USDJPY has fallen below 155.00

The USDJPY rate is moving lower, falling below 155.00 amid expectations that the Bank of Japan may raise interest rates at its December meeting. The market is awaiting US inflation data today. Find out more in our analysis for 5 December 2025.

USDJPY forecast: key trading points

- Market focus: today, the market awaits US inflation statistics – the PCE price index

- Current trend: correcting downwards

- USDJPY forecast for 5 December 2025: 156.20 or 153.70

Fundamental analysis

The USDJPY pair fell below 155.00 yen per dollar, driven by expectations that the Bank of Japan may raise interest rates later this month. Reports indicate that key members of Prime Minister Sanae Takaichi’s government will not oppose a rate hike in December.

Another one or two BoJ rate hikes are anticipated next year. These expectations strengthened after Bank of Japan Governor Kazuo Ueda expressed confidence in Japan’s economic outlook and stated that the central bank will carefully weigh all the pros and cons before raising rates and take appropriate action.

USDJPY technical analysis

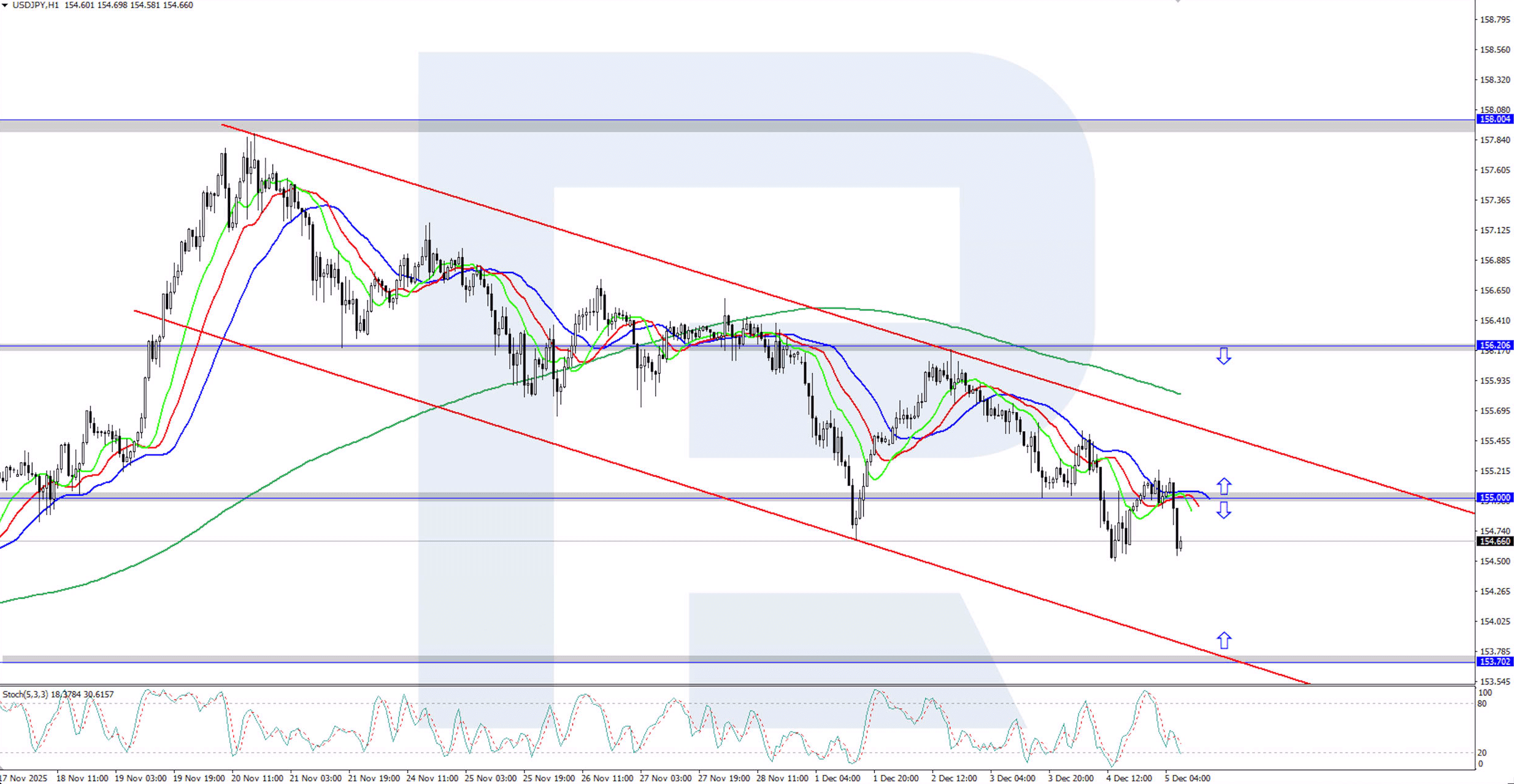

The USDJPY pair continues to decline as part of the current downward correction. The Alligator indicator has turned downwards, confirming the prevailing bearish momentum. The nearest local support level is located at 153.70.

The USDJPY forecast for today suggests that the pair may continue its decline towards the 153.70 support level if bears maintain control. A bullish move will become possible if buyers push the price above 155.00, which could trigger growth towards 156.20.

Summary

The USDJPY price has dipped below 155.00 during the ongoing downward correction. Market participants are awaiting US inflation data today, with the PCE price index scheduled for release.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.