USDJPY moves lower: yen strengthens on weakening US dollar

The USDJPY pair declined to 144.92 on Thursday. Markets are pricing in potential Fed policy easing. Discover more details in our analysis for 26 June 2025.

USDJPY forecast: key trading points

- The USDJPY pair edges down moderately on Thursday amid broad US dollar weakness

- BoJ’s rate path will depend on GDP and inflation forecasts

- USDJPY forecast for 26 June 2025: 144.50

Fundamental analysis

The USDJPY rate continued to fall on Thursday, reaching 144.92. The Japanese yen is strengthening against the US dollar as the USD weakens. This trend links directly to expectations of Federal Reserve interest rate cuts and easing geopolitical tensions in the Middle East.

Market sentiment improved after reports of an upcoming meeting between US and Iranian officials next week, aimed at containing Tehran’s nuclear programme. The ceasefire between Iran and Israel remains in place for now.

Meanwhile, Federal Reserve Chairman Jerome Powell stated that if tariffs do not exert upward pressure on inflation, the central bank would likely proceed with its rate-cutting cycle.

The Bank of Japan’s latest summary of opinions showed a cautious stance on future monetary policy. BoJ board members emphasised the need to maintain accommodative conditions and noted that potential rate hikes would depend on the realisation of growth and inflation forecasts. The statement also flagged ongoing external trade and geopolitical risks.

Overall, the USDJPY outlook is cautious.

USDJPY technical analysis

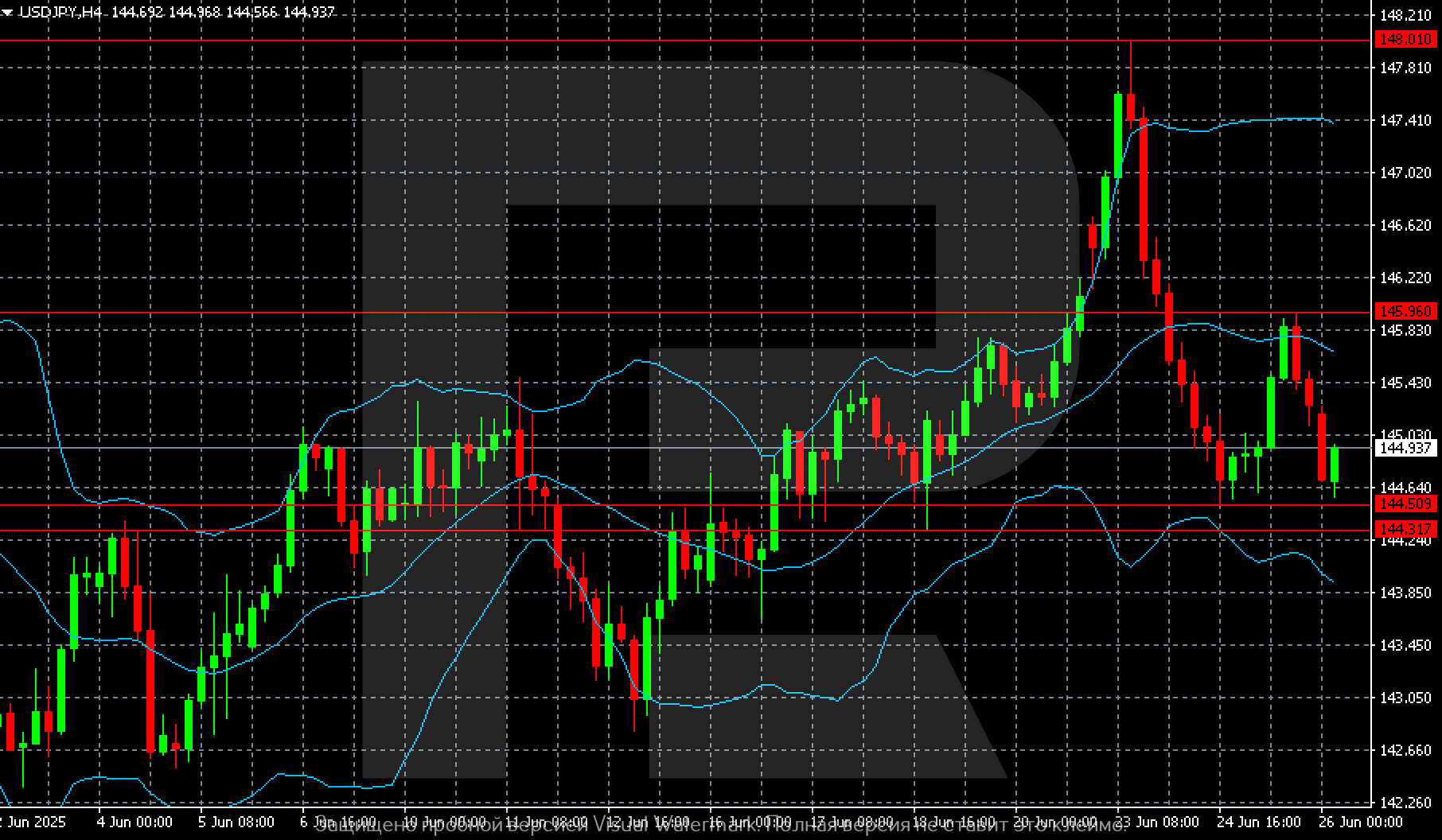

On the USDJPY H4 chart, the ascending channel continues to correct. If the sell-off deepens, the pair could retest the 144.50 level and possibly slide to 144.31.

If this scenario plays out, bears may gain more control, pushing the downtrend further towards the pattern’s lower boundary and the next target at 143.15.

Summary

The USDJPY pair continues to decline, supported by both fundamental and technical factors. The USDJPY forecast for today, 26 June 2025, anticipates further downside pressure, with the first key target at 144.50.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.