DE 40 forecast: the index maintains its upward trajectory, rising above 20,300.0

This week, the DE 40 stock index continues to rise, steadily remaining above the psychologically important level of 20,000.0. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

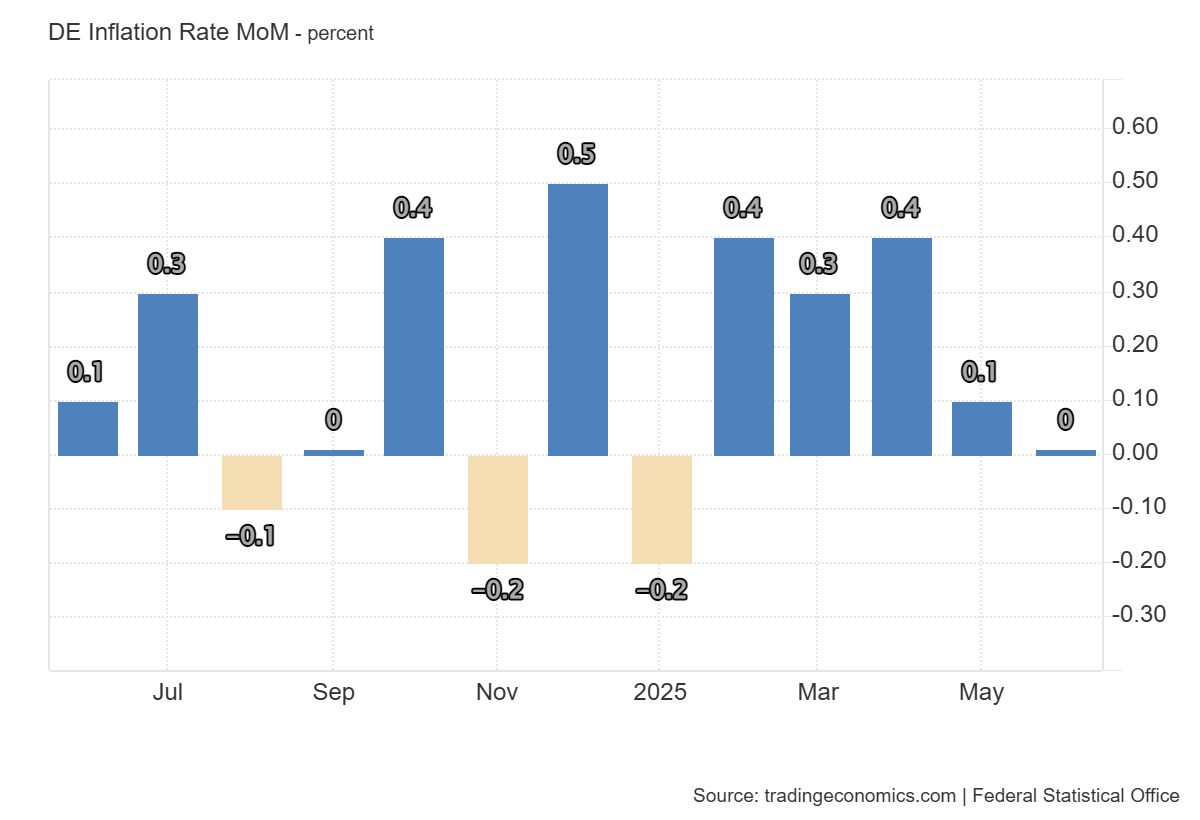

- Recent data: Germany’s Consumer Price Index for June stood at 0.0%

- Market impact: zero inflation eases concerns over potential ECB monetary tightening and supports investor sentiment in the equity market

DE 40 fundamental analysis

The actual Consumer Price Index reading for June was 0.0%, below the forecast of 0.2% and the previous figure of 0.1%. Zero inflation indicates price stabilisation, suggesting an easing of inflationary pressure. Stable prices positively influence consumer purchasing power, supporting retail and service companies.

Consumer price stabilisation in Germany creates positive expectations in the stock market, supporting both the consumer and industrial sectors. The financial sector may experience mixed impacts due to the lack of prospects for rising interest rates.

