Markets on edge – GBPUSD on the verge of a breakout

A decline in US economic indicators may become a trigger for GBPUSD growth towards 1.3250. Discover more in our analysis for 26 November 2025.

GBPUSD forecast: key trading points

- US initial jobless claims: previously at 220 thousand, projected at 226 thousand

- Core PCE price index: previously at 2.9%, projected at 2.7%

- GBPUSD forecast for 26 November 2025: 1.3250

Fundamental analysis

The GBPUSD forecast for 26 November 2025 is favourable for the pound, with the pair having a good chance to partially regain its positions.

US initial jobless claims show how many people filed for unemployment benefits for the first time during the previous week. This indicator reflects the state of the labour market, with an increase in initial jobless claims indicating rising unemployment.

The previous reading was 220 thousand, and today’s forecast indicates a rise to 226 thousand. The increase is modest, but actual data can differ significantly from expectations, and such deviations can noticeably impact USD performance.

The core PCE price index is the key US inflation gauge that tracks the cost of goods and services excluding food and energy. The core PCE reflects real consumer purchasing power and the stability of the economy because it is less sensitive to short-term fluctuations.

The forecast for 26 November 2025 suggests the index may decline to 2.7%. The probability of such a decrease is not high, as this is only a forecast – the real outcome will be clear only after publication. If the figure comes in worse than expected, it may negatively affect the US dollar and push the GBPUSD pair higher.

GBPUSD technical analysis

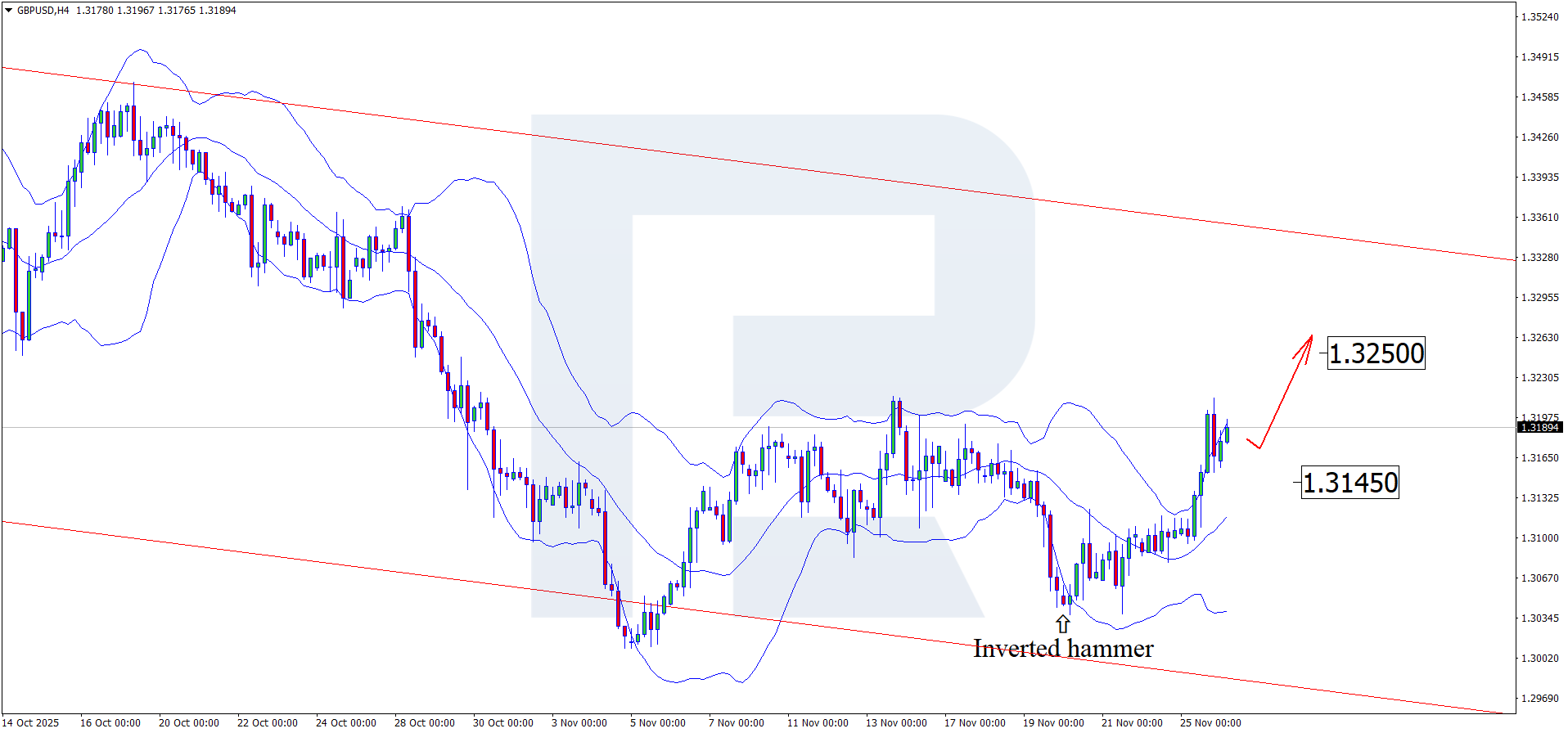

Having tested the lower Bollinger Band, the GBPUSD pair formed an Inverted Hammer reversal pattern on the H4 chart. At this stage, it may continue an upward wave following the pattern signal. Since the pair remains within a descending channel, the corrective wave is expected to develop.

The upside target is currently the 1.3250 resistance level. If the price rebounds from this resistance, downward pressure may resume.

The GBPUSD forecast for today also considers an alternative scenario, where the price declines towards 1.3145 without testing the resistance level.

Summary

The pound continues to strengthen, and the GBPUSD technical analysis suggests a rise towards the 1.3250 resistance.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.