USDJPY corrected: time for a pause

The USDJPY pair pulled back to 145.35 on Friday, with the yen stabilising following the release of Japan’s May inflation data. Find out more in our analysis for 20 June 2025.

USDJPY forecast: key trading points

- The USDJPY pair halted its upward movement and is declining on Friday

- The market analyses the latest inflation data from Japan for May

- The yen ends the week down around 1% against the US dollar

- USDJPY forecast for 20 June 2025: 145.77

Fundamental analysis

The USDJPY rate fell to 145.36 at the end of the week. The yen partially strengthened after some initial stress around the May consumer inflation report.

The data showed that the CPI stood at 3.5% y/y, slightly down from 3.6% previously. However, core prices rose by 3.7% y/y, up from 3.5% a month earlier, marking the highest level since January 2023. This increased expectations that the Bank of Japan might continue tightening monetary policy to curb persistent inflationary pressures.

Earlier this week, the BoJ left its key rate unchanged at 0.5% but noted that companies continue to pass wage growth on to consumer prices, keeping inflation elevated.

Bank of Japan Governor Kazuo Ueda reiterated his commitment to a data-dependent policy path and did not rule out further rate hikes if inflation remains stable.

Despite Friday’s rebound, the yen is set to end the week with a nearly 1% loss.

The USDJPY forecast is neutral.

USDJPY technical analysis

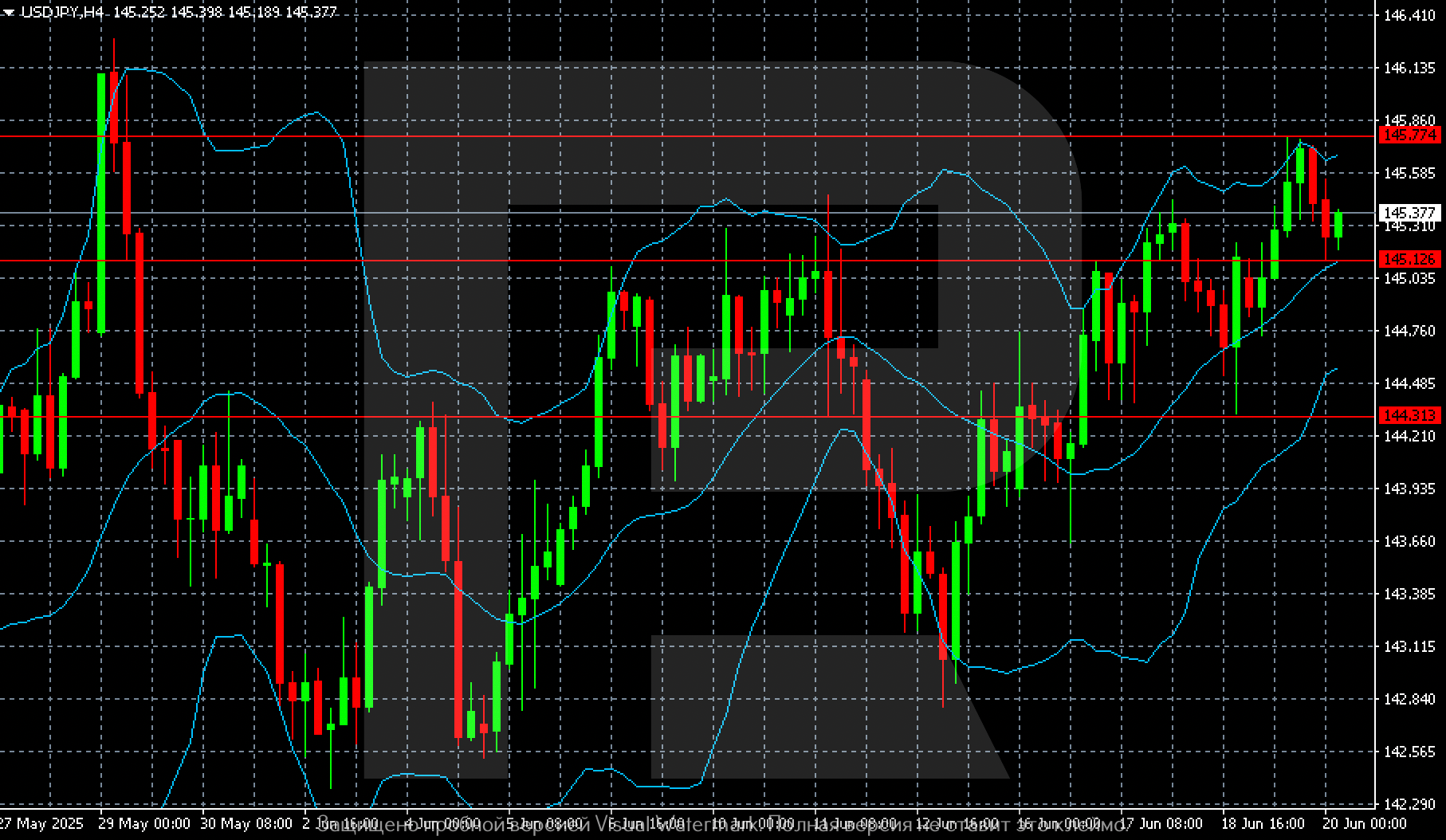

The USDJPY H4 chart shows potential for an ongoing correction down to 145.15. However, the pair is likely to resume its upward movement afterwards, with the first target at 145.77.

Summary

The USDJPY pair has paused after recent gains, correcting slightly amid incoming macroeconomic data. The USDJPY forecast for 20 June 2025 expects the correction to end and the pair to resume growth towards 145.77.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.