USDCAD under pressure: dovish Fed and strong CAD weigh on USD

US monetary policy easing supports the CAD. After completing its correction, the USDCAD pair may decline towards the 1.3770 support level. Discover more in our analysis for 25 August 2025.

USDCAD forecast: key trading points

- The Federal Reserve prepares for a September rate cut

- The Jackson Hole Symposium worked against the USD

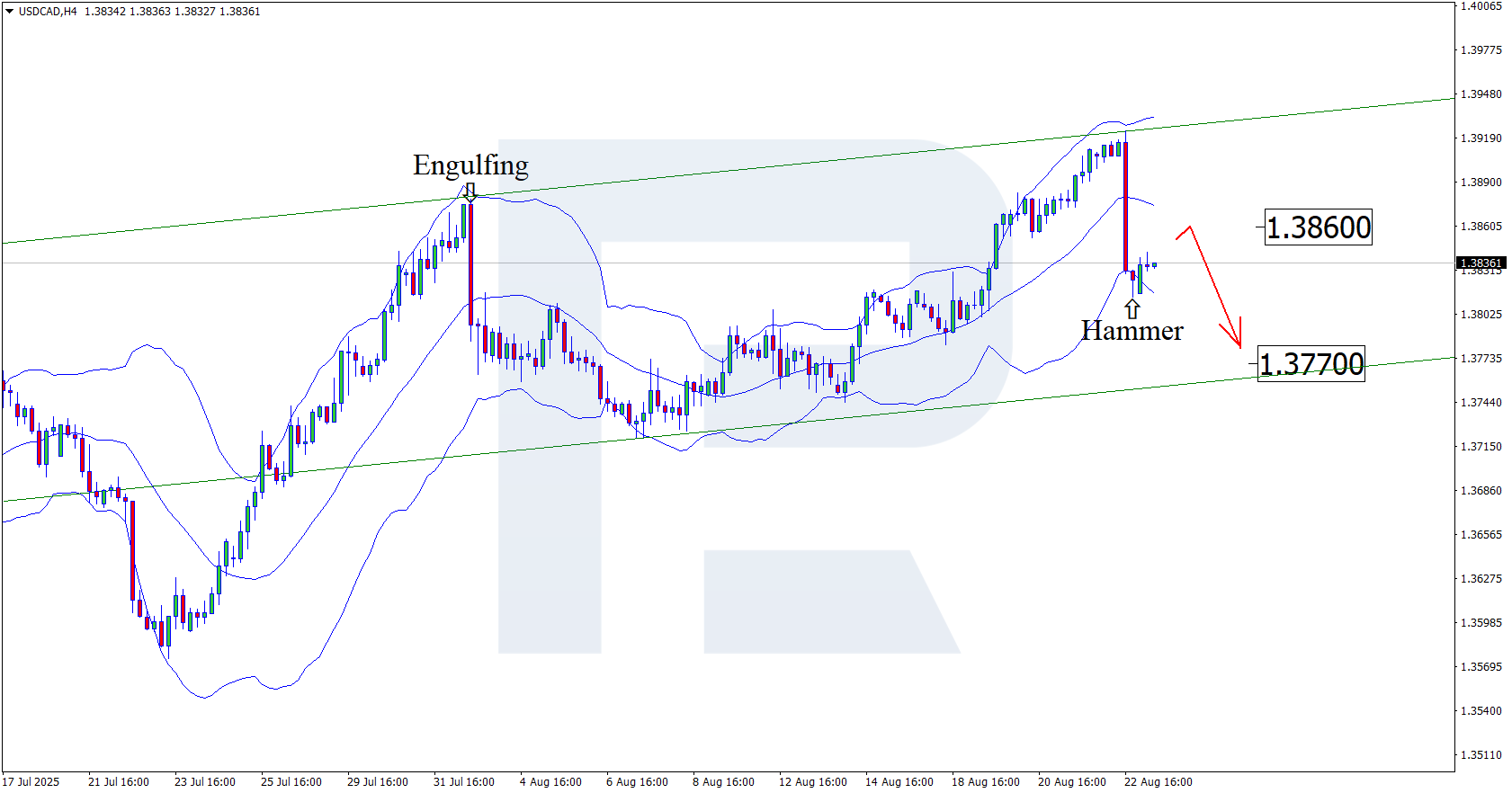

- USDCAD forecast for 25 August 2025: 1.3770 and 1.3860

Fundamental analysis

Today’s USDCAD outlook is favourable for the CAD. Expectations of a US rate cut weigh on the dollar, while the Canadian dollar continues to strengthen.

The main drivers for the USDCAD pair this week include:

- Powell’s speech and US monetary policy. Federal Reserve Chairman Jerome Powell delivered dovish signals at the Jackson Hole Symposium, opening the door to a possible September rate cut. This weakened the US dollar and affected the USDCAD rate

- The final minutes of the Fed meeting also pointed to a tendency to pause and watch in US monetary policy. Rate-cut expectations are strengthening the CAD, partly due to the weakness of the USD

Canadian data also play a role:

- Annual inflation slowed to 1.7% in July, while the three-month core CPI fell to 2.4%, boosting expectations of BoC policy easing

- Retail sales rose by 1.5% in June, compared with a preliminary July decline of -0.8%. While June was positive, weaker July figures still weigh on the CAD

Trade policy and tariffs:

- Canadian Prime Minister Mark Joseph Carney announced the removal of many retaliatory tariffs on US goods and stronger cooperation on trade and security. This creates structural support for the CAD and reduces devaluation risks

USDCAD technical analysis

On the H4 chart, the USDCAD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair is building a corrective wave based on this signal. Since quotes remain within an ascending channel, a rebound towards the nearest resistance level at 1.3860 is possible. A bounce from this resistance would open the way for continued downside.

At the same time, the forecast for 25 August 2025 also considers a scenario where the price falls to 1.3770 without testing the resistance level.

Summary

US fundamentals remain unfavourable for the USD. USDCAD technical analysis suggests a decline after the correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.