GBPUSD in tension: the budget question remains open

The GBPUSD pair remains stable near 1.3138. Investors are watching the budget story closely. Discover more in our analysis for 19 November 2025.

GBPUSD forecast: key trading points

- Market focus: the GBPUSD pair is moving amid tense macroeconomic developments

- Current trend: the pound remains in a sideways range until major news appears

- GBPUSD forecast for 19 November 2025: 1.3084 or 1.3218

Fundamental analysis

The GBPUSD rate is hovering around 1.3138 on Wednesday as the market follows domestic news from the UK.

The UK Treasury is preparing to increase spending on social benefits, The Telegraph reports. Chancellor Rachel Reeves plans to allocate around 6 billion GBP in additional funding in the annual budget to be presented next week. Payments for working-age citizens may rise by 3.8% from April next year. The Treasury stated that it does not comment on “budget speculation”.

The backdrop remains tense: in July, the government abandoned part of the reforms aimed at reducing spending, which increased doubts about its readiness to take tough fiscal decisions. To stay within its own fiscal targets, Reeves will need to raise tens of billions of pounds.

Additional market volatility was triggered by reports that the minister abandoned the idea of increasing income tax amid an improved financial forecast. Conflicting signals around the budget undermine confidence in the government’s economic policy.

The GBPUSD forecast is moderate.

GBPUSD technical analysis

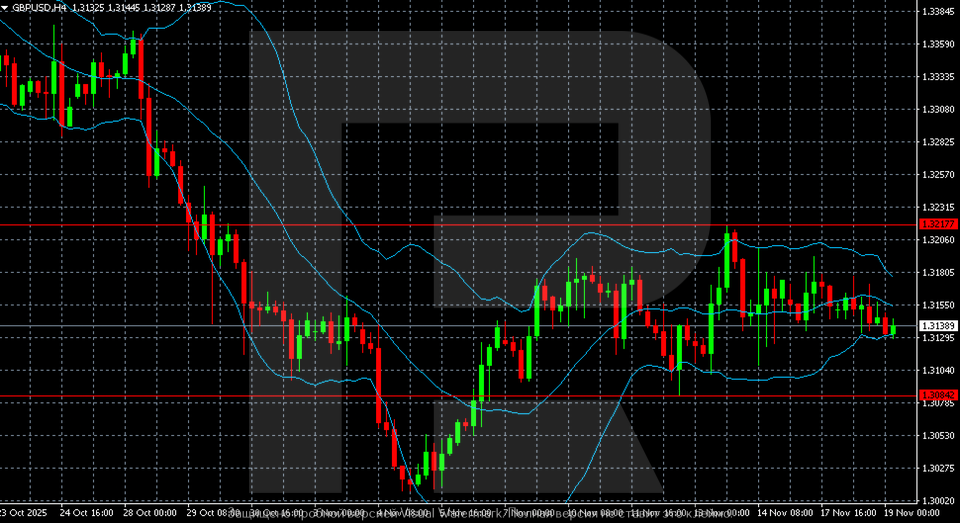

On the H4 chart, the GBPUSD pair is hovering within a narrow sideways range near 1.3135, consolidating after a deep sell-off at the end of October. The current structure remains neutral to bearish, with no impulse for recovery and attempts to grow consistently limited by the resistance level.

Bollinger Bands are narrowing, indicating lower volatility and an accumulation phase. The price moves along the middle band, occasionally bouncing from the upper boundary – this reflects a lack of confident buying pressure.

The key resistance level lies at 1.3218 – the level where the pair has repeatedly reversed downwards and which remains the upper boundary of the current range. The support level lies in the 1.3084 area, from which the pair reversed upwards on 7–8 November. Holding above it preserves the baseline sideways scenario.

Summary

The GBPUSD pair is moving within the 1.3084–1.3218 range with weak recovery potential. The GBPUSD forecast for today, 19 November 2025, suggests this range could remain unchanged.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.