EURUSD weekly forecast: higher chances for sideways move

The EURUSD pair ended the week near 1.1580. Market expectations for a December Fed rate cut rose to nearly 87%. Investors interpreted the latest US data as a signal of potential easing: ADP private employment dropped by 13.5 thousand, retail sales rose only 0.2%, and the PPI confirmed a moderate slowdown in price pressure. Against this backdrop, the dollar corrected but remained in a strong position.

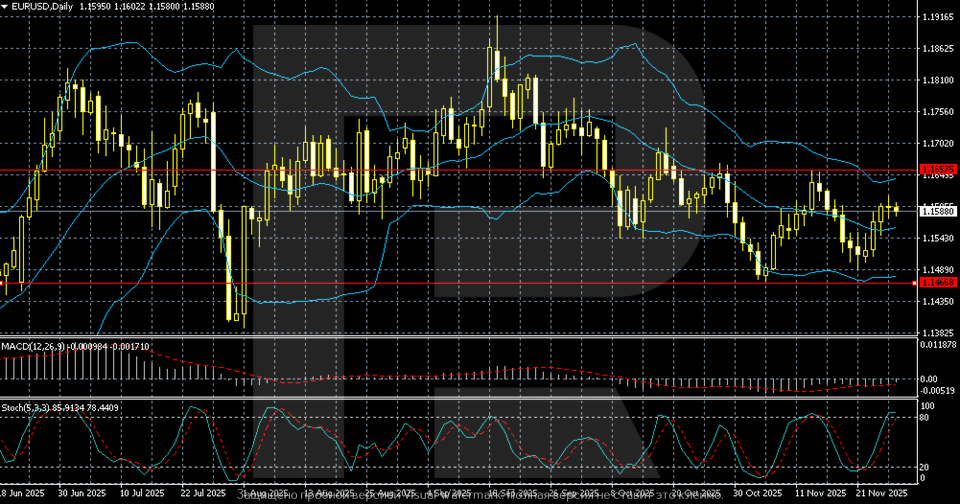

Despite the local recovery, the EURUSD pair remains in a broad range between 1.1466 and 1.1657, failing to break above the dynamic resistance level near 1.1600. Indicators show weak momentum and signs of overbought conditions, which limits upside potential. This review examines the factors that will shape the pair’s movement during the week of 1–5 December 2025.

EURUSD forecast for this week: quick overview

- Market focus: the EURUSD pair closed the week up by approximately 0.5% as investors are increasingly pricing in a December Fed rate cut. The market estimates the likelihood of a 25-basis-point cut at nearly 87% and expects three more cuts in 2026. Amid weakening demand for safe-haven assets, the dollar remains under pressure.

- Current trend: the EURUSD rate is hovering near 1.1588 within the broad multi-month range. The pair remains between resistance at 1.1657 and support at 1.1466. The price is gradually recovering from the November low but remains below the Bollinger midline around 1.1600.

- Weekly outlook: The baseline scenario suggests sideways trading within the 1.1466–1.1657 range. A breakout below the 1.1466 level would open the path towards 1.1400. For a sustainable EURUSD recovery, the pair needs to break above 1.1600 and overcome resistance at 1.1657 – only this will change the short-term structure and provide the basis for strengthening the euro.

EURUSD fundamental analysis

The USD weakened by around 0.5% during the week, as investors continue to price in a higher likelihood of a Fed rate cut in December. The market currently estimates a 25-basis-point move at nearly 87%, with an additional three cuts expected throughout 2026. Another supporting factor is the news that Kevin Hassett, Director of the National Economic Council, is being considered the leading candidate for the Fed chair.

The market views him as a supporter of a more dovish policy path, further reinforcing expectations of continued easing. The US dollar also lost ground amid declining demand for safe-haven assets.

US statistics were mixed. According to ADP, private sector employment fell by 13.5 thousand after a 2.5 thousand decline in the previous month. The Producer Price Index (PPI) for September rose by 0.3% m/m and 2.7% y/y, while the core PPI increased by 2.6% y/y. Retail sales rose by 0.2% over the same period, falling short of forecasts.

This data mix supports the market’s view that the Fed still has room to ease policy as early as December.

EURUSD technical analysis

The EURUSD pair is hovering near 1.1588, remaining within the wide range of recent months. The upper resistance boundary is near 1.1657, while key support lies around 1.1466. In recent sessions, the price has moved up from the November low near the 1.1466 support level but still remains below the central part of the range.

Candlesticks are forming in the middle area of Bollinger Bands. The upper band is located around 1.1750–1.1800, and the lower band is near 1.1450. The Bollinger midline runs around 1.1600, with the price currently slightly below it.

MACD is in negative territory: the histogram is small and near zero, indicating weak momentum and a continuation of the range-bound structure. The MACD lines are nearly horizontal.

The Stochastic Oscillator has risen into the 80+ area, signalling overbought conditions. The indicator lines are pointed upwards, reflecting the recent recovery move.

The overall picture: the EURUSD pait remains between 1.1466 (support) and 1.1657 (resistance), with the structure holding within a sideways range. At the same time, indicators suggest weak momentum and a potential overbought phase on the daily timeframe.

EURUSD trading scenarios

The EURUSD pair ended the week near 1.1588, under local pressure. Overall, the USD declined by about 0.5% for the week. The market now estimates an 87% probability of a December rate cut, with three more steps priced in for 2026.

The technical outlook appears neutral-to-negative. The EURUSD pair is trading within the broad 1.1466–1.1657 range, forming candlesticks in the mid-zone of Bollinger Bands. MACD remains in negative territory with a weak histogram, reflecting a lack of clear momentum. The Stochastic Oscillator has moved above 80, indicating local overbought conditions. The price is hovering just below dynamic resistance at 1.1600, limiting the upside potential.

- Buy scenario

Long positions are appropriate only after a breakout above 1.1600, with a breakout above the 1.1657 resistance level confirming a bullish reversal.

Targets: 1.1720–1.1750, then a test of the 1.1800 area.

Stop-loss: below 1.1530.

- Sell scenario

Short positions are preferable after a breakout below the 1.1466 support level – this would send the pair back towards 1.1400.

Targets: 1.1400–1.1380; if pressure increases, a move towards 1.1300.

Stop-loss: above 1.1600.

Conclusion

The baseline scenario is consolidation within the 1.1466–1.1600 range, with a risk of retesting the lower boundary if the dollar strengthens. For confirmation of a bullish reversal, the EURUSD pair must break and hold above 1.1657 – this is the key level currently holding back buyers.

Summary

During the period of 1–5 December 2025, the EURUSD pair is expected to maintain neutral dynamics. The market is pricing in an 87% chance of a December Fed rate cut, while mixed US data (weak ADP, soft PPI, and retail sales) is limiting dollar strength. Uncertainty over the scale of easing is preventing the pair from achieving sustainable growth.

The technical picture is turning sideways. The EURUSD pair is trading within the 1.1466–1.1657 range, failing to break above dynamic resistance near 1.1600. MACD is weak, and the Stochastic Oscillator is in overbought territory. The key levels include support at 1.1470 and resistance at 1.1657. The baseline scenario suggests consolidation in the 1.1470–1.1600 range with limited upside potential.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.