USDCAD: the pair reversed upwards, will growth continue?

USDCAD reversed upwards and consolidated above 1.3600 amid weak Canadian economic data published last week. Details – in our analysis for 7 July 2025.

USDCAD forecast: key trading points

- Market focus: Trump announced that trade tariffs will come into force from 1 August

- Current trend: an upward correction is underway

- USDCAD forecast for 7 July 2025: 1.3557 and 1.3700

Fundamental analysis

Last week’s published data showed that business confidence in Canada fell to a three-month low as uncertainty over US trade policy continued to limit investor optimism. The recent change of government in Canada also pressures the Canadian currency.

US President Donald Trump announced that large-scale trade tariffs will come into force on 1 August. US Treasury Secretary Scott Bessent earlier explained that tariffs would return to the 2 April levels for countries that have not reached a trade agreement with the US. US-Canada trade negotiations are still ongoing.

USDCAD technical analysis

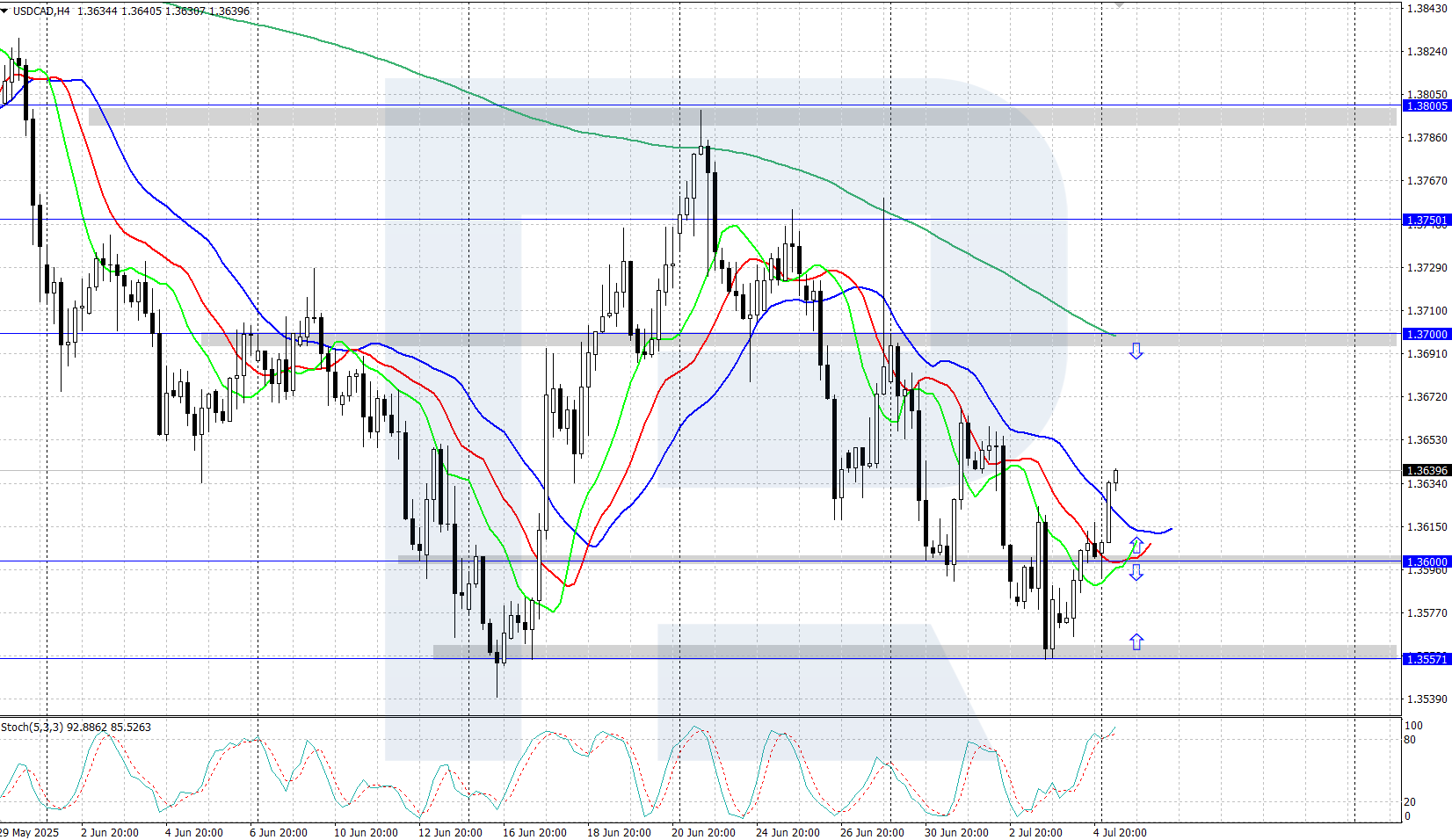

On the H4 chart, USDCAD quotes show an upward correction within a downtrend. Quotes rebounded from daily support at 1.3557 and formed a reversal upwards. In the near term, there is a high probability of the upward correction continuing.

Within the short-term USDCAD price forecast, if bears manage to push quotes below 1.3557, the decline may continue. However, if bulls manage to maintain initiative and stay above 1.3600, growth towards the area around 1.3700 and higher may continue.

Summary

USDCAD quotes reversed upwards and rose to an area above 1.3600. The upward correction remains in play and may continue.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.