GBPUSD consolidates above 1.3600 ahead of Fed decision

The GBPUSD rate has climbed above 1.3600 ahead of key interest rate decisions from the Federal Reserve and the Bank of England. Discover more in our analysis for 17 September 2025.

GBPUSD forecast: key trading points

- Market focus: today, the market is awaiting the Fed’s rate decision, with the Bank of England’s announcement scheduled for tomorrow

- Current trend: bullish momentum is in play

- GBPUSD forecast for 17 September 2025: 1.3620 and 1.3672

Fundamental analysis

The GBPUSD pair is firmly holding above 1.3600 ahead of today’s Fed rate decision. Markets widely expect the Federal Reserve to cut its benchmark rate by 25 basis points, the first reduction since December last year. Traders will closely watch Chairman Jerome Powell’s comments for guidance on the path of future policy.

Tomorrow brings the Bank of England’s announcement. The BoE is expected to keep its key rate at 4.0% while slowing the pace of gilt runoffs by 100 billion GBP. Fresh UK data released today showed consumer inflation at 3.6% year-on-year in August.

GBPUSD technical analysis

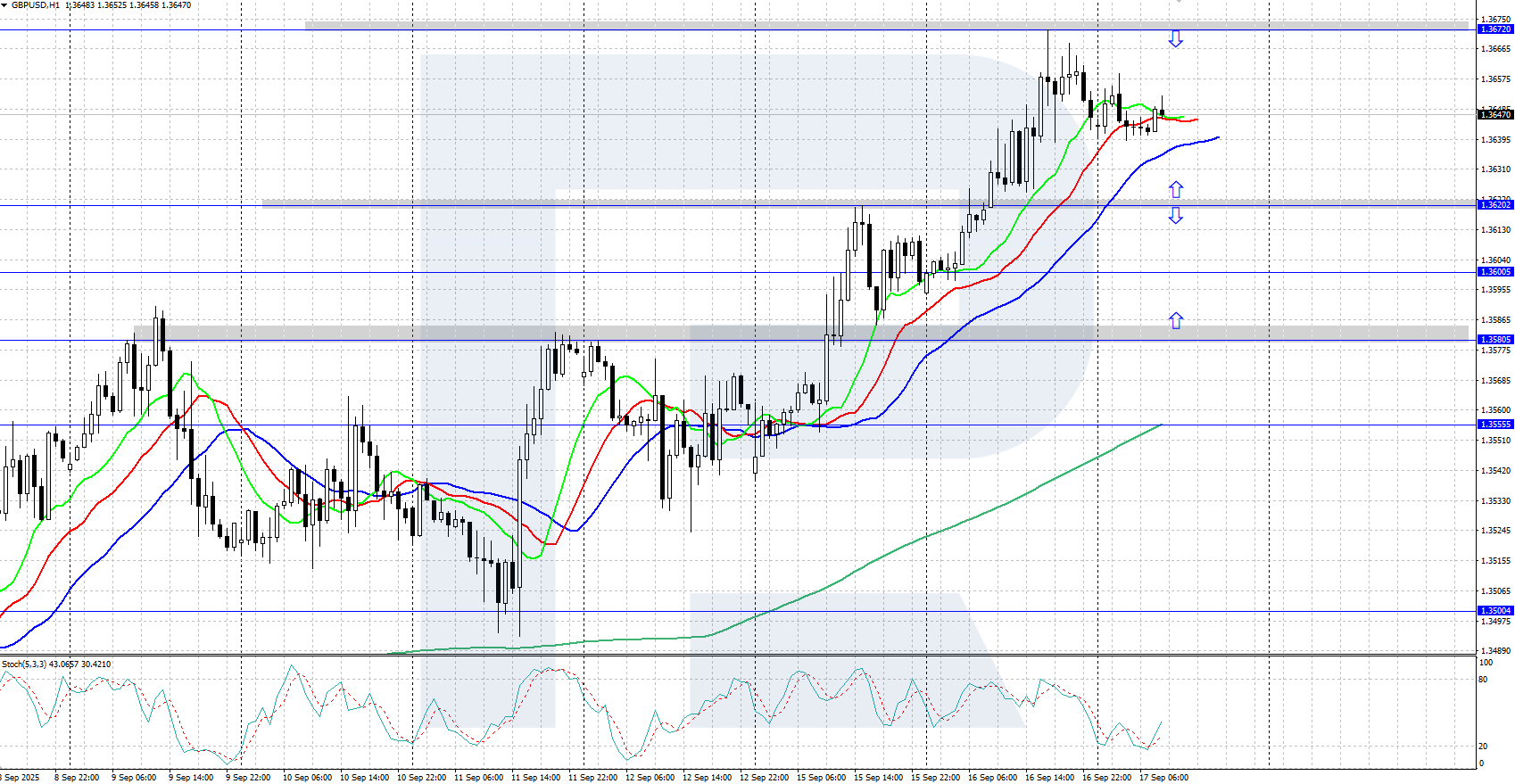

On the H4 chart, the GBPUSD pair shows bullish momentum, consolidating above 1.3600. The Alligator indicator points upwards, confirming a continued upward impulse.

The short-term GBPUSD forecast suggests the pair could extend gains towards the 1.3672 resistance level and higher if bulls hold the price above the 1.3620 support level. Conversely, a downside correction could begin if bears gain a foothold below 1.3620, opening the way towards the support level near 1.3580.

Summary

The GBPUSD pair has consolidated above 1.3600. Markets are now awaiting interest rate decisions from the Federal Reserve and the Bank of England.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.