Investors buy USDJPY ahead of BoJ policy decisions

The USDJPY pair continues to strengthen amid ongoing political uncertainty and expectations of the upcoming Bank of Japan meeting, currently trading at 151.56. Find out more in our analysis for 21 October 2025.

USDJPY forecast: key trading points

- Uncertainty remains regarding the stability of the ruling coalition and Sanae Takaichi’s future economic policies

- BoJ board member Hajime Takata stated that it is time to consider a rate hike

- Investors focus on the upcoming BoJ meeting scheduled for next week

- USDJPY forecast for 21 October 2025: 152.65

Fundamental analysis

The USDJPY rate has been rising for the third consecutive session. Buyers confidently reversed the pair from the key support level at 150.05, indicating stronger demand for the US dollar. The Japanese yen remains under pressure as investors await the parliamentary vote expected to confirm Sanae Takaichi as Japan’s next prime minister. However, uncertainty persists regarding the coalition’s stability and whether Takaichi will adopt a more hawkish economic approach.

Some support for the yen came from comments by BoJ board member Hajime Takata, who said that it is time to raise interest rates. However, investors’ primary focus is now on the BoJ meeting next week, where policymakers are expected to keep interest rates unchanged.

USDJPY technical analysis

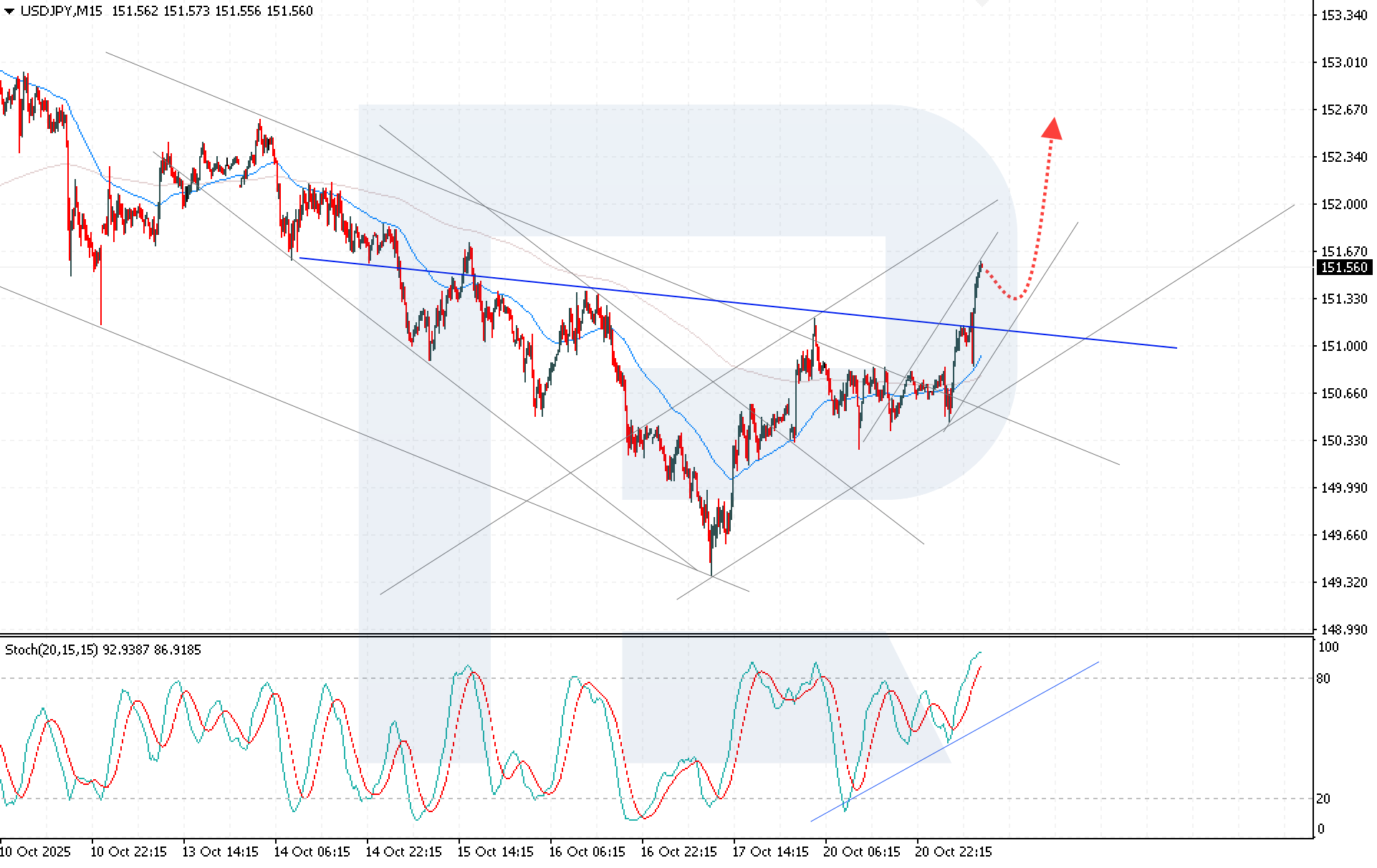

The USDJPY pair continues its upward trajectory after breaking above the upper boundary of a Head and Shoulders reversal pattern. Buyers have confidently held the price above the 151.00 resistance level, confirming a sustained bullish momentum.

The Stochastic Oscillator remains in overbought territory but continues to point upwards, indicating persistent buying activity and potential for further growth.

According to today’s USDJPY forecast, the pair is expected to extend its rise towards 152.65 following a brief correction. If the price holds steadily above 151.00, this will serve as an additional signal confirming further gains.

Summary

Political uncertainty in Japan and investor focus on the upcoming Bank of Japan meeting continue to drive demand for the US dollar. Technical analysis of USDJPY indicates sustained bullish momentum with upside potential towards 152.65.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.