USDJPY in positive territory: trade tariffs made all the difference

The USDJPY pair climbed to 147.20. While markets anticipate a hawkish tone from the Bank of Japan next week, the interest rate is expected to remain unchanged. Find more details in our analysis for 25 July 2025.

USDJPY forecast: key trading points

- The USDJPY pair strengthens again as investors assess the impact of the trade deal

- The Bank of Japan is unlikely to change the rate yet, but may revise forecasts upwards

- USDJPY forecast for 25 July 2025: 147.50 and 149.20

Fundamental analysis

The USDJPY pair rose to 147.20 at the end of the week as markets react to the new trade agreement between the US and Japan.

According to the deal, tariffs on Japanese exports to the US will stand at 15%, significantly softer than the earlier target of 25%. This offers temporary relief, but trade policy tensions persist.

On the macroeconomic side, core inflation in Tokyo for July came in slightly below expectations, but remains well above the Bank of Japan's 2% target. This strengthens expectations of a potential rate hike in the second half of the year.

The Bank of Japan will make its monetary policy decision next week. Markets expect no rate change, considering the economic risks posed by external trade restrictions. However, the regulator will likely revise its inflation forecast upwards in the quarterly review.

Earlier this week, BoJ Deputy Governor Shinichi Uchida stated that the central bank maintains a cautious stance on further policy tightening due to high uncertainty surrounding US trade actions and their global impact.

The USDJPY forecast is positive.

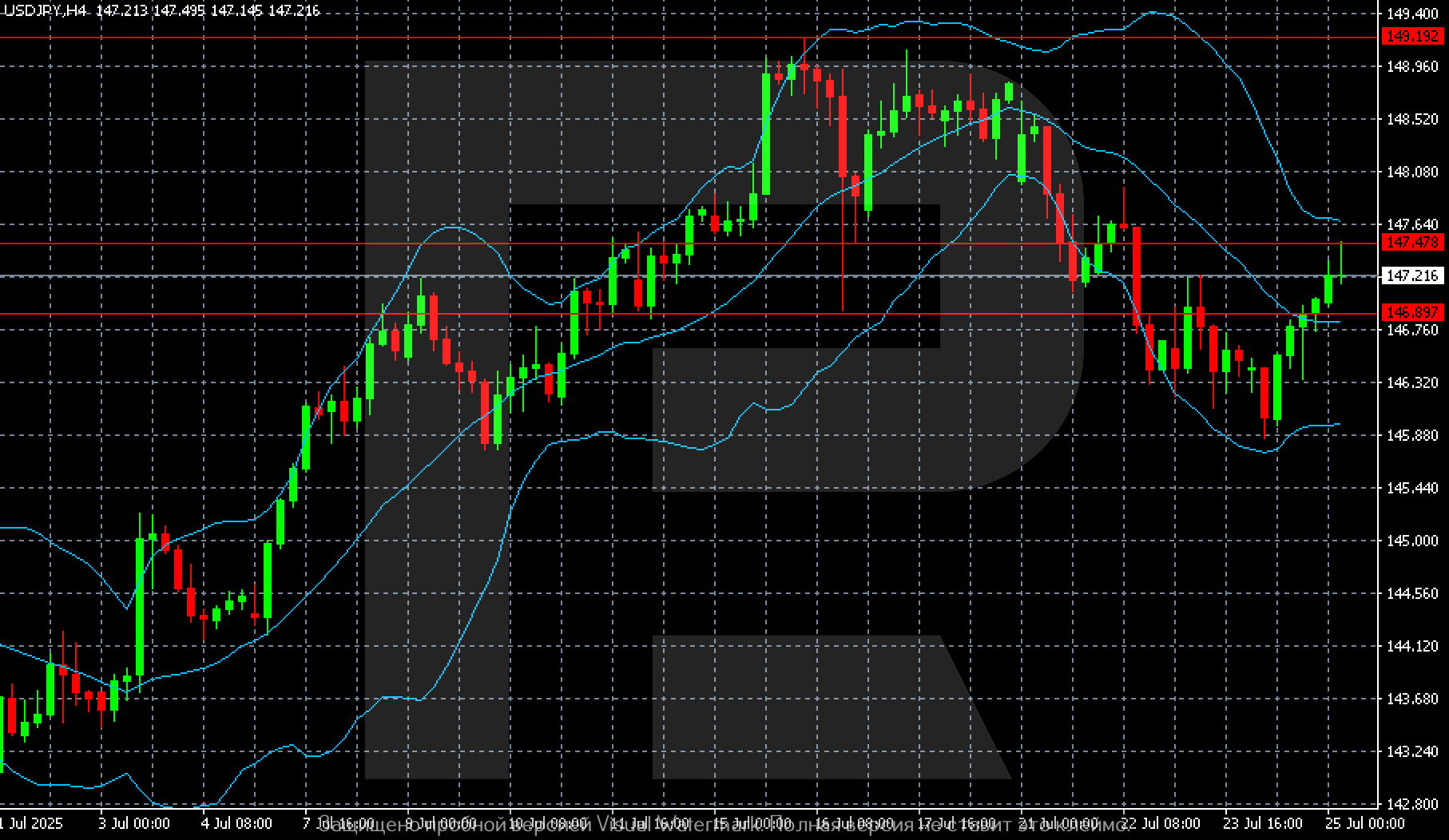

USDJPY technical analysis

On the H4 chart, USDJPY fluctuates around 147.20. The pair is rebounding after declining to the 145.80 local support level. A bounce off the lower Bollinger Band and movement towards the middle line of the indicator suggest an attempt to return within the previous ascending range.

The nearest resistance level lies at 147.50. A breakout and consolidation above this level would open the way to the next target near 149.20. As long as this barrier holds, there is a risk of a pullback towards 146.90 and a retest of the 145.80 support level, where the previous rebound began.

From a technical standpoint, the structure remains neutral-positive, with the market correcting after a rally and consolidating while awaiting new catalysts.

Summary

The USDJPY pair has advanced and retains upside potential. The USDJPY forecast for today, 25 July 2025, includes the possibility of an extended upward wave towards 147.50 and further to 149.20.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.