USDJPY falls below 143.00 – is a correction coming?

The yen continues to strengthen, pushing the USDJPY rate below the 143.00 level. Find more details in our analysis for 26 May 2025.

USDJPY forecast: key trading points

- Market focus: Japan’s Leading Economic Index for March was revised up to 108.1

- Current trend: a downtrend is in progress

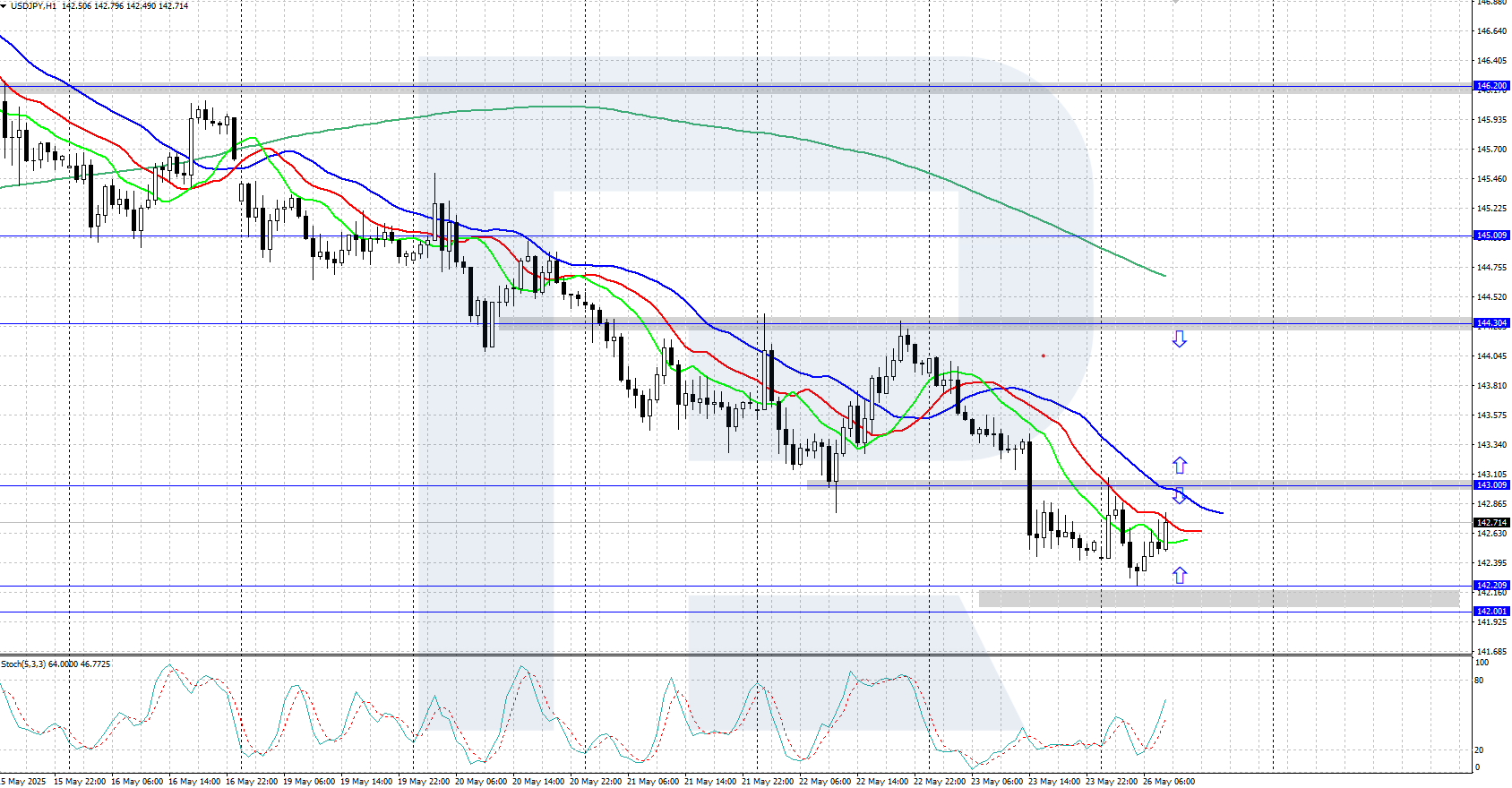

- USDJPY forecast for 26 May 2025: 142.00 and 144.30

Fundamental analysis

Japan's Leading Economic Index, which estimates the country's economic outlook for the coming months, was revised up to 108.1 for March 2025 from a preliminary reading of 107.7.

Market participants continue to assess the Bank of Japan’s policy outlook, with expectations growing that it may proceed with rate hikes in response to persistent inflation. Last week’s data showed that Japan’s core inflation unexpectedly accelerated to 3.5%, the highest level in two years, strengthening the case for the central bank to raise rates.

USDJPY technical analysis

The USDJPY pair is declining on the H4 chart, maintaining a steady downtrend. The Alligator indicator is directed downwards, confirming the bearish momentum. However, the pair is currently in an oversold zone, suggesting a possible upward correction before any further decline.

Today’s USDJPY forecast expects a move lower towards the 142.00 daily support level if bears retain control. Conversely, an upward correction may be expected if bulls push the price above 143.00 and secure a foothold.

Summary

The USDJPY pair has fallen below 143.00, driven by US dollar weakness. Market participants expect the Bank of Japan to tighten its monetary policy amid rising inflation.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.