GBPUSD stabilises: market absorbs UK labour data

The GBPUSD pair found support near 1.3478. Markets are regaining balance following weak employment data. Discover more in our analysis for 11 June 2025.

GBPUSD forecast: key trading points

- The GBPUSD pair initially dropped on UK employment data but has started to recover

- While the pound appears weak, stabilisation is possible

- Statistical reporting issues in the UK make market analysis more complex

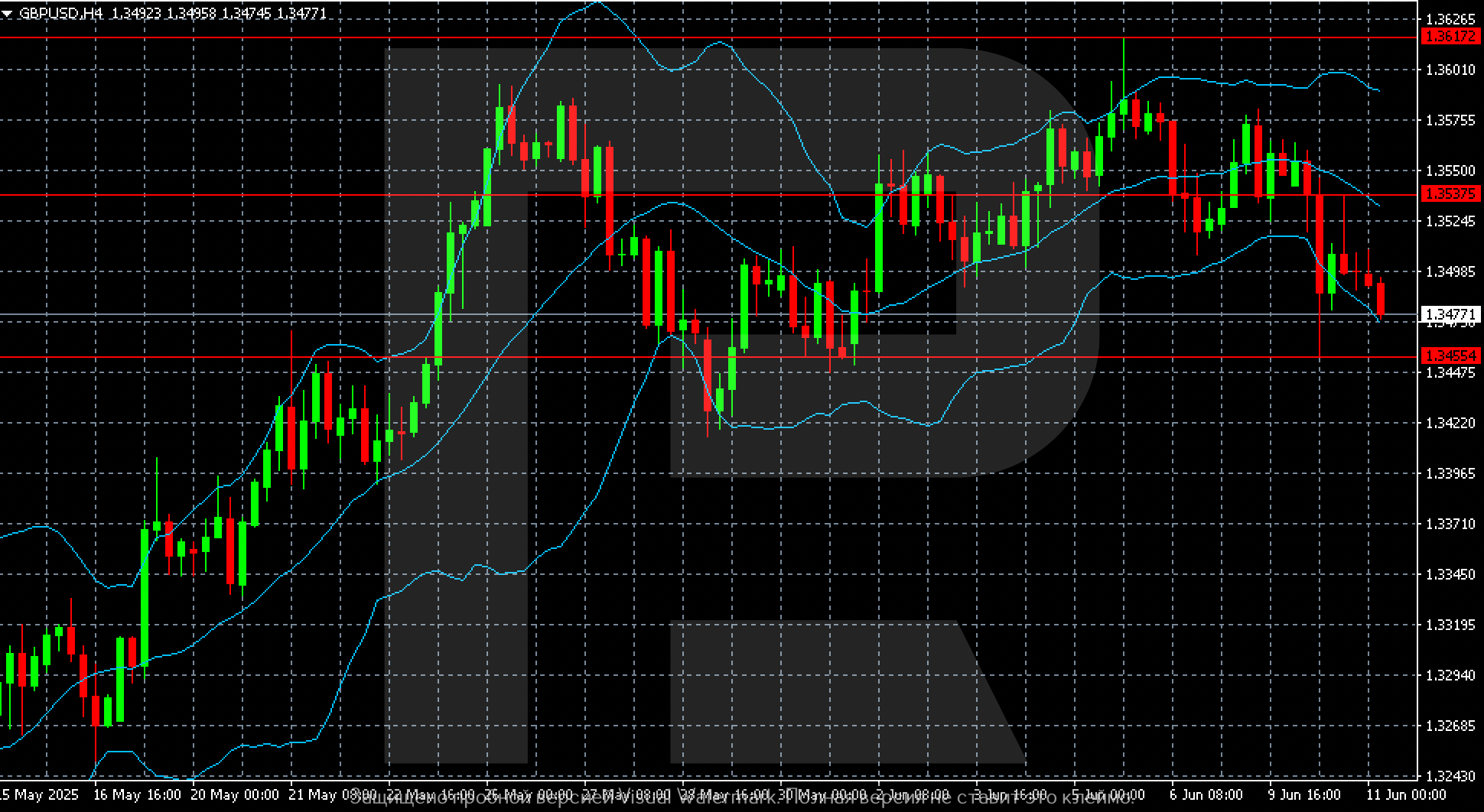

- GBPUSD forecast for 11 June 2025: 1.3455

Fundamental analysis

The GBPUSD rate is currently holding near 1.3478 after recent volatility driven by UK employment data.

Unemployment in the UK has reached its highest level since 2020, and employment fell by 109,000. Against this backdrop, the pair plunged from 1.3535 to 1.3460 but began to gradually recover losses.

The rebound is partly due to the US dollar's general weakness. Nonetheless, the British pound still looks underwhelming in global markets. Uncertainty around the reliability of UK labour data has become a surprising support factor. The Office for National Statistics (ONS) has repeatedly flagged concerns over data quality, casting doubt on the accuracy of recent releases.

Earlier, Bloomberg highlighted a crisis at the ONS, including the departure of its head, who was appointed to address such structural issues. As a result, investors and the Bank of England are navigating almost blindly.

On the monetary side, the probability of a rate cut at the 19 June meeting stands at just 10%. However, expectations for the August meeting rise sharply to 73%.

The GBPUSD forecast is mixed.

GBPUSD technical analysis

On the H4 chart, GBPUSD shows potential for a retest of the 1.3455 level, followed by a possible rebound towards 1.3498.

Summary

The GBPUSD pair is pricing in the UK’s employment data. The forecast for 11 June 2025 anticipates another attack on 1.3455, after which the price may recover.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.