DE 40 technical analysis

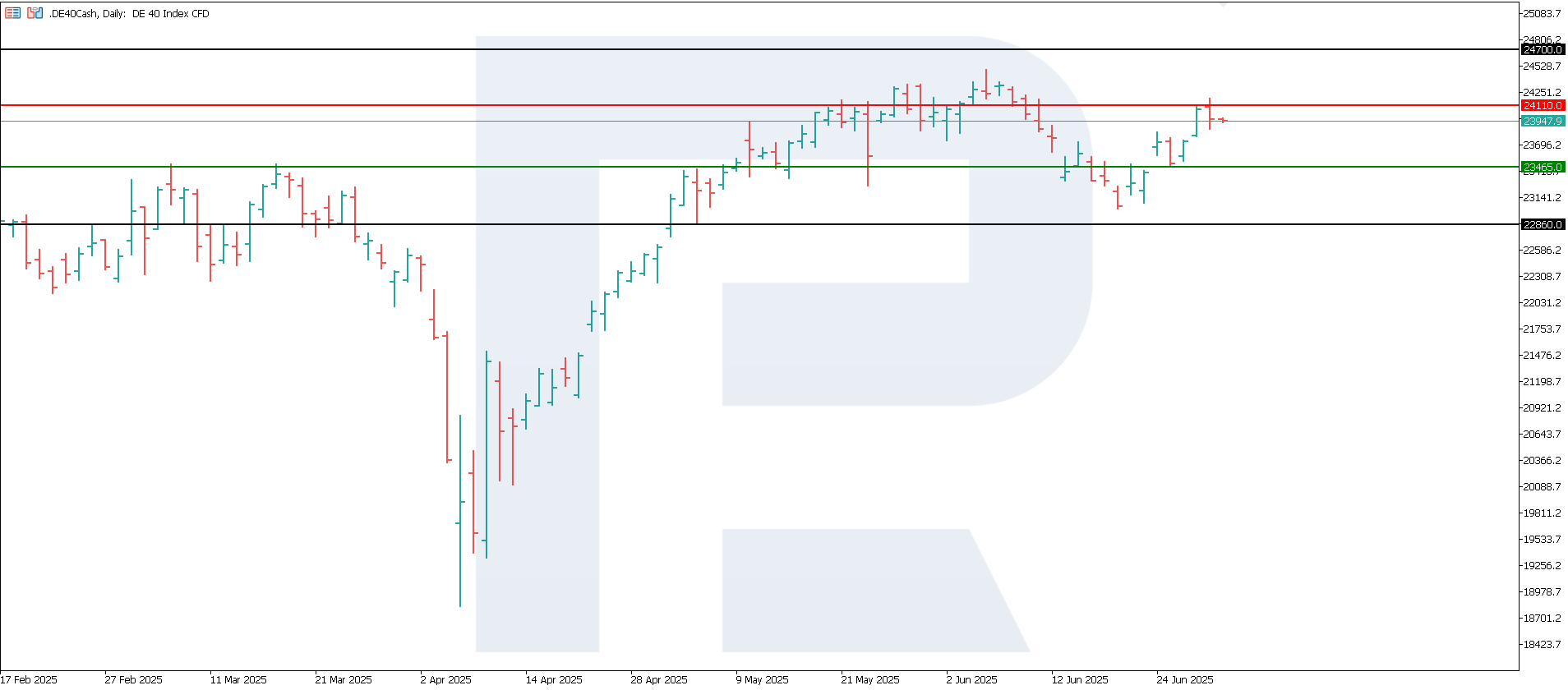

Resistance for the DE 40 index has formed at 24,110.0. A new support level has been set at 23,465.0. The previous resistance was broken with strong momentum, indicating continuation of the previous medium-term uptrend. There is a very high potential for a new all-time high.

Scenarios for the DE 40 index price forecast:

- Pessimistic scenario for DE 40: if the support level at 23,465.0 is breached, prices may fall to 22,860.0

- Optimistic scenario for DE 40: if the resistance level at 24,110.0 is broken, prices may rise to 24,700.0

Summary

The CPI slowdown suggests that the ECB will continue to ease its monetary policy. This positively affects equity market demand from investors. The DE 40 stock index remains in an uptrend and aims to reach a new all-time high. The next growth target may be 24,700.0, which would become the new historical maximum.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.