GBPUSD: pair holds above 1.3400

The GBPUSD pair consolidated above the 1.3400 mark amid the expected U.S. government shutdown and ahead of the ADP U.S. employment data release. Full details in our analysis for 1 October 2025.

GBPUSD forecast: key trading points

- Market focus: today the U.S. ADP employment report will be released

- Current trend: upward movement continues

- GBPUSD forecast for 1 October 2025: 1.3500 and 1.3400

Fundamental analysis

The U.S. government shutdown is set to begin on Wednesday after the Senate rejected a short-term spending cut measure. This step threatens disruptions in air travel, federal services, and the release of key economic data, including the monthly employment report.

According to the latest forecasts, the UK economy will grow by less than 1.5% in 2025, while inflation is likely to reach 4% in September, double the Bank of England’s target.

Today, markets await U.S. employment data from Automatic Data Processing Inc. (ADP). The September figure is expected to rise by 52K, following 54K in the previous month.

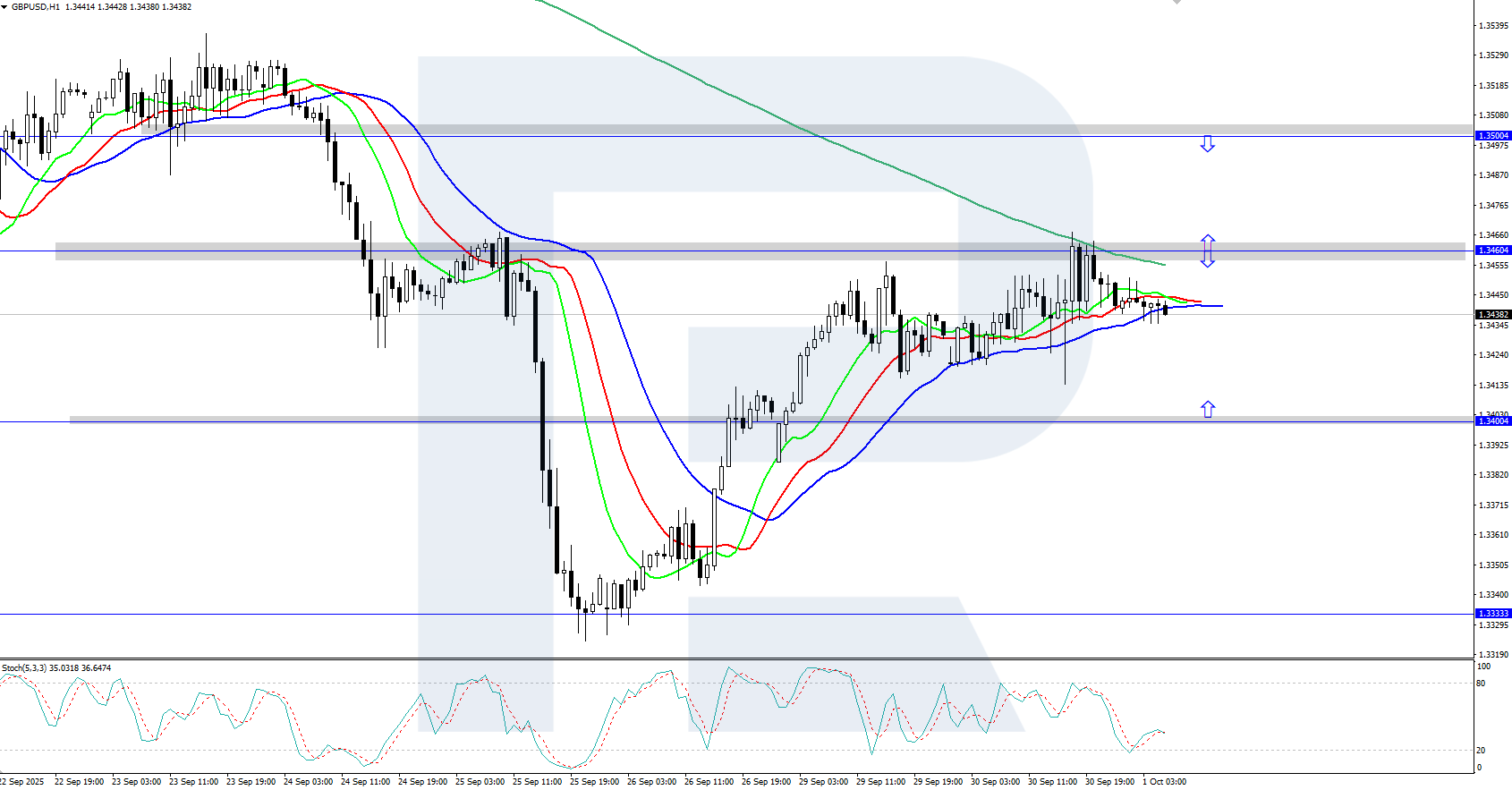

GBPUSD technical analysis

On the H4 chart, GBPUSD shows moderate growth, consolidating above the 1.3400 level. The Alligator indicator is pointing upward, suggesting the bullish movement could continue. The key support for the uptrend is at 1.3333.

The short-term GBPUSD forecast suggests that if bulls maintain control, the pair has room to advance toward resistance at 1.3500 and higher. A bearish scenario would come into play if sellers manage to push the price back below 1.3400, targeting support at 1.3333.

Summary

The GBPUSD pair has climbed above 1.3400. Today, markets await the release of U.S. employment data from ADP.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.