GBPUSD holds steady above 1.3100

The GBPUSD rate consolidated above 1.3100 despite rising unemployment in the UK. Discover more in our analysis for 12 November 2025.

GBPUSD forecast: key trading points

- Market focus: UK unemployment rose to 5.0% in September

- Current trend: correcting upwards

- GBPUSD forecast for 12 November 2025: 1.3100 and 1.3250

Fundamental analysis

Weaker-than-expected UK labour market data strengthened expectations of a Bank of England rate cut next month. Regular wage growth slowed to 4.6% in Q3, while unemployment rose to 5.0%, exceeding the forecast of 4.9%.

Last week, the Bank of England kept interest rates unchanged but indicated that a rate cut in December would depend on how strong domestic inflationary pressure remains. The market is now awaiting the UK Q3 GDP figures, scheduled for release on Thursday.

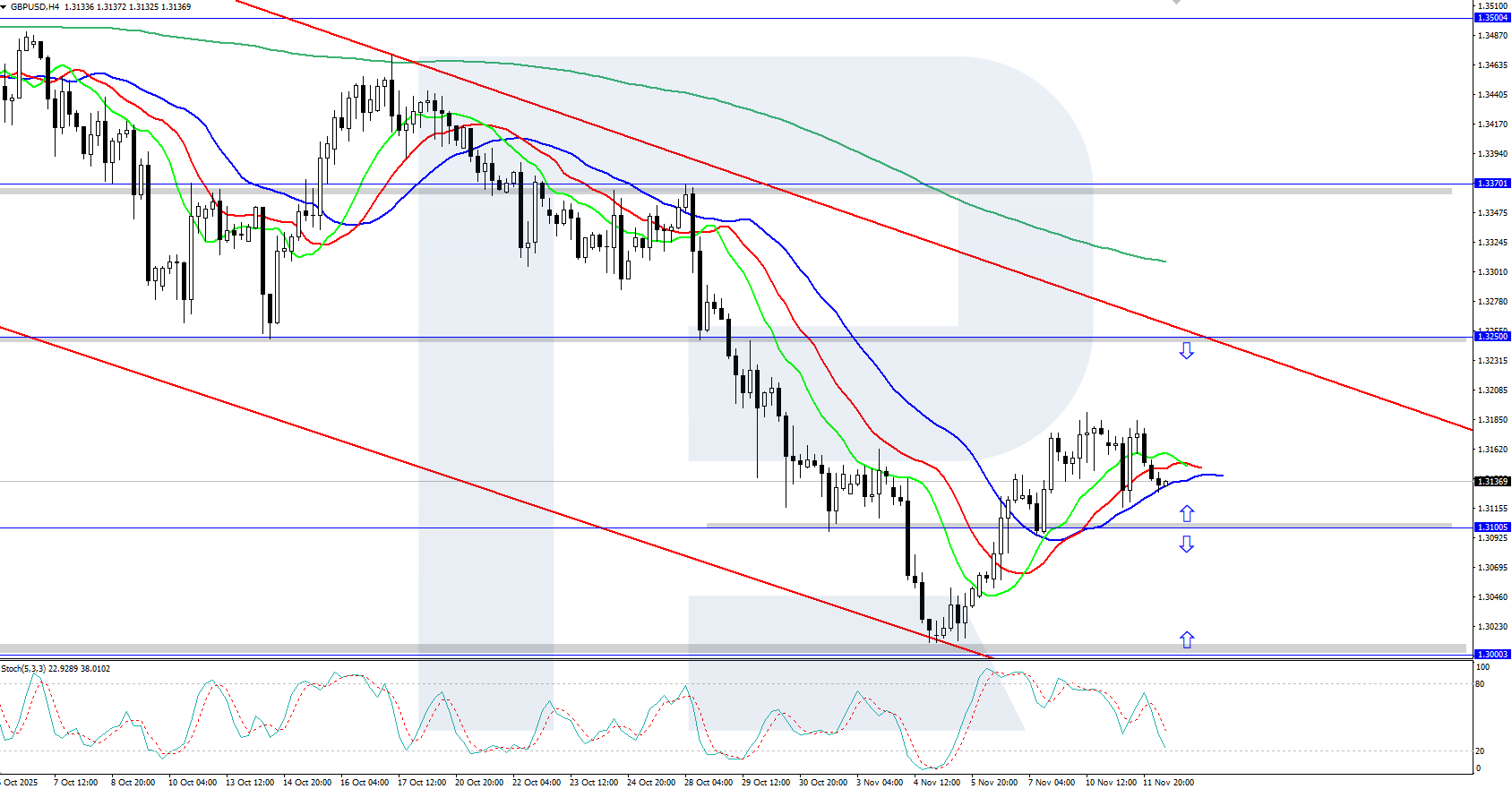

GBPUSD technical analysis

On the H4 chart, the GBPUSD pair shows moderate growth, holding above the 1.3100 mark. The Alligator indicator is pointing upwards, suggesting that the upward correction may continue. The key resistance level is located at 1.3250.

The short-term GBPUSD forecast suggests continued growth towards the 1.3250 resistance level if the bulls hold the price above the 1.3100 support level. However, a further decline may occur if the bears gain a foothold below 1.3100, with the next downside target near 1.3000.

Summary

The GBPUSD pair is undergoing an upward correction, consolidating above 1.3100. The market is now awaiting UK Q3 GDP data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.