USDJPY set to climb as CGPI drop and weak yen offer bullish signal

The decline in Japan's CGPI contributes to the rise in the USDJPY pair, with quotes likely to test the 146.00 level in the near term. Find out more in our analysis for 11 June 2025.

USDJPY forecast: key trading points

- Japan’s Corporate Goods Price Index (CGPI): previously at 4.1%, currently at 3.2%

- US core Consumer Price Index (core CPI): previously at 0.2%, projected at 0.3%

- USDJPY forecast for 11 June 2025: 146.00

Fundamental analysis

Today’s USDJPY forecast takes into account the drop in Japan’s CGPI to 3.2% from the previous 4.1%. Alongside other domestic indicators, this CGPI decline has contributed to a weaker yen versus the US dollar.

The US core CPI gauges changes in consumer prices of goods and services. According to the forecast for 11 June 2025, it could rise modestly to 0.3%. While a 0.1% increase might seem minor in isolation, it could support a short-term USD rally when combined with other positive US macroeconomic data.

USDJPY technical analysis

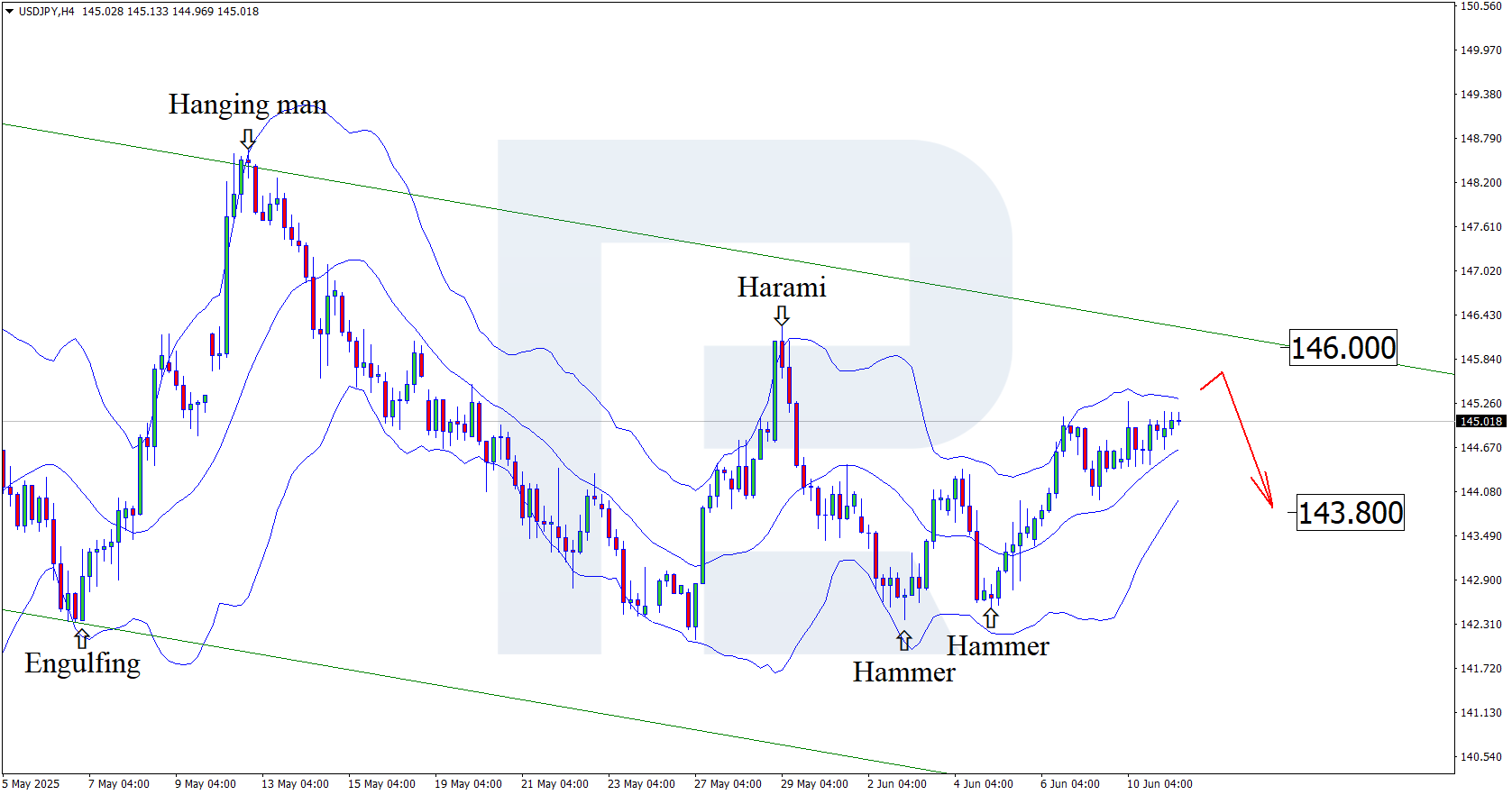

On the H4 chart, the USDJPY pair tested the lower Bollinger Band and formed a Hammer reversal pattern, currently trading near 145.00. The pair now continues a corrective wave following the signal from the pattern. Since the USDJPY rate remains within a descending channel, it has the potential to reach the 146.00 resistance level.

However, today’s USDJPY forecast also considers an alternative scenario with a decline to 143.80 without a resistance test.

Summary

The drop in Japan’s CGPI and expected rise in the US core CPI support the US dollar, strengthening the USDJPY rate. If US inflation data meets forecasts, the dollar may extend gains, adding to pressure on the yen. USDJPY technical analysis aligns with the fundamental setup, suggesting an upward move towards the 146.00 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.