USDJPY at a crossroads: BoJ surprises with minutes, US PMI in focus

Following the release of the BoJ meeting minutes, the yen remains under pressure, and the USDJPY pair has a real chance to rise towards the 149.00 level. Discover more in our analysis for 5 August 2025.

USDJPY forecast: key trading points

- Bank of Japan monetary policy meeting minutes

- US services PMI: previously at 52.9, projected at 55.2

- USDJPY forecast for 5 August 2025: 149.00

Fundamental analysis

The fundamental outlook for 5 August 2025 takes into account the publication of the BoJ monetary policy meeting minutes from 16-17 July 2025.

Key takeaways from the minutes:

- The Bank of Japan kept its key interest rate at 0.5%, citing high uncertainties related to US trade tariffs and global risks

- Some Board members expressed readiness to return to a rate-hiking cycle if US trade tensions ease and inflation maintains its uptrend

- Inflation in Japan continues a steady upward trend, particularly due to rising food prices and wage increases

- The BoJ decided to gradually reduce its balance sheet: bond purchases will be scaled down to approximately 3 trillion yen per month by March 2026, and to around 2 trillion yen by March 2027, with the possibility of further reductions to 1 trillion or even zero in the long term

- At the 30-31 July meeting, the interest rate remained unchanged, but inflation forecasts were revised upwards and the economic growth outlook improved. This strengthens the case for future tightening of monetary policy

Today’s USDJPY forecast also includes the upcoming US services PMI data. The previous reading was 52.9 points, and the forecast for 4 August 2025 points to a rise to 55.2, favouring the USD. Given that the index has risen over the past two months, another increase in the current reporting period is likely. A figure equal to or above the forecast could push the USDJPY rate higher.

USDJPY technical analysis

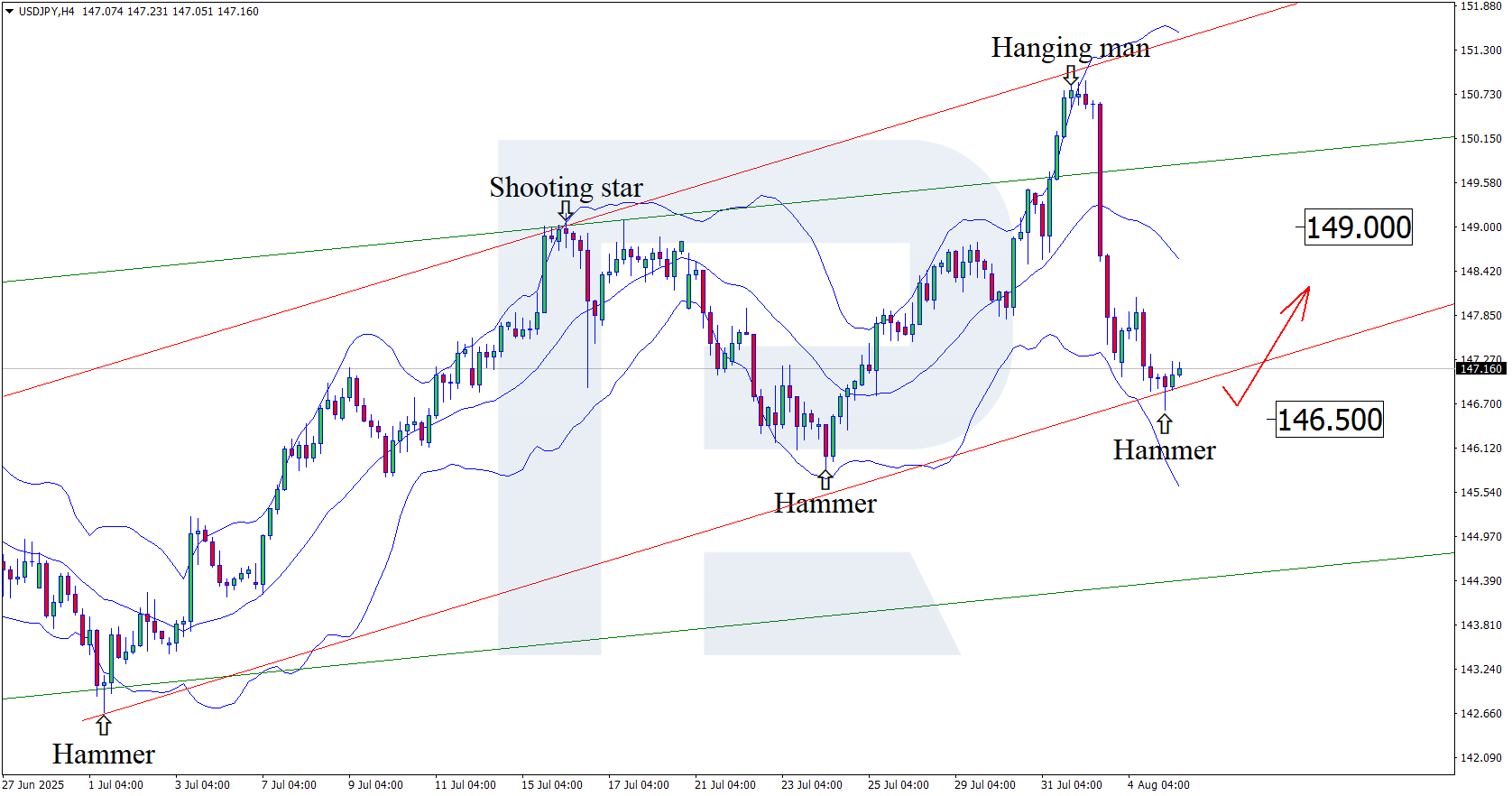

Having tested the lower Bollinger Band, the USDJPY pair formed a Hammer reversal pattern on the H4 chart and is now trading around 147.10. At this point, the pair may continue its upward momentum in line with the reversal signal. Since the USDJPY rate remains within an ascending channel, a rebound from the support level and a rise towards the 149.00 resistance level is possible.

However, the USDJPY forecast also considers an alternative scenario, where the price may dip to 146.50 before resuming growth.

Summary

Supported by positive data from the US, the USDJPY rate may form an upward wave. USDJPY technical analysis points to the 149.00 resistance level as a potential price target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.