cost and demand predictability.

Germany inflation rate MoM: https://tradingeconomics.com/germany/inflation-rate-momDE 40 technical analysis

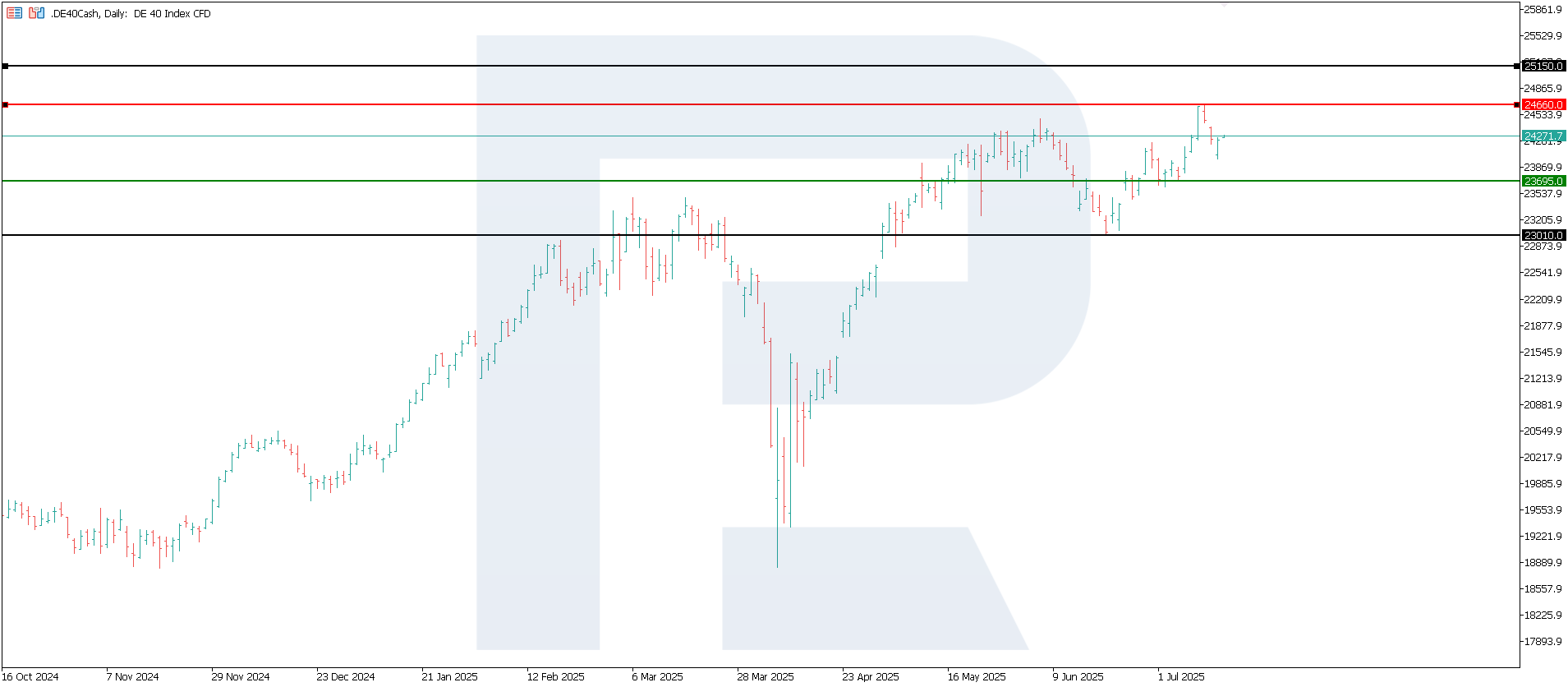

The DE 40 index has formed resistance at 24,660.0, with support now at 23,695.0. The price broke above the previous resistance with strong momentum, indicating the continuation of the medium-term uptrend and opening wide opportunities for reaching a new all-time high.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 scenario: a breakout below the 23,695.0 support level could send the index down to 23,010.0

- Optimistic DE 40 scenario: a breakout above the 24,660.0 resistance level could propel the index to 25,150.0

Summary

Stable CPI figures in Germany create favourable conditions for medium-term growth in the DE 40 index, minimising risks of sudden disruptions in key sectors. The DE 40 continues its upward movement with an eye on a new all-time high. The next upside target is 25,150.0, which would mark a record level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.