Fundamental factors increase pressure on EURUSD

EURUSD remains under pressure amid persistent expectations regarding Fed policy and mixed signals from the US labor market. Current quote — 1.1728. Details — in our analysis for 17 December 2025.

EURUSD forecast: key trading points

- US nonfarm employment increased by 64K in November

- US unemployment rate rose to 4.6% in November

- Markets continue to price in a high probability of the Fed keeping interest rates unchanged

- EURUSD forecast for 17 December 2025: 1.1630

Fundamental analysis

EURUSD has declined for the second consecutive trading session. Contradictory US labor market data have had little impact on market expectations regarding the Federal Reserve’s next steps.

Employment in the US economy increased by 64K in November, exceeding the average market forecast of 50K. In October, employment had declined by 105K, marking the sharpest drop since December 2020.

The US unemployment rate rose to 4.6% in November, reaching a four-year high. In September, the figure stood at 4.4%, while the consensus forecast had expected no change.

Markets are now pricing in a high probability that the Federal Reserve will keep interest rates unchanged at its January meeting, which supports a bearish EURUSD outlook for today.

EURUSD technical analysis

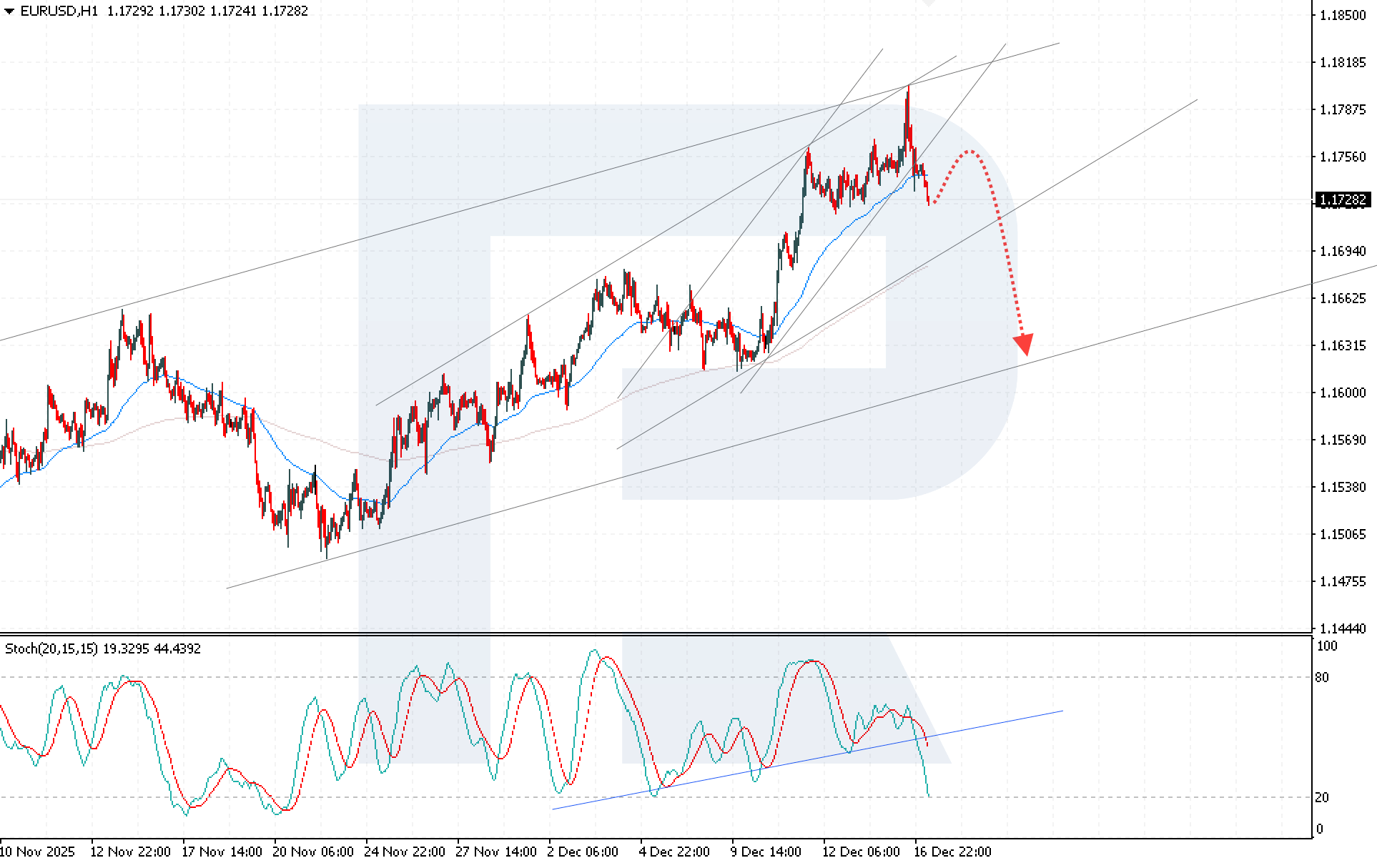

EURUSD is declining, with sellers having consolidated below the EMA-65 line, indicating increasing bearish pressure. Today’s EURUSD forecast suggests a continuation of the decline toward the 1.1630 level.

An additional bearish signal is forming on the Stochastic Oscillator. The signal lines have broken below the bullish trendline and formed a bearish crossover, indicating a resumption of downward momentum.

A firm consolidation below the 1.1695 level will confirm the downside scenario and further price decline. At the same time, a potential bullish correction toward 1.1755 cannot be ruled out; however, such a pullback would likely strengthen sellers’ positions, as it could lead to the formation of a Head and Shoulders reversal pattern.

Summary

Persistent expectations regarding the Federal Reserve’s monetary policy and stable US macroeconomic data continue to support the US dollar. EURUSD technical analysis remains bearish, and the dominance of downside signals increases the likelihood of further declines in the pair.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.