USDJPY rebounds from support – correction or start of a reversal?

The USDJPY rate is recovering, although the US dollar remains under pressure, with the price currently at 142.64. Discover more in our analysis for 27 May 2025.

USDJPY forecast: key trading points

- Japan’s inflation accelerated to 3.5%, the highest level in two years

- Rising inflation increases the likelihood of a BoJ rate hike

- USDJPY forecast for 27 May 2025: 144.95

Fundamental analysis

The USDJPY rate is correcting after rebounding from the key support level at 142.25. The US dollar remains under pressure as investors adjust their expectations for the Bank of Japan’s next moves, pricing in another rate hike amid steady inflation. According to last week’s data, Japan’s core inflation unexpectedly accelerated to 3.5%, its highest in two years, strengthening the case for further monetary policy tightening.

Meanwhile, Tokyo’s unemployment rate rose to 2.5% in March from 2.4% in February, while employment showed a slight decline. Japan’s Leading Economic Index, which signals short-term economic prospects, was revised up to 108.1 from 107.7 but remains at its lowest since December due to weak consumer sentiment. The Coincident Index, tracking current economic activity including industrial production, fell to 115.9, the lowest reading since November.

USDJPY technical analysis

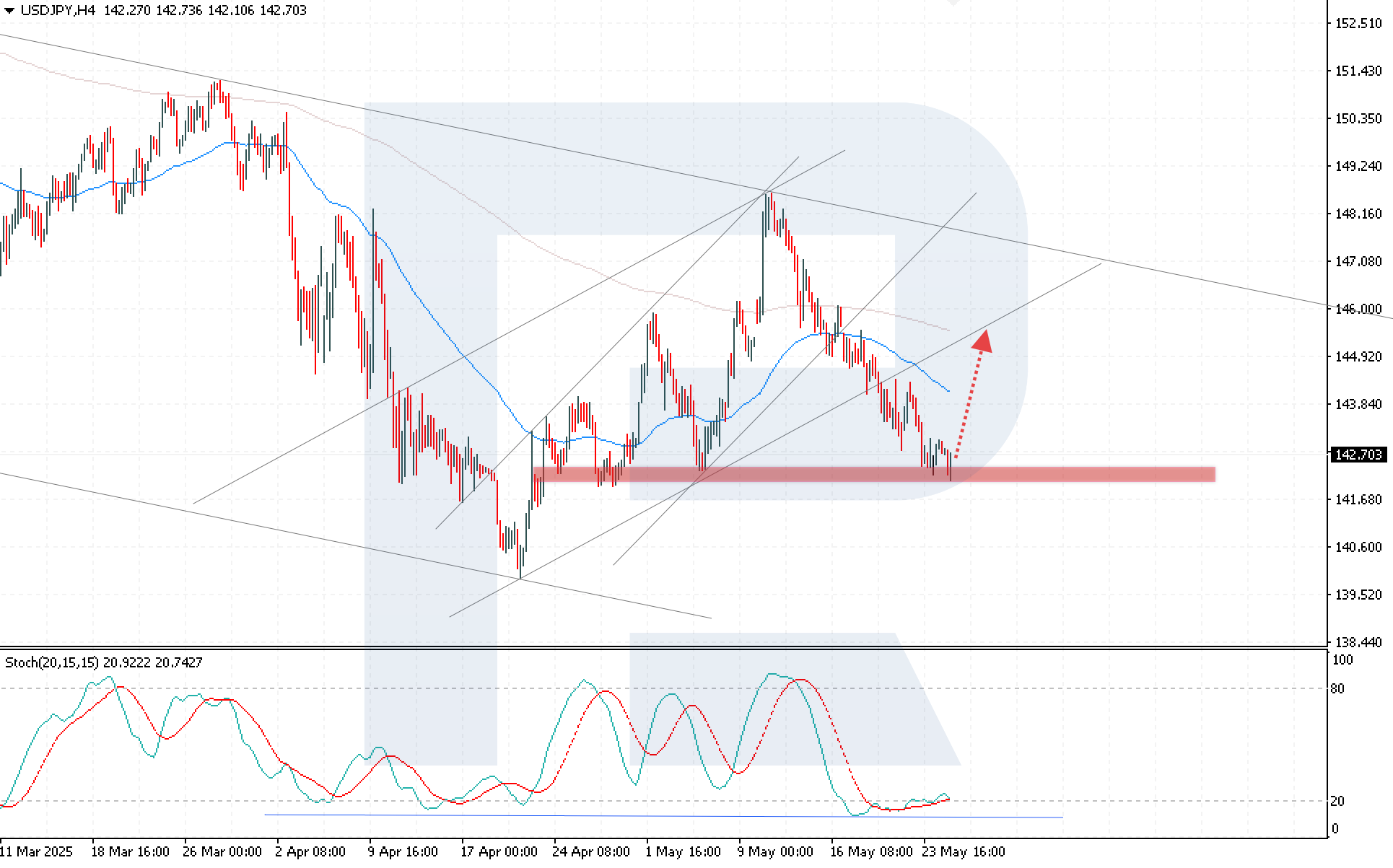

The USDJPY rate is testing the key support area at 142.25. Today’s USDJPY forecast suggests a potential rebound from this demand zone, with a short-term bullish correction towards 144.95.

Technical indicators support the upside scenario: the price is holding above the support level formed in mid-April, and the Stochastic Oscillator is reversing from oversold territory with a bullish divergence forming.

A breakout above the nearest resistance level would confirm the upside, with the price consolidating above 143.15.

Summary

Persistently high inflation in Japan supports expectations of further policy tightening by the BoJ, putting pressure on the US dollar. However, USDJPY technical analysis points to a possible short-term upside pullback towards 144.95.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.