USDCAD under pressure? Investors turning towards CAD

After forming a corrective wave, USDCAD quotes may continue their upward movement towards 1.3760. Discover more in our analysis for 28 July 2025.

USDCAD forecast: key trading points

- Investors await the US interest rate decision

- The Canadian dollar continues to strengthen

- USDCAD forecast for 28 July 2025: 1.3760 and 1.3675

Fundamental analysis

Today’s USDCAD forecast leans in favour of the CAD. Ongoing uncertainty surrounding US-Canada negotiations is weighing on the US dollar, while the Canadian dollar keeps gaining strength.

Investors remain optimistic, expecting the Federal Reserve to leave interest rates unchanged at 4.5%. This outlook continues to pressure the USD and impacts the USDCAD exchange rate.

The Bank of Canada will review its interest rate on 30 July. Markets expect the rate to remain unchanged at 2.75%, although the actual outcome may differ from forecasts. A weakening economy may trigger a rate cut.

USDCAD technical analysis

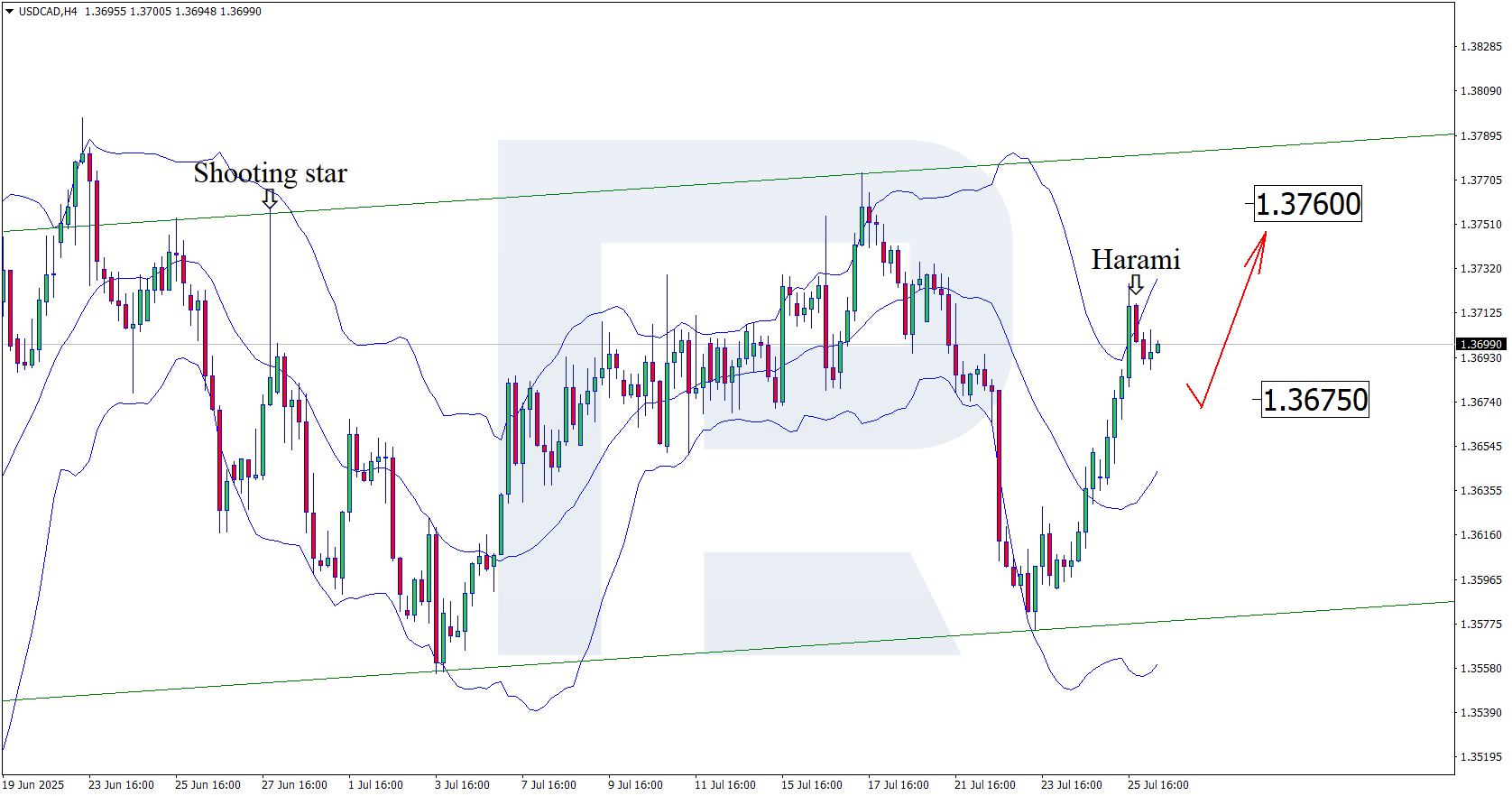

On the H4 chart, the USDCAD price has formed a Harami reversal pattern near the upper Bollinger Band. The pair is currently forming a corrective wave following the signal from this pattern. Since the quotes remain within the boundaries of the ascending channel, a pullback to the nearest support at 1.3675 is possible. A rebound from this support could pave the way for a continuation of the uptrend.

Meanwhile, the forecast for 28 July 2025 also includes a scenario of further growth to 1.3760, with the pair gaining upward momentum after breaking above the resistance level.

Summary

Anticipation of interest rate decisions in both the US and Canada is boosting the Canadian dollar. USDCAD technical analysis suggests a potential correction towards the 1.3675 support level before growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.