USDJPY at a nine-month high: news flow continues to work against the yen

The USDJPY pair has climbed to 157.50. Markets are waiting for Japan’s government stimulus package. Discover more in our analysis for 20 November 2025.

USDJPY forecast: key trading points

- Market focus: the USDJPY pair is rising, with the yen under pressure amid expectations of new stimulus in Japan

- Current trend: markets do not expect quick measures to support the yen

- USDJPY forecast for 20 November 2025: 157.65

Fundamental analysis

The USDJPY pair has risen towards 157.50, staying near ten-month highs. This comes amid expectations that Prime Minister Sanae Takaichi’s government will announce a large stimulus package exceeding 20 trillion JPY. The plan fuelled concerns over fiscal sustainability and triggered another wave of the ‘Sell Japan’ strategy – pressure on the yen and Japanese government bonds while equity markets remain stable.

Additional downward pressure on the yen came from comments by Finance Minister Satsuki Katayama, who noted that currency issues were not discussed during her meeting with Bank of Japan Governor Kazuo Ueda. This reduced expectations for near-term support measures. Traders believe authorities may intervene only if the USDJPY pair approaches 160, the level of previous interventions.

Pressure also increased as the US dollar strengthened following a series of hawkish remarks from Federal Reserve officials who see a December rate cut as unlikely.

The USDJPY outlook is positive.

USDJPY technical analysis

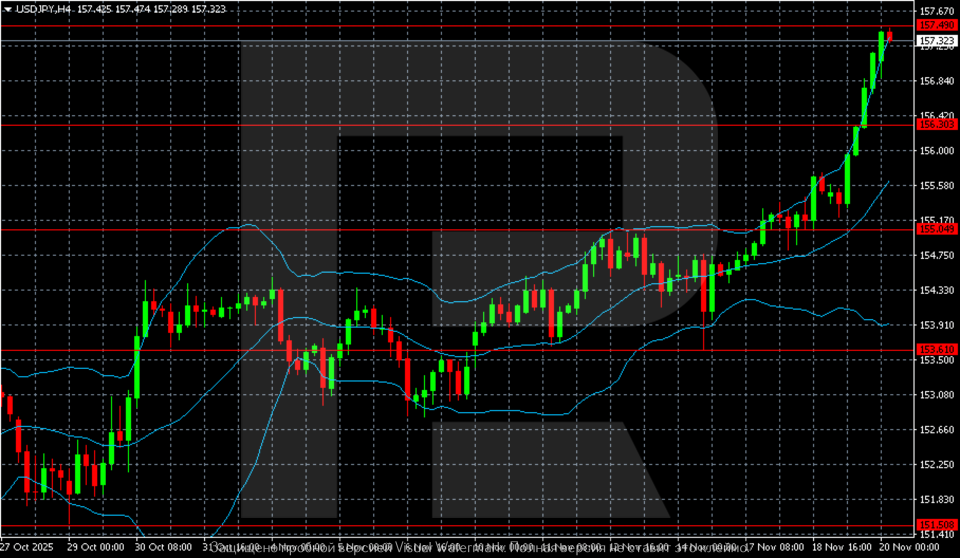

On the H4 chart, the USDJPY pair shows a strong acceleration in its upward move. The price has broken out of the 153.60–155.05 range, surpassed all nearby resistance levels, and approached the key 157.50 zone, which now acts as the primary barrier. The move is aligned with the upper Bollinger Band, highlighting the strength of the trend while also signalling overbought conditions.

The support level is shifting to the 156.30 area, with the next level at 155.05. As long as these levels hold, the structure remains firmly bullish. The candlesticks are wide and directional, with shallow pullbacks – buyers are in complete control of the market.

A correction will be possible only if the pair confidently drops below 156.30 or forms a reversal candlestick pattern, but at the moment, momentum remains strong.

Summary

The USDJPY pair continues to rise. The USDJPY forecast for today, 20 November 2025, suggests a move towards 157.65 and possibly higher.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.