USDJPY in correction, but everything can change

The USDJPY pair has declined to 155.89, with all eyes on possible interventions to support the yen. Find out more in our analysis for 26 November 2025.

USDJPY forecast: key trading points

- Market focus: the USDJPY pair has entered a correction phase, but everything can change quickly

- Current trend: the market does not rule out interventions to support the yen

- USDJPY forecast for 26 November 2025: 155.65

Fundamental analysis

The USDJPY rate fell to 155.89 on Wednesday, a weekly low driven partly by US dollar weakness.

Support for the yen emerged after the latest US data showed a slowdown in consumer activity. Additional support came from reports that a candidate with a more dovish policy stance is being considered for the role of Fed chair.

Another important foundation for yen strength is rising expectations of a possible currency intervention from Tokyo. The upcoming Thanksgiving holiday in the US creates a potential window for Japanese authorities to act. Traditionally, periods of reduced liquidity increase the likelihood of intervention.

Last Sunday, Prime Minister’s adviser Takuji Aida stated that Japan is ready to intervene actively in the market to offset the negative economic consequences of a weak yen. His comments align with recent statements from Bank of Japan Governor Kazuo Ueda and Finance Minister Satsuki Katayama, increasing expectations of potential support measures for the currency.

The USDJPY forecast is moderately favourable.

USDJPY technical analysis

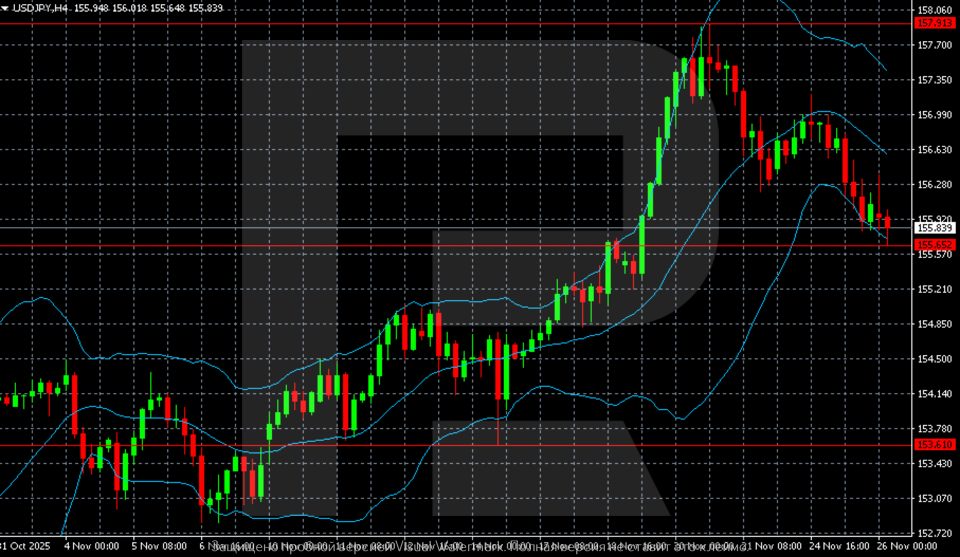

The USDJPY H4 chart shows a corrective decline after a sharp rise towards highs near 157.90–158.00. After forming a local peak, the price reversed downwards and is now testing the key support zone at 155.65 – a level that previously acted as resistance and is now being retested for strength.

The candlestick structure shows a slowdown in the decline within the 155.65–155.85 zone, but there is no strong reversal signal yet. The price has moved into the middle area of Bollinger Bands, while the heightened volatility of recent days is gradually diminishing. A breakout below 155.65 will open the path to a deeper correction towards 154.80–154.30, and then to the major support level at 153.60.

If buyers hold the current zone, the pair could pull back to 156.30–156.70, where the middle Bollinger band and nearest dynamic resistance are located. A return above 157.00 would be the first confirmation of a restored bullish impulse.

Summary

The USDJPY pair is correcting, but its short-term outlook remains mixed. The USDJPY forecast for today, 26 November 2025, suggests a decline towards 155.65.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.