BoJ prepares a shock, USDJPY may continue to fall

The yen continues to strengthen amid potential interest rate changes from both the Fed and the Bank of Japan. Quotes may test the 155.00 support level. Find out more in our analysis for 27 November 2025.

USDJPY forecast: key trading points

- The BoJ may raise interest rates in the near future

- The Fed is expected to cut interest rates

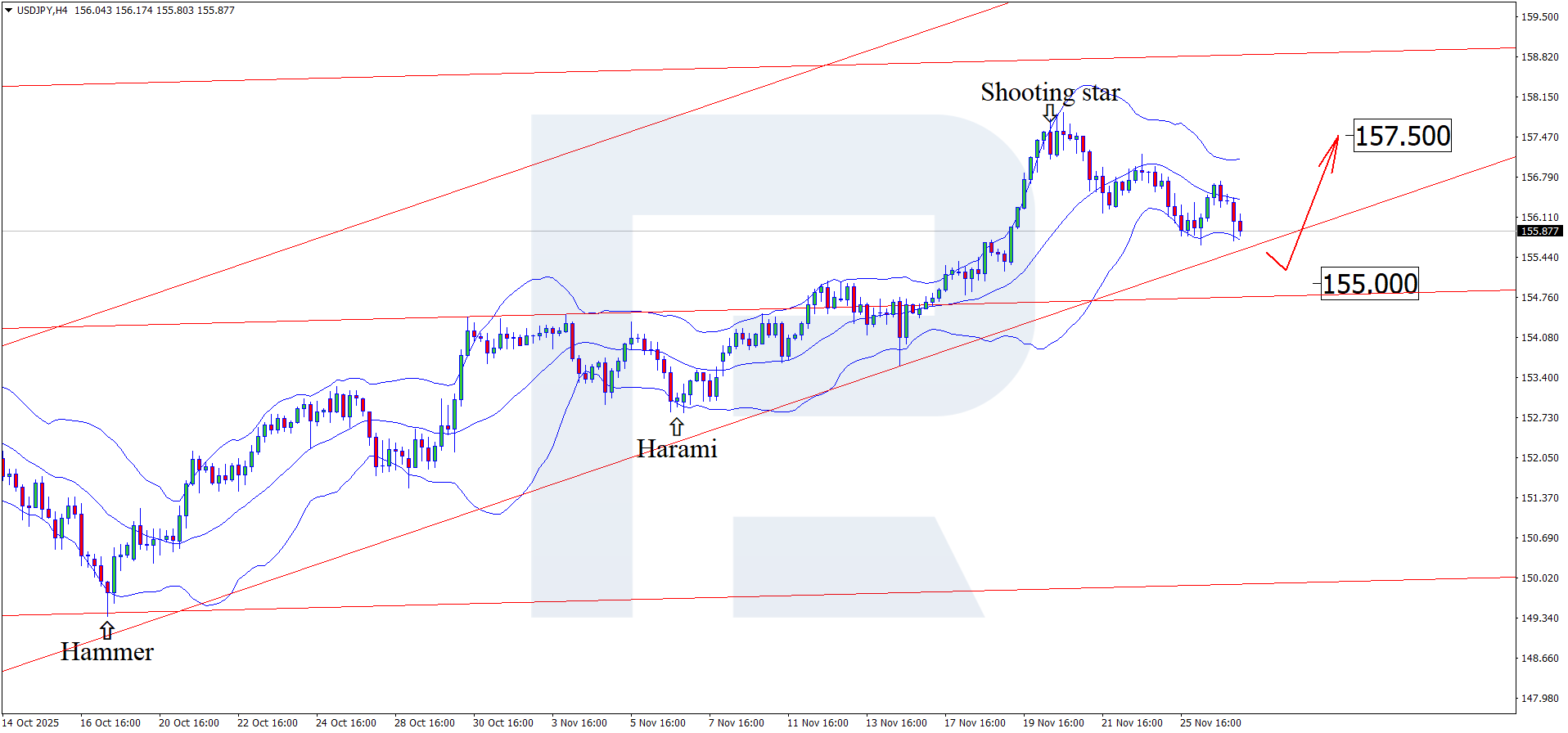

- USDJPY forecast for 27 November 2025: 155.00 and 157.50

Fundamental analysis

The forecast for 27 November 2025 takes into account that the USDJPY pair, after setting a new price record for 2025, continues its correction and is trading near 155.80.

The key triggers influencing the USDJPY rate today:

- BoJ member Asahi Noguchi supported the idea of gradually returning to interest rate hikes if economic and inflation conditions allow it

- This signal reinforces expectations that the BoJ may raise rates soon. A tightening cycle would support the yen and could limit further weakening

- Amid expectations of a potential Fed rate cut or a more accommodative policy stance, the US dollar is weakening, giving additional support to USDJPY on the downside

Attempts by the BoJ to strengthen the yen are influencing the USDJPY outlook and increasing volatility. Since 27 November is a public holiday in the US, the USDJPY pair may continue to decline without support from American market participants.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has formed a Shooting Star reversal pattern near the upper Bollinger Band and is currently trading around 155.80. At this stage, the pair may continue its downward wave in response to this signal, with a correction target at 155.00.

However, today’s USDJPY forecast also considers an alternative scenario, in which the price may rise towards 157.50 without testing the support level.

Summary

The pair remains under pressure, and volatility may increase as central-bank decisions approach. USDJPY technical analysis suggests a decline towards the 155.00 support level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.