DE 40 forecast: German index aims to break resistance and continue rising

The DE 40 stock index quotes have approached the resistance level and aim to continue rising. The forecast for DE 40 today is positive.

DE 40 forecast: key trading points

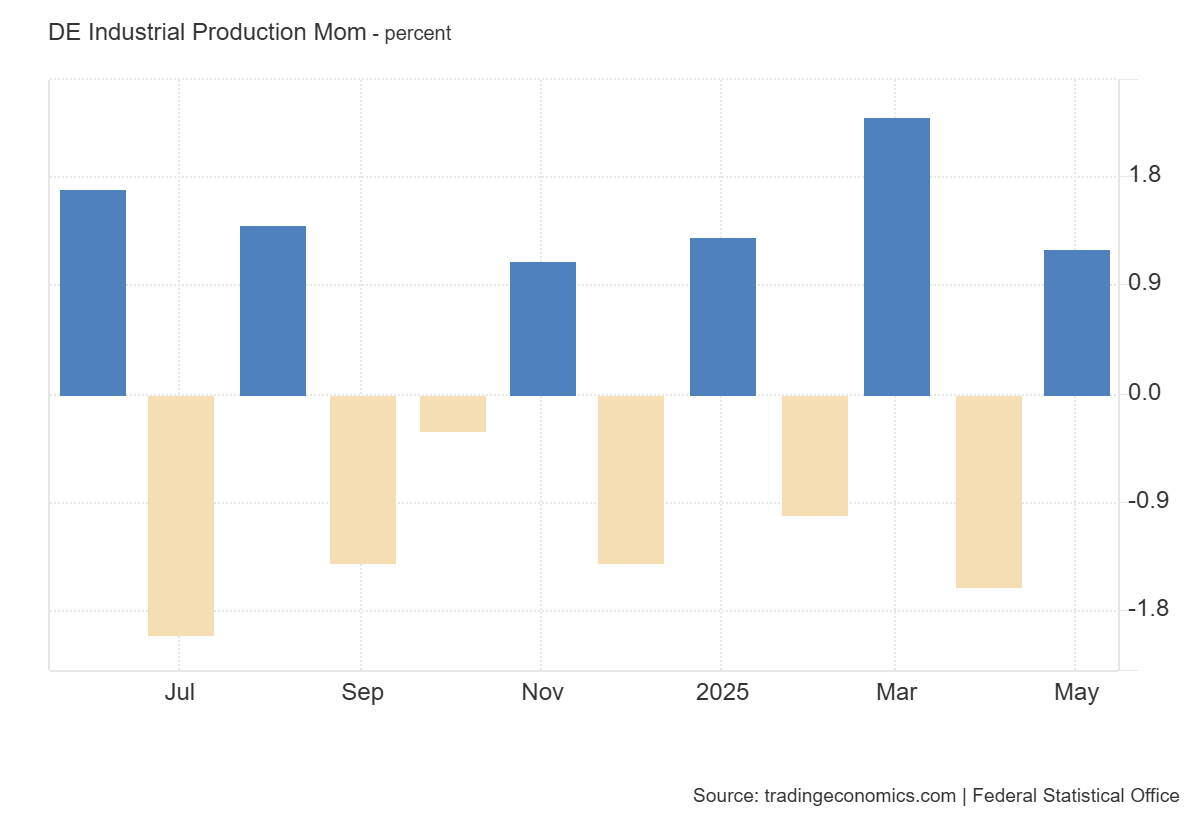

- Recent data: Germany's industrial production for May increased by 1.2%

- Market impact: investors see that German industrial companies are recovering revenue and margins, which, combined with an improved business climate, strengthens expectations of their stock growth

DE 40 fundamental analysis

Industrial Production is one of the main leading indicators of economic activity, reflecting the output volume of domestic goods from factories, plants, and mining enterprises. The 1.2% growth in May (vs. forecast -0.6% and April’s decline of -1.4%) indicates a sudden and significant rebound in domestic production after a downturn. This suggests that companies received more orders, successfully replenished inventories, and increased capacity utilisation.

The industrial sector accounts for about 30% of the DE 40’s market capitalisation, so such unexpected Industrial Production data will likely drive the index higher in the short term. Industrial and engineering company assets will gain the strongest momentum.

