USDJPY confidently holds above 155.00

The USDJPY rate is rising, having consolidated above 155.00. Today, the market focuses on the minutes of the latest US Fed meeting. Find out more in our analysis for 19 November 2025.

USDJPY forecast: key trading points

- Market focus: the minutes of the October Federal Reserve meeting will be published today

- Current trend: upward momentum

- USDJPY forecast for 19 November 2025: 156.00 or 154.00

Fundamental analysis

On Tuesday, the Japanese government proposed an additional budget exceeding 25 trillion yen to finance Prime Minister Sanae Takaichi’s economic stimulus program – a figure far above last year’s supplementary budget of 13.9 trillion yen.

Meanwhile, Bank of Japan Governor Kazuo Ueda informed the prime minister that the central bank is gradually raising rates to maintain inflation at 2% while supporting stable growth. Ueda also told reporters that the prime minister did not make any specific requests regarding monetary policy.

Today, market participants await the release of the minutes of the latest Federal Open Market Committee (FOMC) meeting, which may offer investors insight into the regulator’s next steps in monetary policy.

USDJPY technical analysis

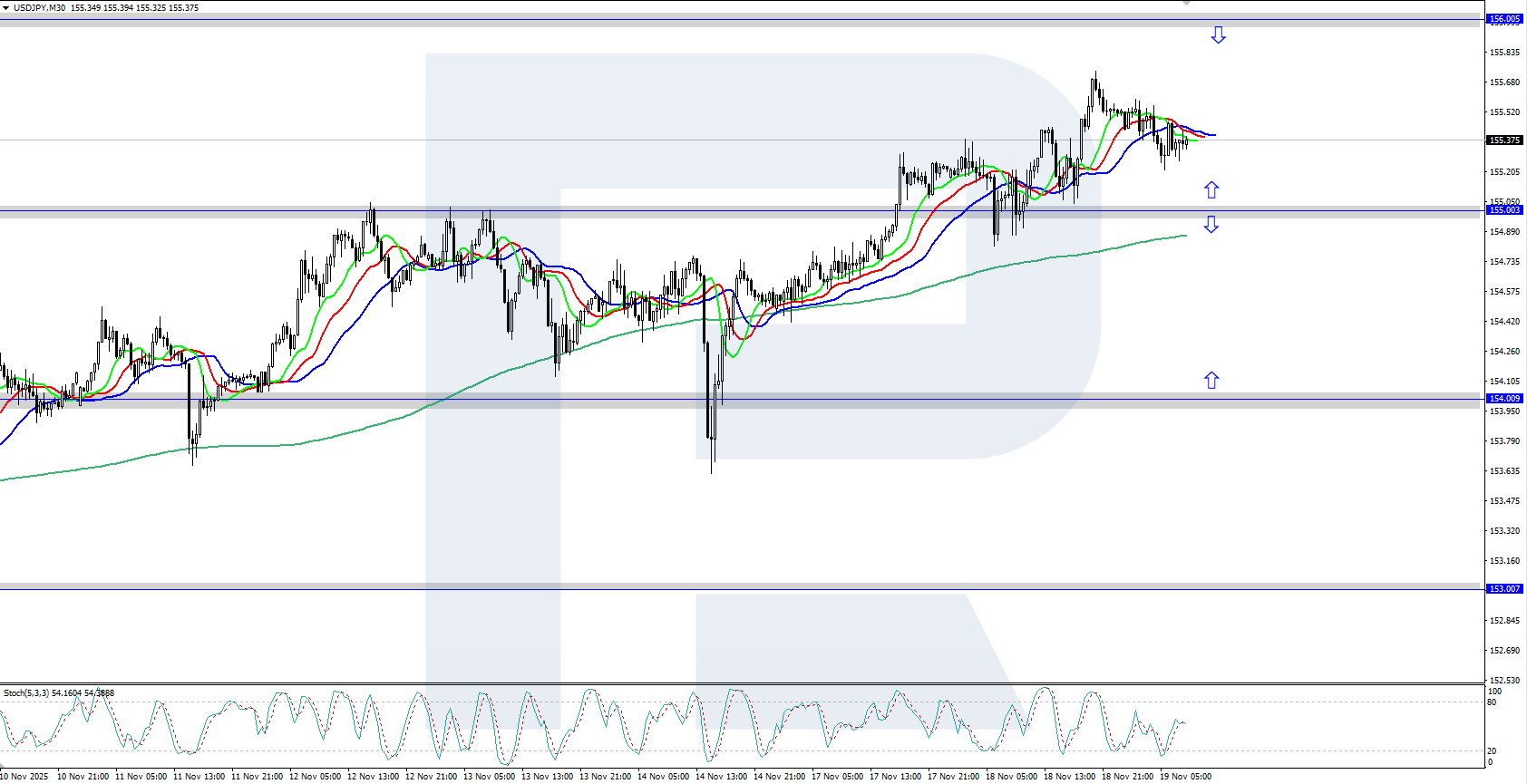

The USDJPY pair is rising confidently on the H1 chart, having consolidated above 155.00. The Alligator indicator is moving upwards, confirming the current bullish momentum. Further growth towards the local resistance level at 156.00 is possible.

The USDJPY forecast for today suggests that the pair may continue its ascent if buyers stay above 155.00. A decline will become possible if sellers regain control and firmly push the price below 155.00, which may trigger a correction towards the 154.00 support level.

Summary

The USDJPY pair is rising, holding above 155.00. Today, the market will focus on the minutes of the latest US Fed meeting.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.