Japan’s first female prime minister crashes the yen – USDJPY breaks above 150.00

The victory of Sanae Takaichi triggered a sharp sell-off in the yen and may lead to further weakening, as the USDJPY pair broke through the 150.00 mark. Find more details in our analysis for 6 October 2025.

USDJPY forecast: key trading points

- Sanae Takaichi wins the election

- The USDJPY pair is testing the 150.00 level

- USDJPY forecast for 6 October 2025: 146.30

Fundamental analysis

The forecast for 6 October 2025 takes into account that following Sanae Takaichi’s victory, the USDJPY pair is trading around 150.30.

Sanae Takaichi, representing Japan’s Liberal Democratic Party, won the leadership election and is set to become Japan’s first female prime minister. Her victory strengthened expectations of fiscal stimulus and continued monetary easing, causing the yen to weaken sharply.

Long-term Japanese government bonds came under pressure, with the yield on 40-year bonds rising by 12 basis points.

Despite recent moves towards economic stimulus, analysts and Takaichi’s economic advisors suggest that by January 2026, a rate hike may be adopted if economic conditions and wage growth remain strong. This creates a unique dynamic: on the one hand, the rise in USDJPY supports the US dollar, and on the other hand, the potential pressure on Japan to tighten monetary policy is growing.

The USDJPY pair opened the trading session with a price gap, quickly reaching the psychological mark of 150.00. At this stage, a short-term correction to close the gap is possible, but the overall potential for continued growth remains strong, suggesting new record highs may soon follow.

USDJPY technical analysis

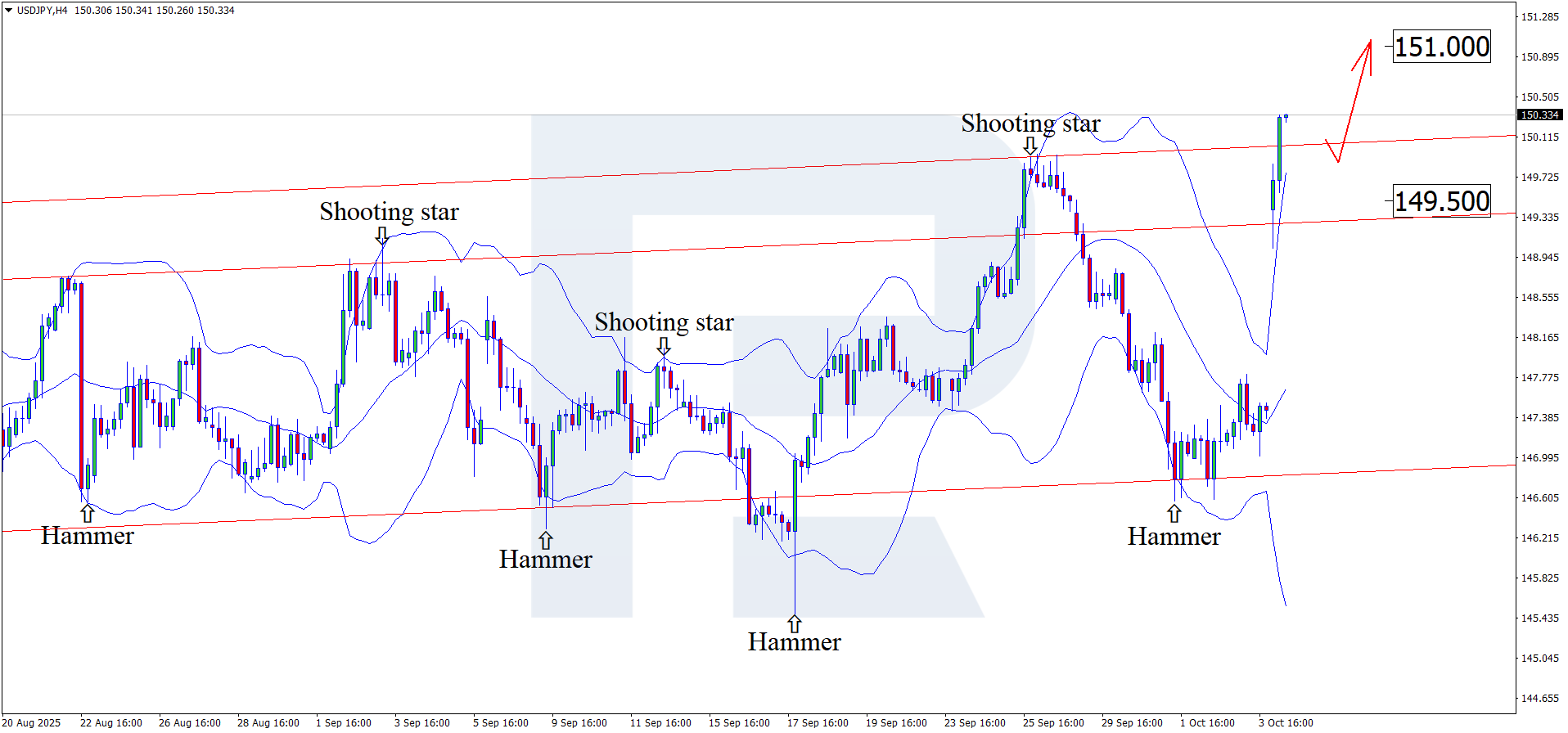

On the H4 chart, the USDJPY rate tested the lower Bollinger Band and formed a Hammer reversal pattern, currently trading near 150.30. At this stage, the pair may continue its upward momentum following the pattern’s signal, with a target around 151.00.

However, the USDJPY forecast also considers an alternative scenario. After breaking above the upper boundary of the ascending channel, the USDJPY rate may pull back to the support area near 149.50 before resuming its uptrend.

Summary

The election of Japan’s new prime minister triggered a sharp yen depreciation. The USDJPY technical analysis points to the potential for further growth after a corrective pullback.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.