Inflation surprise: yen strengthens, USDJPY declines

The yen continues to strengthen, pushing the USDJPY rate lower with a potential move towards 142.35. Find out more in our analysis for 23 May 2025.

USDJPY forecast: key trading points

- Japan’s nationwide core Consumer Price Index (core CPI): previously at 3.2%, currently at 3.5%

- US new home sales: previously at 724 thousand, projected at 694 thousand

- USDJPY forecast for 23 May 2025: 142.35

Fundamental analysis

Japan’s nationwide core CPI measures changes in the cost of goods and services from a consumer perspective, excluding food and energy due to their seasonal volatility. This index is a key tool for assessing inflation and shifts in consumer behaviour.

The impact of the CPI on currency rates is not always straightforward: higher readings can support currency strength through anticipated rate hikes, but during times of an economic crisis, an increase in the CPI may worsen the situation, weakening the national currency.

Fundamental analysis for 23 May 2025 takes into account that Japan’s core CPI came in at 3.5%, above the previous reading – a positive factor for the yen under current conditions.

Meanwhile, US new home sales data, which tracks the number of sold residential buildings over the previous reporting period, is forecast to drop to 694 thousand from a previous 724 thousand. This decline points to weakening consumer purchasing power, likely driven by rising food and energy costs. With a result below expectations, the USDJPY rate could continue to form a downward wave.

The overall USDJPY outlook favours the yen, which continues to strengthen on recent news flow.

USDJPY technical analysis

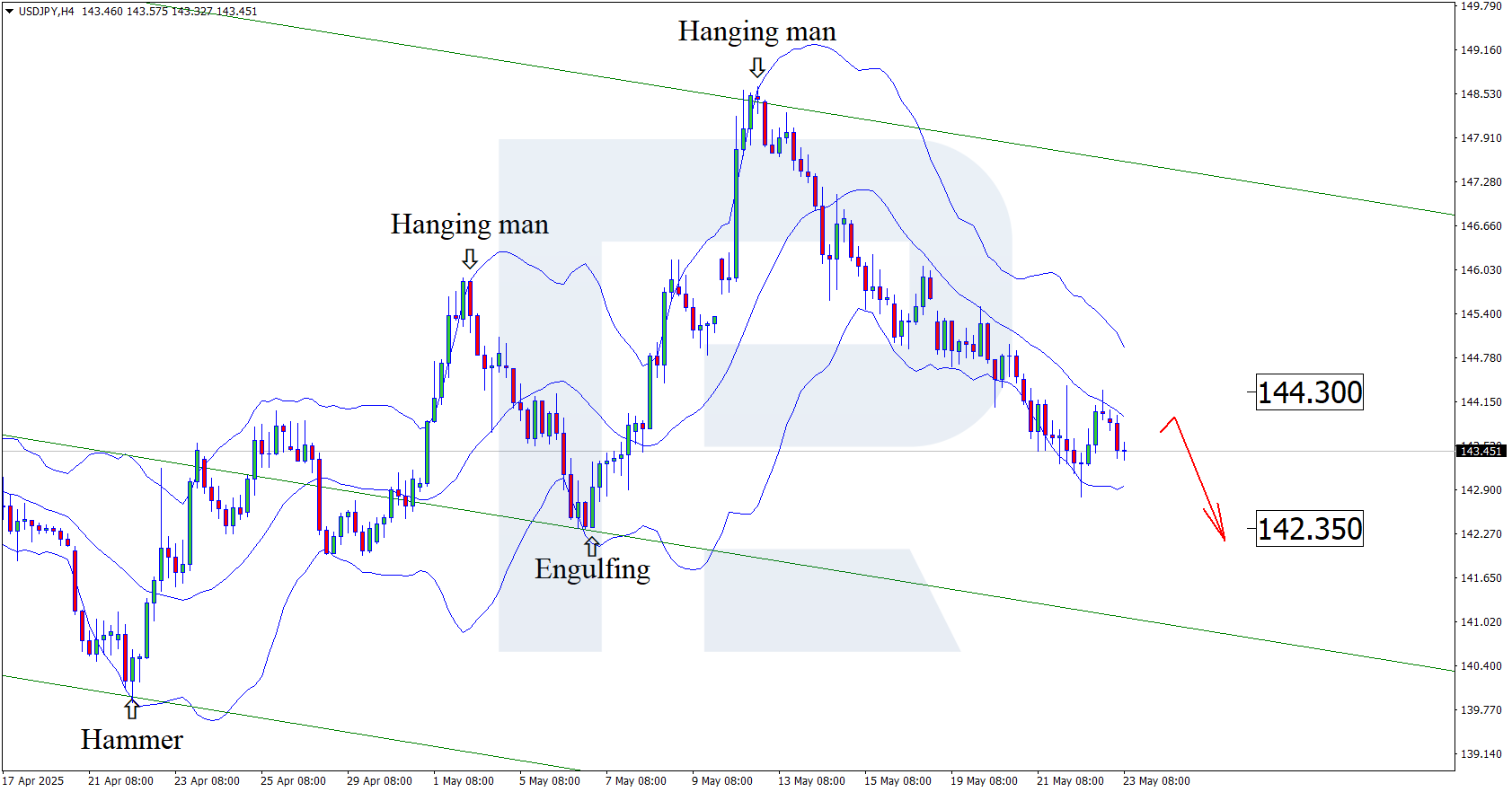

Having tested the upper Bollinger Band, the USDJPY price formed a Hanging Man reversal pattern on the H4 chart near the 143.40 level. The pair may now continue its downward wave based on that signal. The USDJPY pair remains within a descending channel, indicating the likelihood of a move towards the 142.35 support level.

Today’s USDJPY forecast also considers an alternative scenario, where the price corrects towards 144.30 before a decline.

Summary

The increase in Japan's core CPI has strengthened the yen. Combined with USDJPY technical analysis, the forecast suggests a continued decline towards the 142.35 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.