USDJPY entered a correction phase

The USDJPY exchange rate is moderately declining, falling below 156.00 amid expectations of a possible rate hike by the Bank of Japan at its December meeting. Find out more in our analysis for 1 December 2025.

USDJPY forecast: key trading points

- Market focus: Japan’s manufacturing PMI for November was revised downwards to 48.7 points

- Current trend: correcting downwards

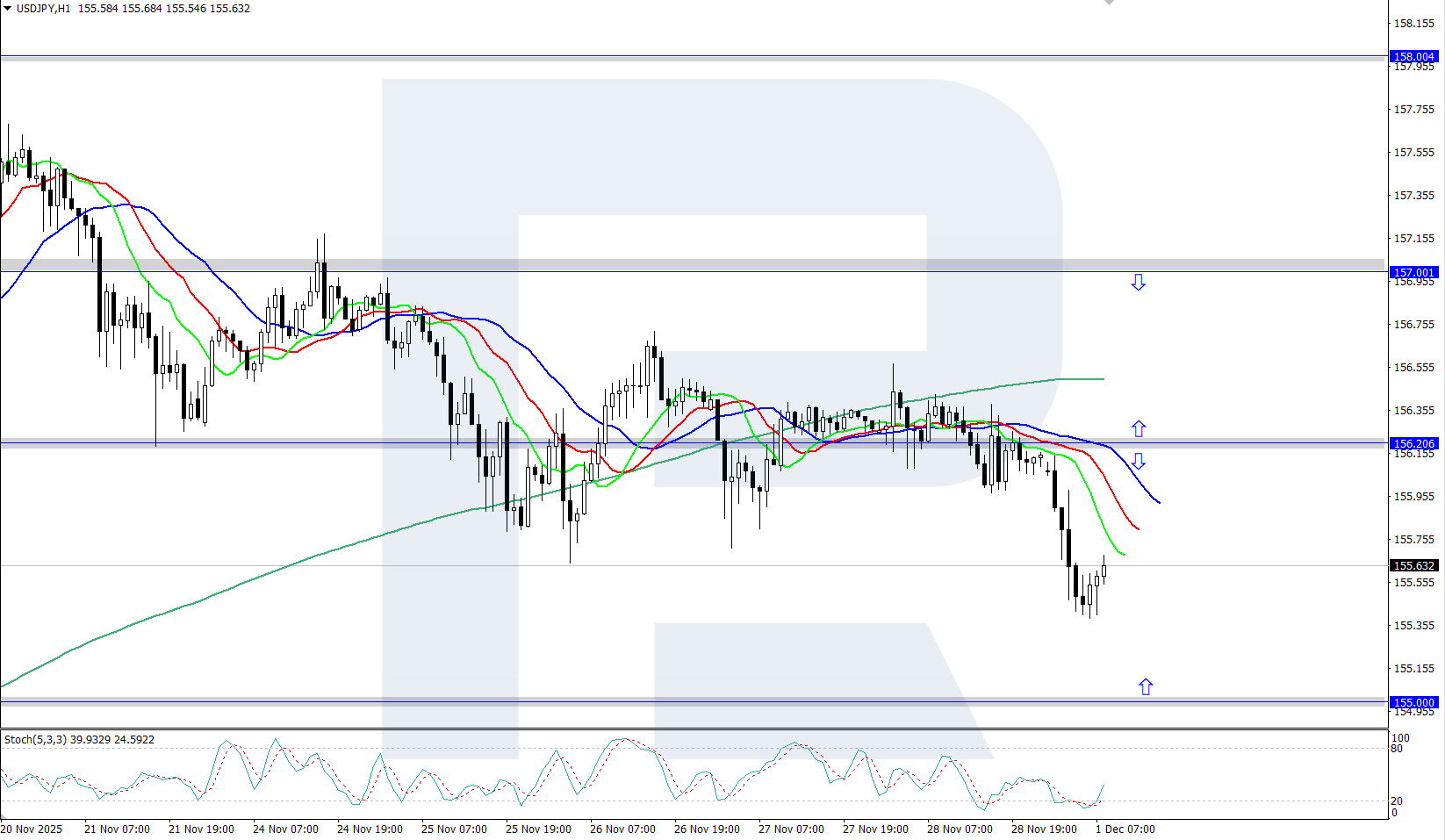

- USDJPY forecast for 1 December 2025: 156.20 or 155.00

Fundamental analysis

Bank of Japan Governor Kazuo Ueda stated in his Monday speech that the BoJ is weighing the pros and cons of raising interest rates at its meeting on 19 December. As risks of US tariffs have eased, he noted that the central bank’s economic and price projections are now more likely to be met.

The market is currently pricing in approximately a 62% likelihood of a rate hike at the upcoming December meeting of the Bank of Japan, with this probability rising to 90% by the January meeting. Expectations of a rate increase have strengthened following a significant depreciation of the yen against the US dollar this quarter, as well as due to inflation remaining above the central bank's 2% target.

USDJPY technical analysis

The USDJPY pair is declining within the current downward correction. The Alligator indicator has turned downwards, confirming the bearish momentum. The nearest local support now stands at 155.00.

Today’s USDJPY forecast suggests that the pair may continue to fall towards the 155.00 support level if bears maintain control. A bullish scenario would be possible if buyers push the price above 156.20, which could trigger a rise towards 157.00.

Summary

The USDJPY rate has dropped below 157.00, with market participants expecting a Bank of Japan rate hike in December or January.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.