USDCAD falls to support at 1.4080

The USDCAD rate declined towards 1.4080 during a downward correction amid rising expectations of another Fed rate cut. Discover more in our analysis for 24 November 2025.

USDCAD forecast: key trading points

- Market focus: the Fed may indeed cut rates in December

- Current trend: the broader trend remains upward

- USDCAD forecast for 24 November 2025: 1.4140 or 1.4000

Fundamental analysis

Federal Reserve Bank of New York President John Williams said on Friday that a rate cut in the near term remains possible, as labour market weakness poses a greater risk than elevated inflation. Markets are now pricing in about a 69% probability of a 25-basis-point rate cut in December, up from 44% a week earlier.

Bank of Canada officials, meanwhile, called for broader economic measures to improve productivity as US trade barriers continue to pressure Canada’s economy. At the same time, headline inflation slowed to 2.2% year-over-year in October, weakening arguments for further monetary tightening by the Bank of Canada.

USDCAD technical analysis

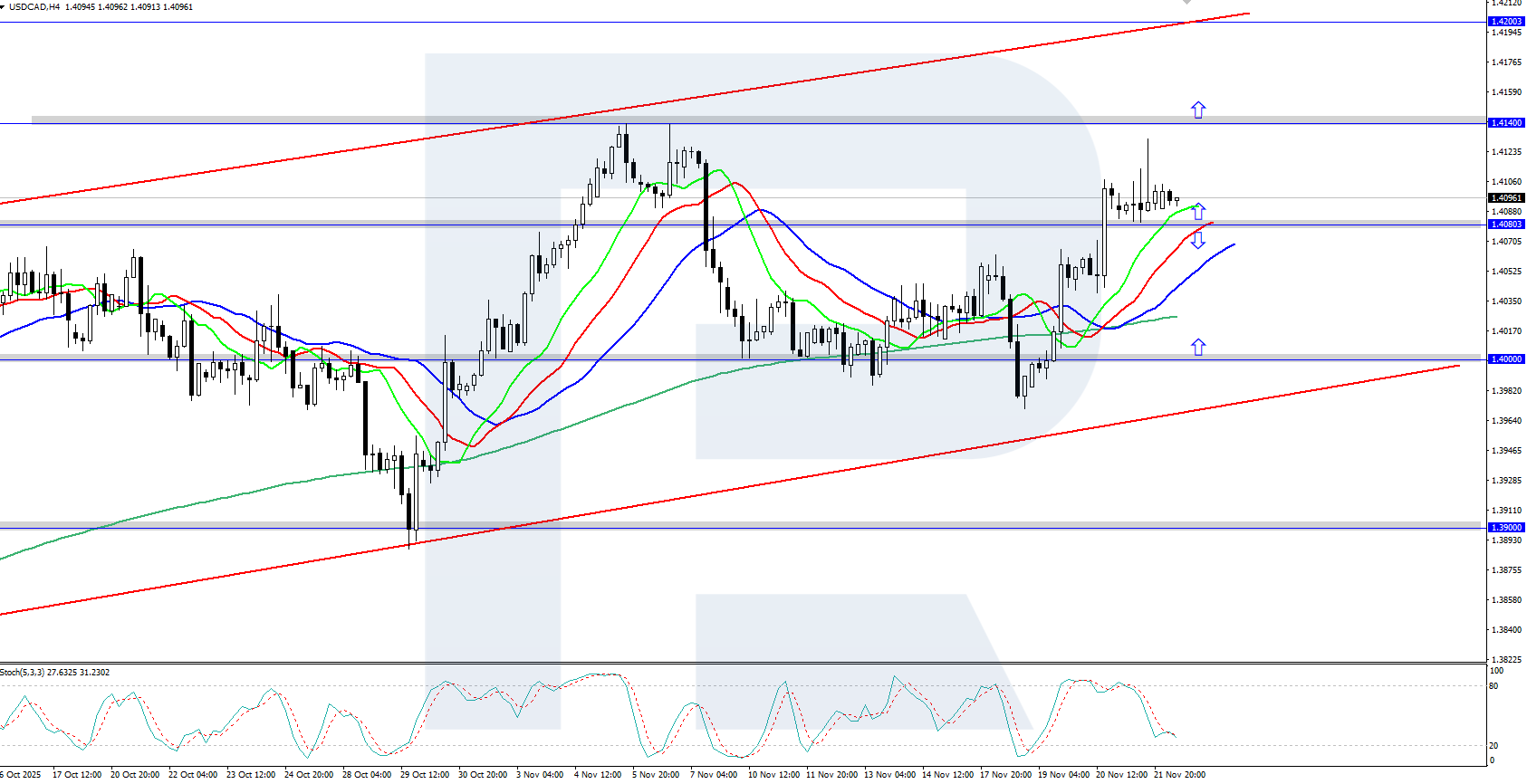

On the H4 chart, the USDCAD pair is declining within the current downward corrective phase. The overall daily trend remains bullish, meaning that once the correction ends, the pair may resume its upward movement.

The short-term USDCAD forecast suggests further decline towards 1.4000 if bears gain a foothold below 1.4080. Conversely, if bulls regain control and push the price above 1.4100, the pair could climb towards 1.4140 and higher.

Summary

The USDCAD pair is moderately declining, approaching the 1.4080 support level. Expectations of a Fed rate cut in December have risen to 69%.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.