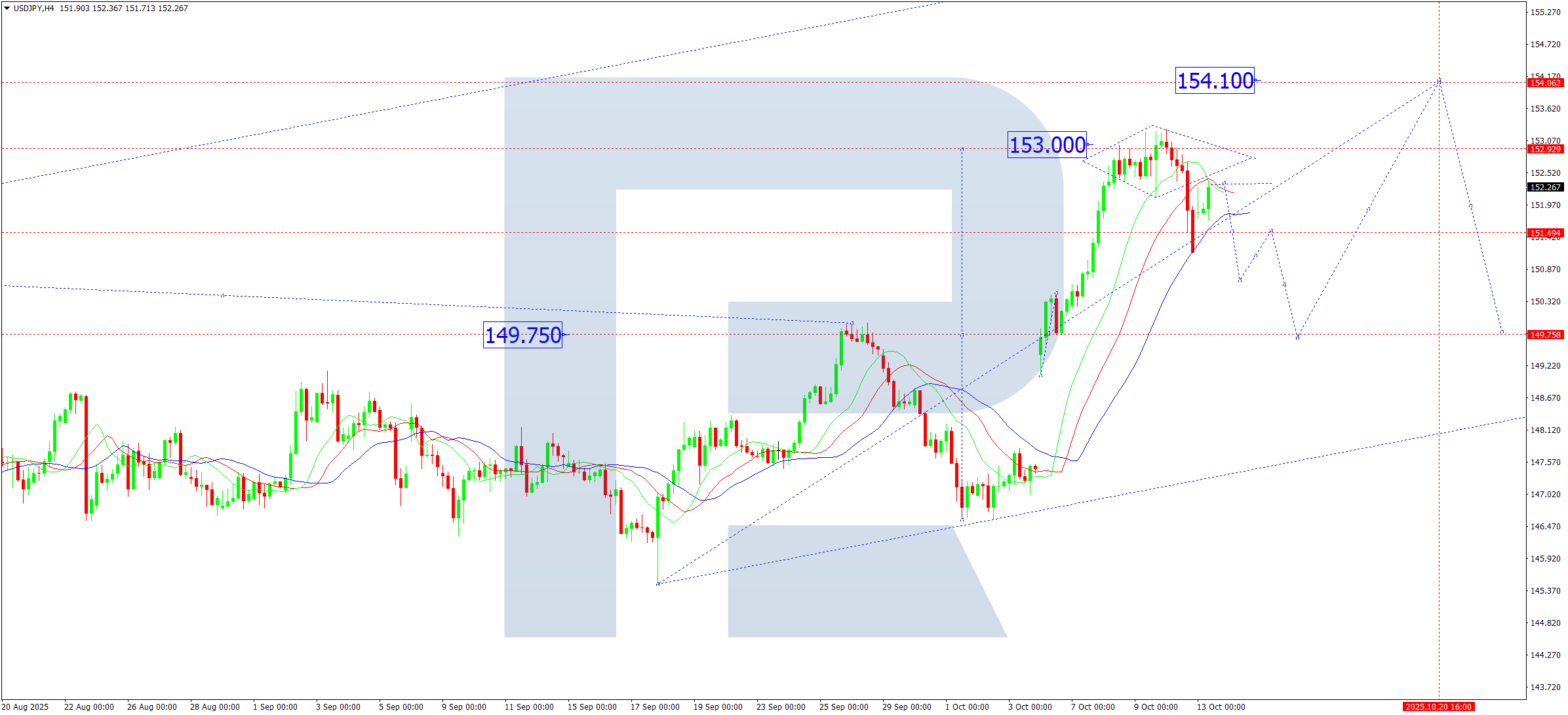

USDJPY corrects towards the 149.75 area

The USDJPY rate begins a correction. Discover more in our analysis for 13 October 2025.

USDJPY forecast: key trading points

- Market focus: investors are focused on US inflation data and comments from Federal Reserve officials, which may clarify the timeline for the possible start of the rate-cutting cycle. An additional factor weighing on the dollar remains expectations of potential currency interventions by the Bank of Japan as the exchange rate approaches the 152.00–152.50 zone

- Current trend: the medium-term uptrend remains in place; however, locally, the market is forming a corrective wave after testing the 152.23 resistance area. Pressure on the dollar is increasing amid profit-taking and rising demand for the yen as a safe-haven asset

- USDJPY forecast for 13 October 2025: 150.70, 149.75, and 152.80

Fundamental analysis

The USDJPY pair remains sensitive to the interest rate differential between the US and Japan. Despite strong US employment data and resilient GDP, the market is increasingly pricing in expectations of a Fed policy shift towards easing by the end of the year. At the same time, speculation is growing in Japan about possible verbal or direct interventions by the Ministry of Finance, as current levels of yen weakness are causing political concern. The likelihood of Bank of Japan intervention remains high if the dollar continues to strengthen further.

USDJPY technical analysis

The USDJPY pair completed a corrective move towards 151.15 and then rose towards 152.23. The USDJPY forecast for today anticipates another downward impulse to 150.70, with a possible continuation of the correction towards 149.75. The Alligator indicator confirms the potential for a downward wave, with its lines beginning to converge, signalling a slowdown of the previous momentum. The 149.75 support level remains key for determining the market’s next direction.

Summary

The primary scenario suggests a decline towards 150.70 and 149.75.

Alternative scenario: if the price consolidates above 152.30, a renewed upward impulse towards 152.80 and 153.40 may follow.

Daily trading range: 149.75–152.30

Key support: 149.75

Key resistance: 152.30

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.