USDJPY falls: BoJ tightening and political coordination weigh on the dollar

Strengthening arguments for monetary tightening in Japan continue to support the yen, with quotes currently trading near 147.10. Find out more in our analysis for 2 October 2025.

USDJPY forecast: key trading points

- The USDJPY rate continues to fall for the fourth consecutive session

- Rising Japan PPI strengthens arguments for monetary tightening

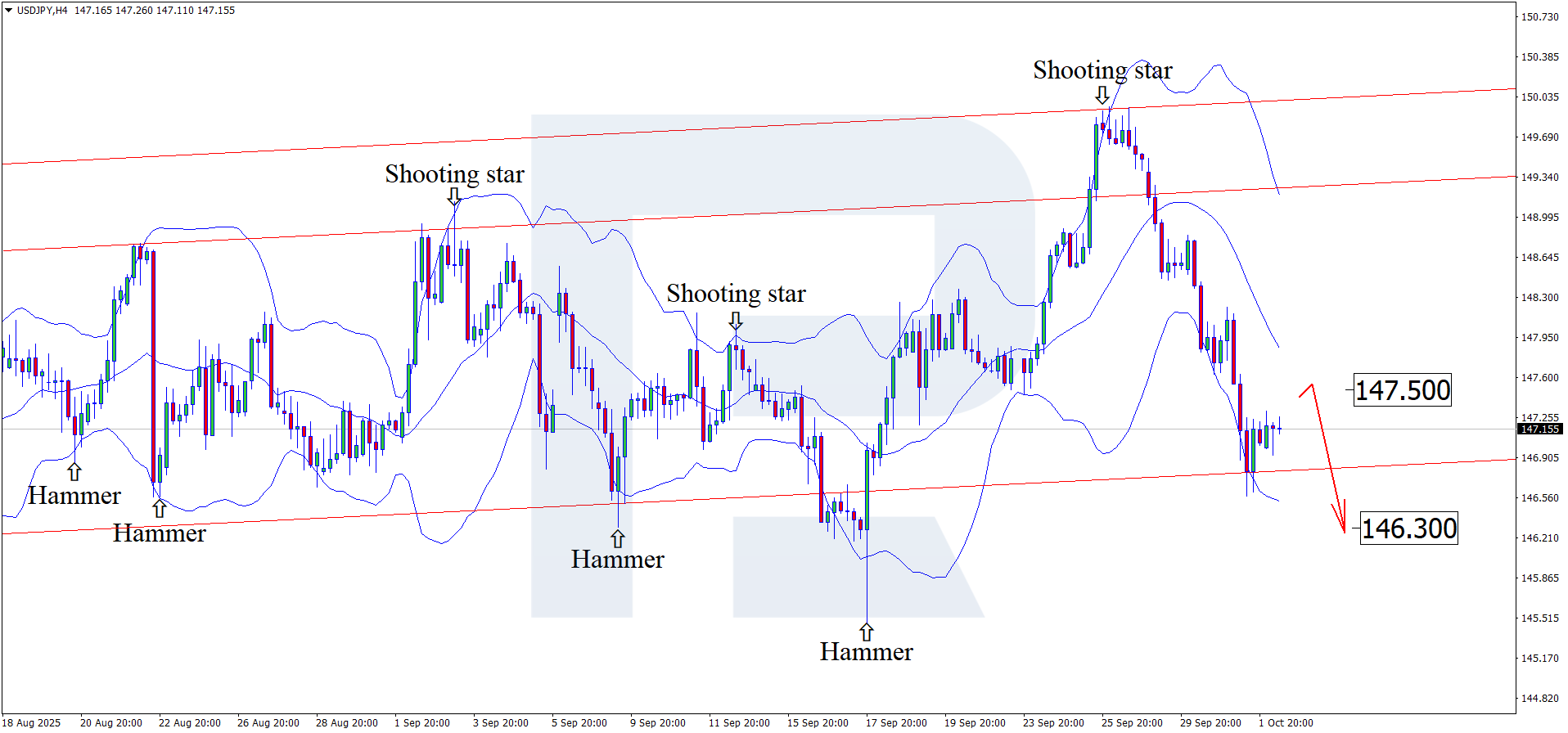

- USDJPY forecast for 2 October 2025: 147.50 and 146.30

Fundamental analysis

The forecast for 26 September 2025 takes into account that the USDJPY pair continues its downward momentum for the fourth consecutive session and is trading around 147.20.

The USD continues to lose ground amid expectations of a rate cut and overall weakness of the US currency. At the same time, confidence is growing that the Bank of Japan may begin policy tightening, giving additional support to the yen.

One of the candidates for Japan’s prime minister, Shinjiro Koizumi, called for close political coordination between the government and the BoJ on economic policy. This may strengthen expectations that BoJ’s monetary policy moves will be more actively integrated into the government’s economic strategy. Previously, there had already been statements in favour of joint action between the BoJ and political leadership.

The latest Tankan survey showed growing optimism among major Japanese manufacturers, another positive sign of improving conditions for business stability.

Japan’s Producer Price Index (PPI) rose in September year-on-year, which could trigger growth in consumer inflation and reinforce arguments for monetary tightening.

The USDJPY forecast for today also factors in that the dollar and yen are highly dependent on US fundamentals (unemployment, employment, inflation). Any surprises in these upcoming reports may sharply shift the balance of power in the pair or provoke further yen strengthening.

USDJPY technical analysis

Having tested the upper Bollinger Band, the USDJPY pair formed a Shooting Star reversal pattern on the H4 chart, currently hovering around 149.70. At this stage, the pair continues its downward wave in line with the pattern signal. The USDJPY rate is approaching the lower boundary of the ascending channel, suggesting a potential rebound towards the resistance level near 147.50.

However, the USDJPY forecast also considers another possible scenario, where the price dips to 146.30 without testing the resistance level.

Summary

The yen continues to strengthen amid anticipation of the Federal Reserve’s rate decision. USDJPY technical analysis suggests a continued decline after the correction is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.