USDJPY surges above 147.00 after Fed decision

The USDJPY pair posted a sharp rally, climbing above the 147.00 level after the Federal Reserve’s rate decision and comments from Fed Chair Jerome Powell. Discover more in our analysis for 18 September 2025.

USDJPY forecast: key trading points

- Market focus: the Federal Reserve lowered rates by 25 basis points

- Current trend: bullish momentum underway

- USDJPY forecast for 18 September 2025: 147.00 or 148.00

Fundamental analysis

The USDJPY pair strengthened as the US dollar rallied following the latest Federal Reserve decision. On Wednesday, the Fed lowered the federal funds rate by 25 basis points, in line with broad market expectations. At the same time, policymakers signalled two additional cuts this year but only one in 2026, diverging from market bets on two or three moves next year.

Meanwhile, the Bank of Japan began its two-day policy meeting, where rates are widely expected to remain unchanged as officials continue to assess the impact of US tariffs on Japan’s export-driven economy.

However, analysts note that the BoJ may raise rates by 25 basis points in October amid signs of economic resilience. On 4 October, Japan’s ruling Liberal Democratic Party will elect a new leader to replace outgoing Prime Minister Shigeru Ishiba.

USDJPY technical analysis

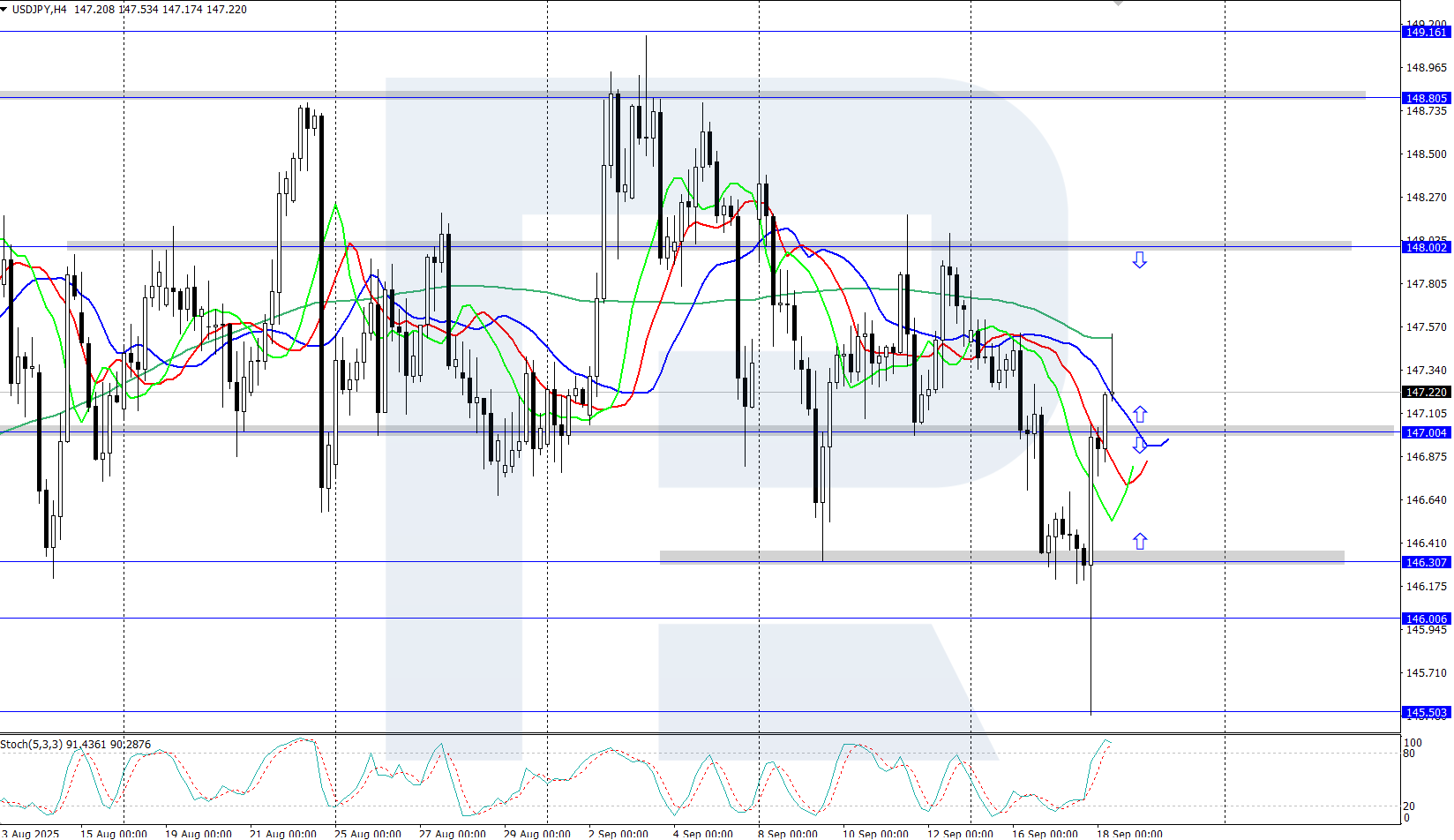

The USDJPY pair is steadily rising on the H4 chart, climbing above 147.00. The Alligator indicator is moving higher, confirming the current bullish momentum. Further upside towards the local resistance level at 148.00 remains possible.

Today’s USDJPY forecast suggests the pair may extend gains if buyers hold above 147.00. A reversal scenario would require a firm move below 147.00, opening the way for a correction towards the 146.30 support level.

Summary

The USDJPY pair is accelerating higher as the dollar strengthens after the Fed meeting. The Bank of Japan is expected to leave its benchmark rate unchanged at 0.5% tomorrow.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.