EURUSD weekly forecast: the shutdown dictates terms to currencies

The US government shutdown has become the main source of uncertainty in the currency market. For nine days, federal agencies have been operating in a limited capacity, and key macroeconomic data releases, including the employment report, have been postponed. This deprives the market of guidance and increases volatility, driving demand for the US dollar as a safe-haven asset.

For the EURUSD pair, the key factor is a combination of political pressure in the US and euro weakness amid uncertainty in the eurozone. The pair remains in a range and reacts primarily to news from Washington.

This analysis explores how the shutdown and expectations for Fed decisions could influence EURUSD performance from 13 to 17 October.

EURUSD forecast for this week: quick overview

- Market focus: the shutdown in the US continues to pressure the market. Negotiations between Democrats and Republicans on government funding have once again reached a deadlock

- Current trend: the EURUSD pair is trading in the 1.1530–1.1560 range, under pressure from a strong dollar and political uncertainty in Europe. Recovery attempts remain limited. The technical picture indicates sideways movement within the 1.1500–1.1740 corridor, with short-term momentum being weak

- Outlook for 13 – 17 October: the baseline scenario suggests consolidation within the 1.1500–1.1740 range with a moderate downward bias. A breakout below 1.1500 would intensify pressure and open the path to 1.1440–1.138Consolidation above 1.1740 would signal recovery towards 1.1830–1.1915

EURUSD fundamental analysis

The EURUSD pair suffered significant losses last week. The potential for growth remains limited by the strong US dollar and continued uncertainty in US fiscal policy.

The US government shutdown has extended into a second week. It has paused the release of key macroeconomic statistics, including the jobs report, and heightened market uncertainty. The likelihood of a Fed rate cut at the 29 October meeting stands at 95%, with the market partially pricing in another cut in December.

The euro is supported by moderately positive data from the eurozone: inflation slowed to 2.6% y/y and business activity in the services sector rose, offsetting weakness in manufacturing. However, political instability in France and expectations of more aggressive fiscal stimulus in Japan have strengthened the dollar's position as a safe-haven asset.

