GBPUSD maintains a bullish bias despite the correction

The GBPUSD pair entered a correction phase; however, a combination of fundamental factors and the technical picture suggests continued potential for renewed growth. The rate currently stands at 1.3437. Discover more in our analysis for 21 January 2026.

GBPUSD forecast: key takeaways

- The bearish correction remains limited due to pressure on the US dollar amid escalating tensions between the US and Europe and statements by Donald Trump regarding Greenland

- The UK unemployment rate remained at 5.1% for the three months to November

- Slowing wage growth strengthened expectations of a more accommodative monetary policy from the Bank of England

- GBPUSD forecast for 21 January 2026: 1.3625

Fundamental analysis

The GBPUSD rate is undergoing a correction after rising for two consecutive trading sessions. Sellers defended the 1.3475 resistance level, preventing a breakout and triggering profit-taking on long positions. At the same time, the current correction remains contained, as escalating tensions between the US and Europe amid increasingly strong statements by President Donald Trump regarding Greenland continue to weigh on the US dollar, making the GBPUSD outlook bullish today.

The UK unemployment rate remained at 5.1% for the three months to November, standing near pandemic-period highs and exceeding market expectations of 5.0%. Unemployment reached its highest level since the three months to March 2021, as the total number of unemployed increased by 158 thousand compared with the previous quarter, reaching 1.832 million.

The labour market continued to show signs of cooling. Wage growth excluding bonuses slowed to 4.5% year-on-year, marking the weakest reading since the three months to April 2022 and reinforcing expectations of a more accommodative BoE monetary policy.

Technical outlook

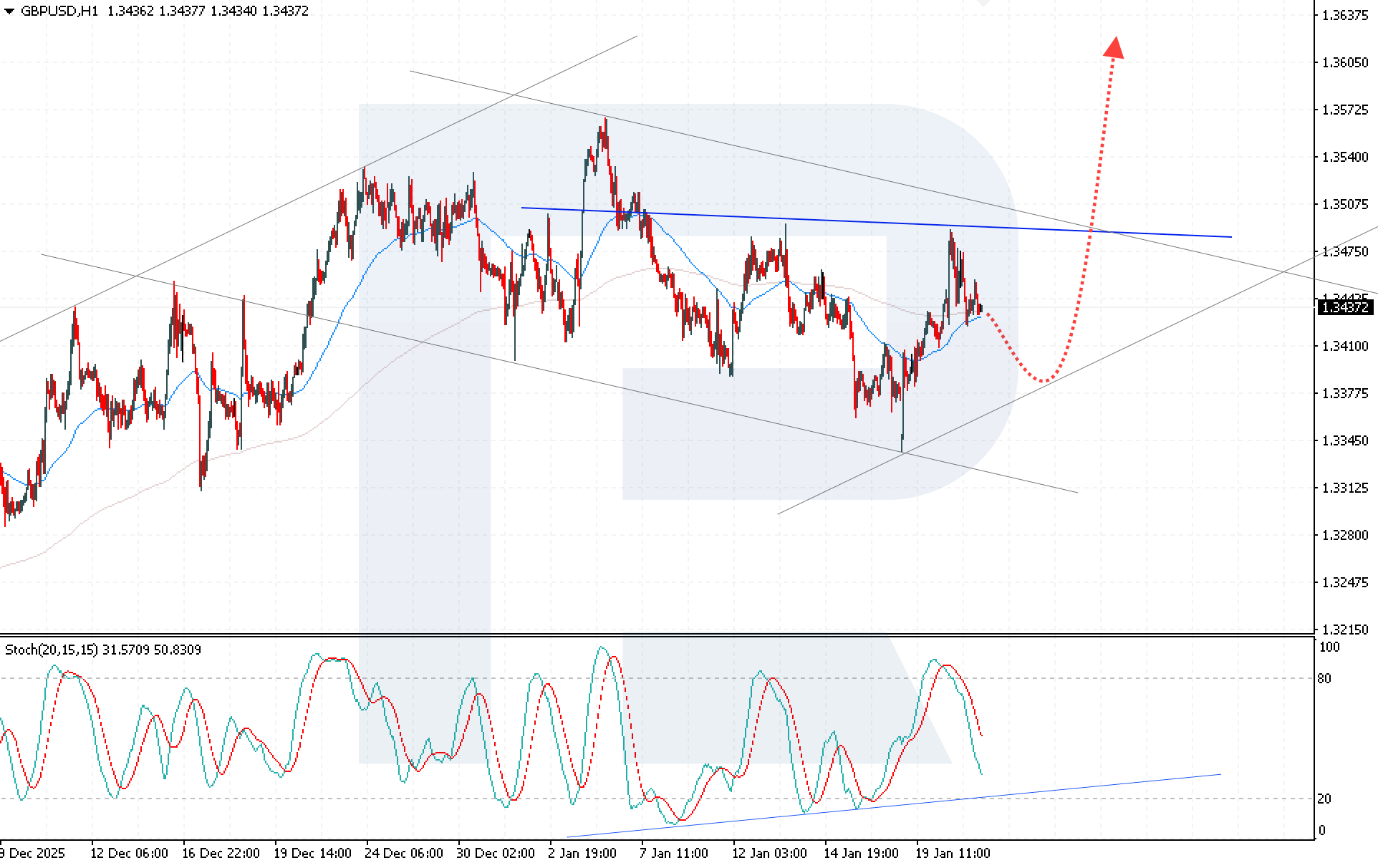

GBPUSD quotes are correcting; however, despite the pullback, the market retains the potential to form a Head and Shoulders reversal pattern.

The GBPUSD forecast for today suggests a test of the 1.3380 level, followed by renewed growth towards 1.3625 as part of the reversal pattern’s development. Technical indicators confirm bullish sentiment. The Stochastic Oscillator has turned from overbought territory and is moving towards the support line, indicating a weakening of the corrective momentum without a change in the medium-term trend.

Key confirmation of the bullish scenario will be consolidation of the GBPUSD pair above 1.3505. Such a signal will indicate a breakout above the upper boundary of the corrective channel and will significantly increase the probability of an accelerated move towards the target level of 1.3625 with full realisation of the Head and Shoulders pattern.

GBPUSD overview

- Asset: GBPUSD

- Timeframe: H1 (Intraday)

- Trend: bullish

- Key resistance levels: 1.3475 and 1.3570

- Key support levels: 1.3380 and 1.3315

GBPUSD trading scenarios for today

Main scenario (Buy Limit)

A rebound from the 1.3380 level may indicate that conditions are forming for a long scenario in GBPUSD today. The risk-to-reward ratio exceeds 1:2.

Potential profit upon reaching the take-profit level amounts to approximately 245 pips, with possible losses capped at 90 pips.

- Take Profit: 1.3625

- Stop Loss: 1.3470

Alternative scenario (Sell Stop)

Short positions become possible if the price breaks and consolidates below the 1.3380 support level. This outcome will indicate the cancellation of the Head and Shoulders reversal pattern.

- Take Profit: 1.3300

- Stop Loss: 1.3420

Risk factors

Risk factors for continued GBPUSD growth include persistently high unemployment and slowing wage growth in the UK, which may limit the bullish scenario’s potential. Additional pressure on the pound may arise from increased uncertainty in global markets or unexpected actions by the Bank of England that could alter current investor sentiment.

Summary

Pressure on the US dollar offsets weakness in the UK labour market and limits the pair’s downside potential. GBPUSD technical analysis indicates a continued bullish scenario with a high probability of renewed growth towards the 1.3625 level after the correction ends and the reversal is confirmed by price consolidation above 1.3505.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.