Germany Industrial Production MoM: https://tradingeconomics.com/germany/industrial-production-momDE 40 technical analysis

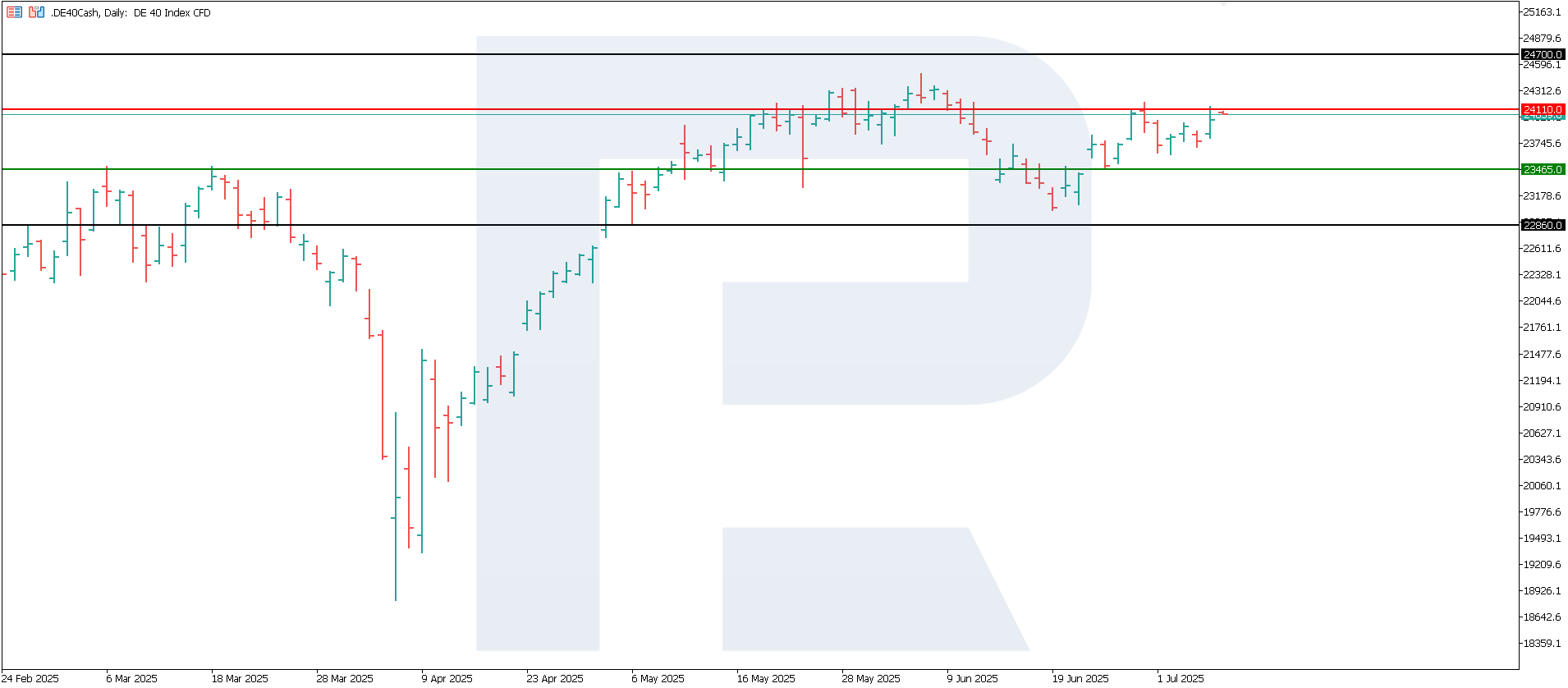

Resistance for the DE 40 index has formed at 24,110.0, with support now at 23,465.0. The previous resistance was broken with strong momentum, indicating the continuation of the medium-term upward trend and opening wide opportunities for reaching a new all-time high.

Scenarios for the DE 40 index price forecast:

- Pessimistic scenario for DE 40: if the support level at 23,465.0 is breached, prices may fall to 22,860.0

- Optimistic scenario for DE 40: if the resistance level at 24,110.0 is broken, prices may rise to 24,700.0

Summary

High activity in the industrial sector increases the attractiveness of DE 40’s traditional sectors, but it remains important to monitor macro data (inflation, ECB policy, and geopolitical risks). The DE 40 index continues its upward movement with a focus on reaching a new all-time high; the nearest growth target is 24,700.0, which would set a new record.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.