EURUSD technical analysis

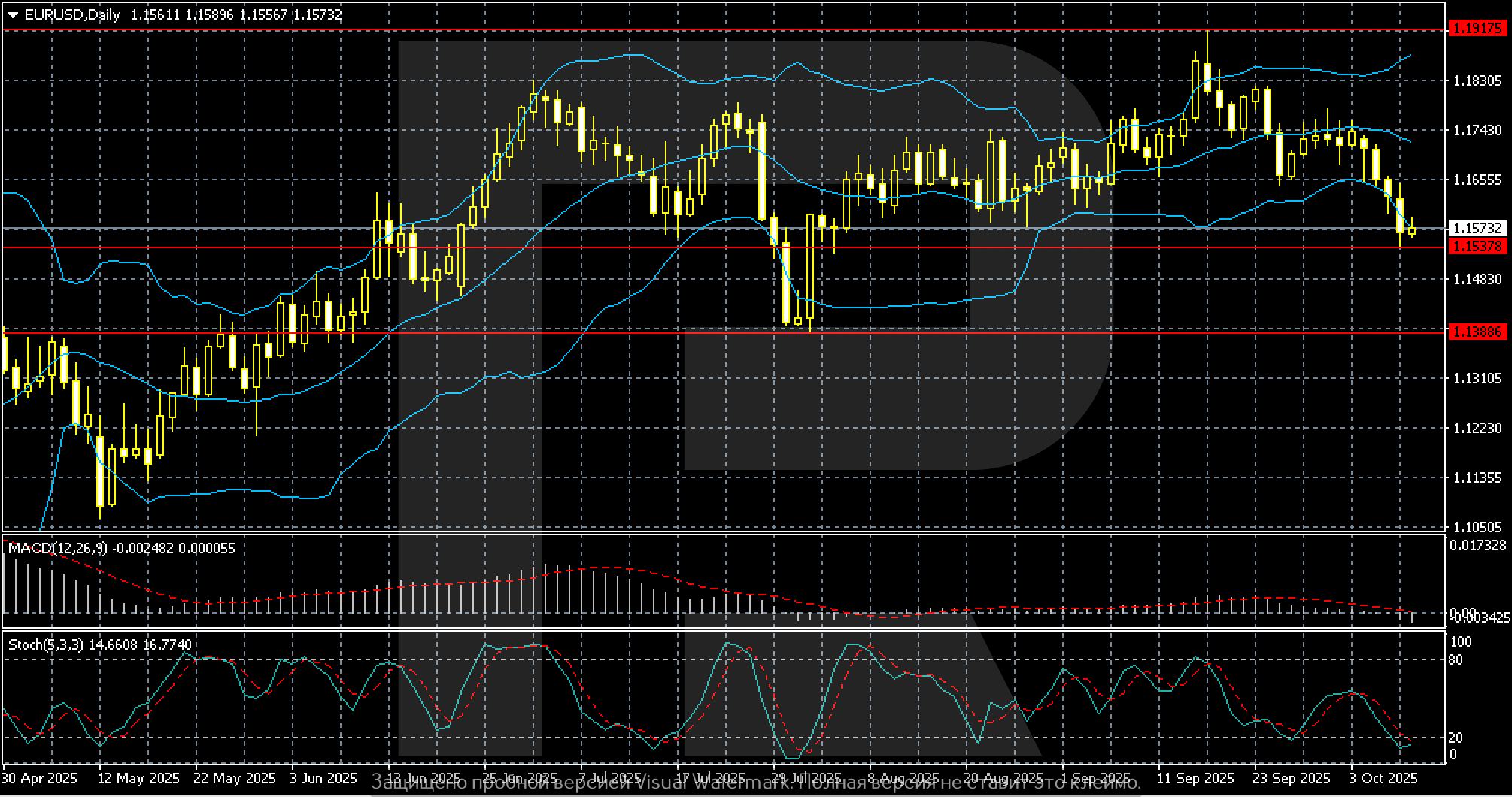

On the daily timeframe, the EURUSD pair is consolidating near 1.1537 after a four-day decline from 1.1743. The current dynamics indicate an attempt at short-term stabilisation after a sharp fall, but the overall technical outlook remains bearish.

The key support level lies at 1.1388, where the first significant pullback by buyers is possible. The nearest resistance level is at 1.1917 – a return above this level would confirm a medium-term bullish reversal.

The Stochastic is near oversold territory and close to zero, indicating the possibility of a short-term bounce, although this is not confirmed by volumes. MACD also remains around the zero line, pointing to weak momentum. Volumes continue to decline, confirming a lack of confidence among market participants.

The price is approaching the lower Bollinger Band, which could trigger a technical rebound. Overall, the pair remains under pressure. Without confirmation of a move above 1.1600, the risk of continued decline towards 1.1388 persists.

EURUSD trading scenarios

The EURUSD pair is consolidating near 1.1537 after a four-day decline from 1.1743. The pair remains under pressure from a strong dollar and US political uncertainty. MACD is hovering near zero, the Stochastic is in oversold territory, and the price is close to the lower Bollinger Band, all pointing to a possible short-term rebound.

The US government shutdown adds to the uncertainty but sustains demand for the dollar as a safe-haven asset. Political instability in France also limits the euro's potential.

- Buy scenario:

Long positions become possible if the price holds above 1.1600. Targets are 1.1740 and 1.1830.

Stop-loss is below 1.1500.

- Sell scenario:

Short positions are relevant if the price breaks below 1.1500. Targets are 1.1440 and 1.1388.

Stop-loss is above 1.1600.

Conclusion: the baseline scenario suggests consolidation within the 1.1500–1.1740 range with a downward bias until the Federal Reserve confirms policy easing.

Summary

Market sentiment on EURUSD remains moderate. The main source of uncertainty is the US government shutdown. No compromise has been reached in Congress, with key macroeconomic data releases remaining suspended. This drives demand for the dollar as a safe-haven asset and limits the euro’s recovery potential.

Technically, the pair is consolidating around 1.1530–1.1560, maintaining room for an upward move towards 1.1740–1.1830 and possibly to 1.1915 in the case of a breakout. However, fundamental conditions appear restrictive. The baseline scenario for 13–17 October suggests the pair will likely hold above 1.1500, trading within the range with a moderately upward bias.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.