GBPUSD in turbulence zone – what will the Bank of England say

The British pound came under pressure again, but ahead of key fundamental data, there is a small chance of a GBPUSD correction towards 1.3425. Discover more in our analysis for 3 September 2025.

GBPUSD forecast: key trading points

- The Bank of England’s Monetary Policy Committee (MPC) hearings

- US JOLTS job openings: previously at 7.437 million, projected at 7.380 million

- GBPUSD forecast for 3 September 2025: 1.3425 and 1.3285

Fundamental analysis

The GBPUSD forecast for 3 September 2025 takes into account today’s MPC hearings.

What to expect from the hearings:

- Tone of the discussion – members of Parliament will question MPC members about inflation outlook, rates, and the overall state of the UK economy. This is a chance to catch the underlying tones not always visible in official statements

- Rates and inflation – markets are looking for signals on whether the BoE is ready to ease policy this autumn or prefers to pause. After recent inflation slowdown and signs of a cooling labour market, rhetoric may lean more dovish

- Impact on the GBP – if the MPC hints at an imminent rate cut, the pound may come under pressure. Conversely, any strong commitment to fighting inflation will support GBP

- Economic risks – global instability and trade relations will also be discussed, adding nervousness to the market

The MPC hearings serve as a barometer for the BoE’s next steps. The market could see heightened volatility in GBPUSD and cross pairs with the pound.

The forecast for 3 September 2025 also factors in US labour market data. JOLTS job openings are expected to decline to 7.380 million from the previous 7.437 million, potentially putting pressure on the USD.

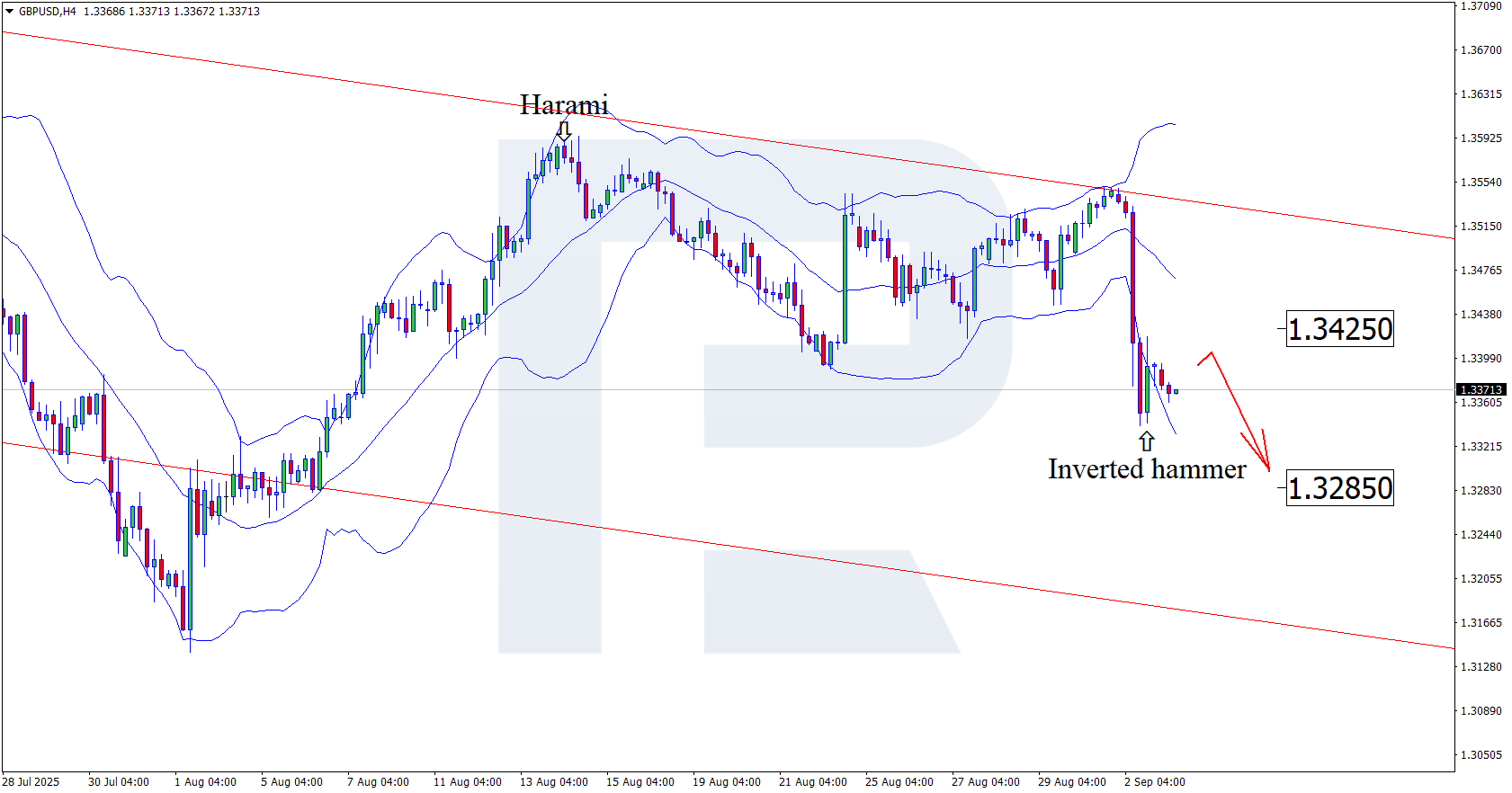

GBPUSD technical analysis

On the H4 chart, the GBPUSD pair tested the lower Bollinger Band and formed an Inverted Hammer reversal pattern. At this stage, the pair may develop a corrective wave following this signal. Given that the price is within a descending channel after a sharp drop, a corrective rebound is likely.

The target for the pullback is 1.3425. A rebound from the resistance level could then open the way for a renewed bearish trend.

The GBPUSD forecast for today also includes an alternative scenario, where the price declines towards 1.3285 without testing the resistance level.

Summary

The market is waiting for the Bank of England MPC hearings. GBPUSD technical analysis suggests a corrective move towards 1.3425 before potential further downside.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.