Record highs and a risky correction: what to expect from USDJPY in the near term

After testing the 153.26 level, the USDJPY pair continues a corrective wave. Find out more in our analysis for 14 October 2025.

USDJPY forecast: key trading points

- Political uncertainty in Japan persists

- The market awaits further actions from the Federal Reserve

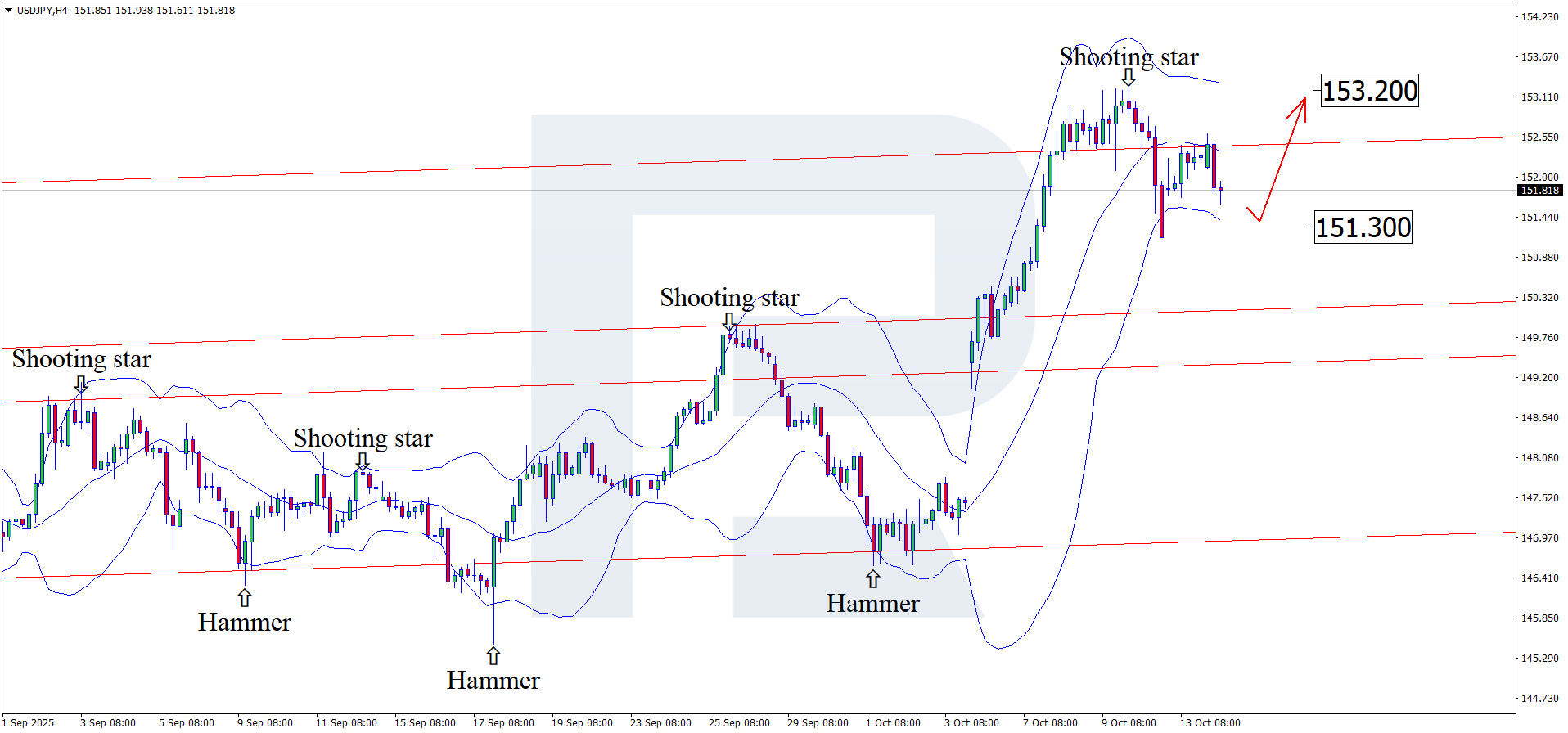

- USDJPY forecast for 14 October 2025: 151.30 and 153.20

Fundamental analysis

The forecast for 14 October 2025 takes into account the ongoing political instability in Japan. After setting another record high, the USDJPY pair continues its correction, trading near 151.80.

The main drivers and events influencing the USDJPY rate include:

- The victory of Sanae Takaichi and her economic stimulus agenda have raised concerns about the stability of the government. Her administration lost its coalition majority, creating a risk of parliamentary shifts

- The collapse of the coalition following Komeito’s withdrawal from the government intensified uncertainty. This acts as a weakening factor for the yen, as investors fear further monetary policy easing

- However, such political chaos can also trigger the opposite reaction – demand for safe-haven assets, including the yen, could grow if confidence in Japan’s leadership deteriorates

Today’s USDJPY outlook also reflects external volatility and expectations of the Federal Reserve’s next moves, which remain a key factor. Pressure from US political and macroeconomic risks could alter the balance and trigger renewed upside momentum in the USDJPY pair.

USDJPY technical analysis

On the H4 chart, the USDJPY rate formed a Shooting Star reversal pattern near the upper Bollinger Band, currently trading around 151.80. At this stage, the pair continues its corrective wave based on this signal, with a target near 151.30.

However, the USDJPY forecast also considers an alternative scenario, where the pair is testing the upper boundary of the ascending channel, which suggests a potential breakout above the resistance level and a move towards 153.20 without a correction to support.

Summary

Political instability in Japan and uncertainty surrounding Federal Reserve policy are adding volatility to USDJPY. Technical analysis indicates potential for renewed growth after the correction is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.