Euro without news, dollar without confidence: EURUSD seizes the moment

The euro has made another attempt to strengthen against the USD, with EURUSD quotes testing the 1.1660 level. Discover more in our analysis for 12 January 2026.

EURUSD forecast: key takeaways

- Political crisis surrounding the Federal Reserve chairman

- The euro is attempting to regain ground

- EURUSD forecast for 12 January 2026: 1.1710 or 1.1640

Fundamental analysis

The EURUSD forecast takes into account that today the euro is forming a corrective wave and is trading around the 1.1660 level.

Key triggers influencing the EURUSD exchange rate:

- Political crisis around the Fed chair. The US dollar came under pressure following reports of a criminal investigation involving Federal Reserve Chairman Jerome Powell. This increased the risk of political interference in US monetary policy and weakened investor confidence in the dollar’s position in the currency market

- The market is anticipating possible future easing of the Federal Reserve’s monetary policy

- There is little news from the eurozone today, and no major economic data has been released so far. As a result, the EURUSD rate is forced to react primarily to external drivers, such as dollar dynamics and global market sentiment

- US employment and inflation statistics scheduled for this week will provide more clarity and may act as a trigger for EURUSD movement

EURUSD technical analysis

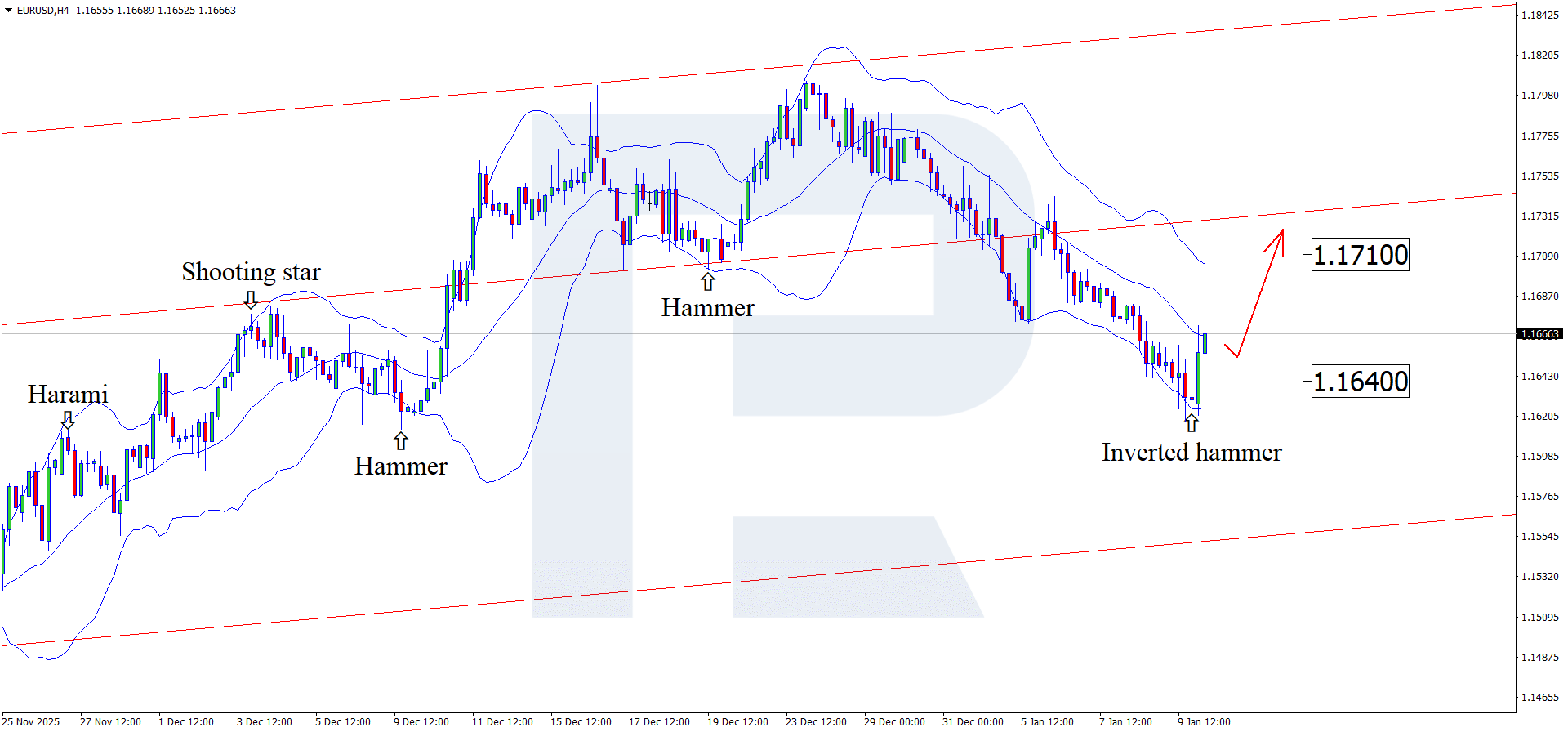

On the H4 chart, the EURUSD pair has formed an Inverted Hammer reversal pattern near the lower Bollinger Band. At this stage, it is developing an upward wave following the pattern’s signal. Since quotes remain within an ascending channel, they may move towards 1.1710. A breakout above this level would open the way for continued upward momentum.

At the same time, today’s EURUSD forecast also considers an alternative scenario, with a corrective move towards 1.1640 before further growth.

Summary

The risk of political interference in the actions of the US Federal Reserve works in favour of the euro. EURUSD technical analysis suggests a rise towards the 1.1710 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.