Strong macroeconomic data from Japan fails to halt USDJPY growth

The USDJPY rate maintains its upward momentum despite improving Japanese data, currently standing at 156.36. Find more details in our analysis for 28 November 2025.

USDJPY forecast: key trading points

- Industrial production in Japan increased by 1.4% in October, far exceeding the forecast decline of 0.6%

- Japan’s unemployment rate remained at 2.6%, while the market expected a drop to 2.5%

- The market has strengthened expectations of a BoJ rate hike next month

- USDJPY forecast for 28 November 2025: 158.90

Fundamental analysis

The USDJPY pair is showing moderate strengthening. Buyers are confidently holding the price above the key support level of 155.85, confirming sustained demand for the US dollar amid cautious yen dynamics.

Industrial production in Japan rose by 1.4% in October after a 2.6% increase in September. The report from the Ministry of Economy, Trade and Industry shows a result that significantly exceeded analysts’ expectations for a 0.6% decline. Retail sales in Japan grew by 1.6% in October compared to September, also beating expectations for a 0.8% increase. The unemployment rate remained flat at 2.6%, while the market expected a drop to 2.5%.

The market has strengthened expectations of a BoJ rate hike as early as next month. Investors note that persistent inflation, yen weakness, and reduced political pressure to maintain ultra-low rates create conditions for potential policy tightening.

USDJPY technical analysis

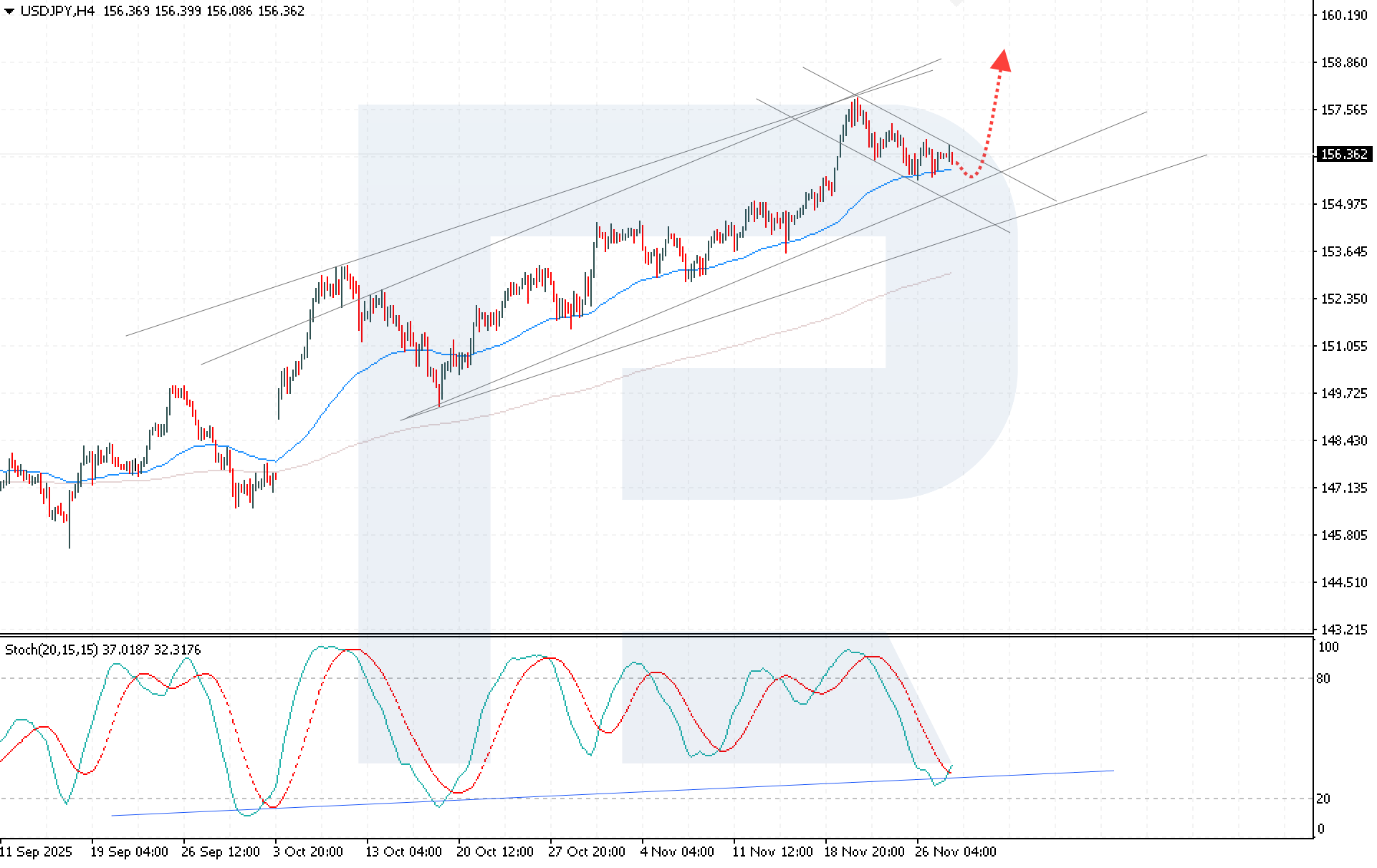

The USDJPY pair is correcting within an ascending channel. Buyers are keeping the price above the EMA-65 line, which confirms the dominance of bullish sentiment.

The USDJPY forecast anticipates a minor bearish correction, followed by a renewed rise towards 158.90. The Stochastic Oscillator further supports the bullish scenario, with its signal lines bouncing from the support level and crossing in favour of upward movement.

A breakout and consolidation above 156.50 will serve as a key confirmation of a full-fledged resumption of the bullish trend and indicate a move beyond the corrective channel.

Summary

Despite rising industrial output and retail sales in Japan, a weak labour market and persistent inflationary risks continue to weigh on the yen, while the BoJ’s accommodative stance keeps the balance in favour of the US dollar. USDJPY technical analysis indicates that a consolidation above 156.50 will open the path towards 158.90.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.