GBPUSD stable near highs: the market may update autumn 2021 peaks

The GBPUSD pair holds around 1.3763. The highest level since October 2021 remains supported by the Bank of England’s dovish stance. Details – in our analysis for 2 July 2025.

GBPUSD forecast: key trading points

- The GBPUSD pair remains at its peak since October 2021

- The market expects the Bank of England to cut the interest rate in August to 4.00% per annum

- GBPUSD forecast for 2 July 2025: 1.3785

Fundamental analysis

The GBPUSD rate holds at a peak of 1.3763 on Wednesday. These are the highest levels since October 2021. The currency is supported by the Bank of England’s (BoE) restrained position against a more dovish policy from the ECB. Meanwhile, inflation in the UK remains consistently above target: in May it stood at 3.4% versus 2.0% in the Eurozone in June.

Nevertheless, the economy is under pressure. April saw a sharp GDP contraction amid global trade restrictions and domestic tax increases. Bank of England Governor Andrew Bailey noted that price growth is mainly driven by regulated tariffs, while weakening signs are emerging in the economy and labour market. He also indicated that rates are likely to move down. The regulator is expected to cut the base rate by 25 basis points in August – from 4.25% to 4.00%.

Additionally, market attention focuses on the vote regarding the social support system reform. Prime Minister Keir Starmer softened the parameters of benefits cuts amid opposition within his own party.

The forecast for GBPUSD is positive.

GBPUSD technical analysis

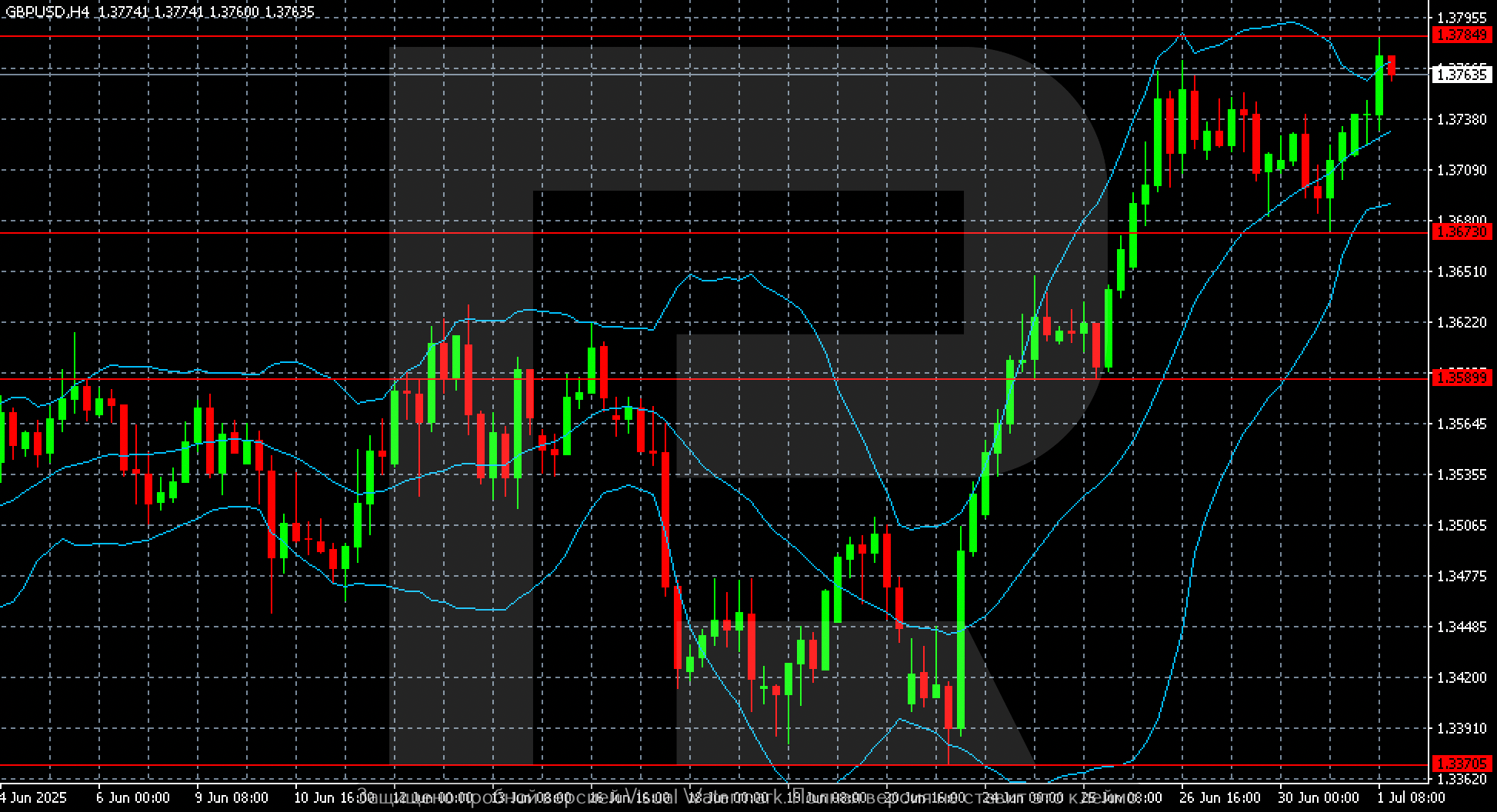

On the H4 chart for GBPUSD, the uptrend remains confirmed. Since 20 June, GBPUSD has gained over 400 points. The price has closely approached the resistance level at 1.3785, marking another peak since 2021.

The momentum is accompanied by Bollinger Bands expansion and confident movement along the upper channel boundary, indicating the strength of the bullish trend. The nearest support lies at 1.3673. In case of a correction, the price may test the middle Bollinger Band line. A breakout of 1.3785 will open the way to new highs. A rebound down from this level may lead to a local regrouping or profit-taking.

Summary

The GBPUSD price retains potential for further gains despite reaching new highs. The GBPUSD forecast for today, 2 July 2025, anticipates a retest of 1.3785.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.